Catastrophe bonds transfer risk from insurers to capital markets, offering investors high yields in exchange for potential losses linked to natural disasters. Retrocession involves insurers purchasing reinsurance themselves, spreading risk across multiple layers to enhance financial stability. Explore the detailed differences and strategic uses of catastrophe bonds and retrocession to optimize risk management.

Why it is important

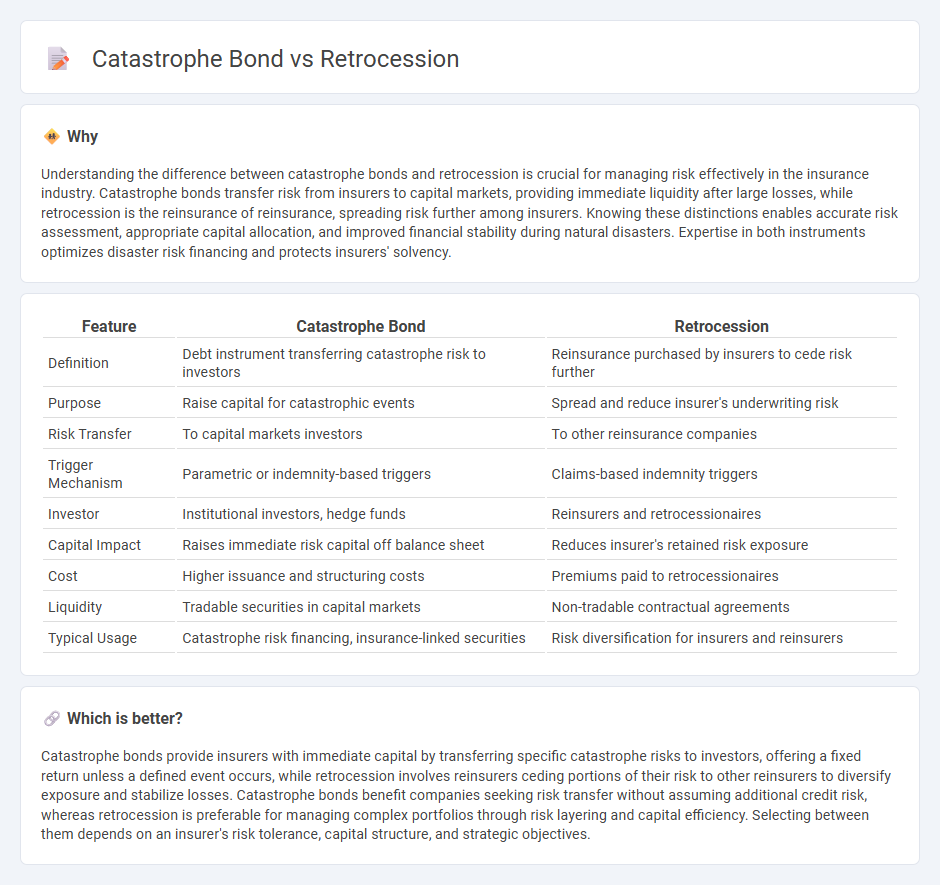

Understanding the difference between catastrophe bonds and retrocession is crucial for managing risk effectively in the insurance industry. Catastrophe bonds transfer risk from insurers to capital markets, providing immediate liquidity after large losses, while retrocession is the reinsurance of reinsurance, spreading risk further among insurers. Knowing these distinctions enables accurate risk assessment, appropriate capital allocation, and improved financial stability during natural disasters. Expertise in both instruments optimizes disaster risk financing and protects insurers' solvency.

Comparison Table

| Feature | Catastrophe Bond | Retrocession |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk to investors | Reinsurance purchased by insurers to cede risk further |

| Purpose | Raise capital for catastrophic events | Spread and reduce insurer's underwriting risk |

| Risk Transfer | To capital markets investors | To other reinsurance companies |

| Trigger Mechanism | Parametric or indemnity-based triggers | Claims-based indemnity triggers |

| Investor | Institutional investors, hedge funds | Reinsurers and retrocessionaires |

| Capital Impact | Raises immediate risk capital off balance sheet | Reduces insurer's retained risk exposure |

| Cost | Higher issuance and structuring costs | Premiums paid to retrocessionaires |

| Liquidity | Tradable securities in capital markets | Non-tradable contractual agreements |

| Typical Usage | Catastrophe risk financing, insurance-linked securities | Risk diversification for insurers and reinsurers |

Which is better?

Catastrophe bonds provide insurers with immediate capital by transferring specific catastrophe risks to investors, offering a fixed return unless a defined event occurs, while retrocession involves reinsurers ceding portions of their risk to other reinsurers to diversify exposure and stabilize losses. Catastrophe bonds benefit companies seeking risk transfer without assuming additional credit risk, whereas retrocession is preferable for managing complex portfolios through risk layering and capital efficiency. Selecting between them depends on an insurer's risk tolerance, capital structure, and strategic objectives.

Connection

Catastrophe bonds provide insurance companies with financial protection by transferring risk to investors, who absorb losses if specified disasters occur. Retrocession allows primary insurers or reinsurers to further mitigate risk by ceding portions of their liabilities to other reinsurers, creating a layered risk management framework. Both mechanisms enhance capital efficiency and stability within the insurance industry by diversifying risk exposure.

Key Terms

Risk Transfer

Retrocession involves reinsurers transferring portions of their risk portfolios to other reinsurers, thereby enhancing capital efficiency and stabilizing loss exposures. Catastrophe bonds, structured as insurance-linked securities, transfer catastrophe risks from insurers to capital market investors, providing alternative risk financing with defined triggers and payouts. Explore the nuances of these risk transfer mechanisms and their strategic applications in modern reinsurance.

Reinsurance

Retrocession and catastrophe bonds are essential tools in reinsurance for risk transfer and capital management. Retrocession involves insurers ceding portions of their risk portfolio to other reinsurers, enabling diversification and risk mitigation, while catastrophe bonds securitize extreme event risks, offering alternative capital to cover losses from natural disasters. Explore more about how these instruments shape reinsurance strategies and financial resilience.

Capital Markets

Retrocession involves the transfer of reinsurance risk from one reinsurer to another to manage capital exposure, while catastrophe bonds are risk-linked securities that transfer catastrophe risk directly to investors, providing capital market access for insurers. Cat bonds offer investors predefined returns contingent on specific disaster events, enhancing insurers' capital efficiency and liquidity. Explore further to understand how these instruments optimize risk transfer strategies in capital markets.

Source and External Links

Retrocession (kickback) - Wikipedia - Retrocession refers to kickback commissions that banks, asset managers, and financial service providers receive from distributors when purchasing financial products, often criticized for conflicts of interest and lack of transparency, especially in Swiss finance.

Retrocession Meaning & Definition - Founder Shield - Retrocession is the practice in reinsurance where a reinsurer transfers part of its assumed risk to another reinsurer to mitigate exposure and diversify risk portfolios.

What is a Retrocession? - Definition from Insuranceopedia - Retrocession involves a reinsurance company transferring some risks to another reinsurer to reduce potential losses from events causing many claims, helping maintain financial stability.

dowidth.com

dowidth.com