Gig worker insurance provides tailored coverage for individuals offering services on a flexible, per-task basis, protecting against liabilities, accidents, and income disruptions unique to gig economy roles. Contractor insurance caters to independent contractors by covering property damage, professional liability, and workers' compensation risks associated with project-based work. Explore the distinct benefits and requirements of each insurance type to safeguard your freelance career effectively.

Why it is important

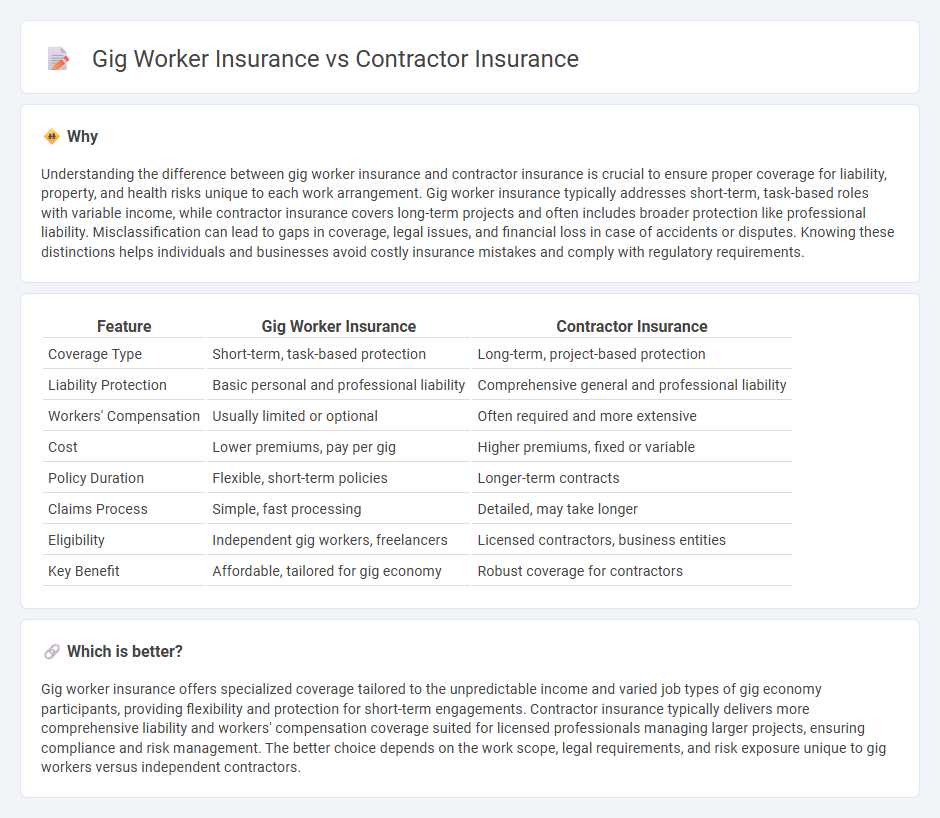

Understanding the difference between gig worker insurance and contractor insurance is crucial to ensure proper coverage for liability, property, and health risks unique to each work arrangement. Gig worker insurance typically addresses short-term, task-based roles with variable income, while contractor insurance covers long-term projects and often includes broader protection like professional liability. Misclassification can lead to gaps in coverage, legal issues, and financial loss in case of accidents or disputes. Knowing these distinctions helps individuals and businesses avoid costly insurance mistakes and comply with regulatory requirements.

Comparison Table

| Feature | Gig Worker Insurance | Contractor Insurance |

|---|---|---|

| Coverage Type | Short-term, task-based protection | Long-term, project-based protection |

| Liability Protection | Basic personal and professional liability | Comprehensive general and professional liability |

| Workers' Compensation | Usually limited or optional | Often required and more extensive |

| Cost | Lower premiums, pay per gig | Higher premiums, fixed or variable |

| Policy Duration | Flexible, short-term policies | Longer-term contracts |

| Claims Process | Simple, fast processing | Detailed, may take longer |

| Eligibility | Independent gig workers, freelancers | Licensed contractors, business entities |

| Key Benefit | Affordable, tailored for gig economy | Robust coverage for contractors |

Which is better?

Gig worker insurance offers specialized coverage tailored to the unpredictable income and varied job types of gig economy participants, providing flexibility and protection for short-term engagements. Contractor insurance typically delivers more comprehensive liability and workers' compensation coverage suited for licensed professionals managing larger projects, ensuring compliance and risk management. The better choice depends on the work scope, legal requirements, and risk exposure unique to gig workers versus independent contractors.

Connection

Gig worker insurance and contractor insurance both provide essential financial protection tailored for non-traditional employment, covering risks like liability, income loss, and medical expenses. These insurance types address gaps left by standard employer policies, offering customized coverage that reflects the independent and flexible nature of gig and contract work. By mitigating potential disruptions through targeted risk management, they ensure stability for freelancers and independent contractors operating in dynamic marketplaces.

Key Terms

Liability Coverage

Contractor insurance typically includes comprehensive liability coverage that protects against property damage, bodily injury, and legal claims arising from project work, offering broader protection for contractors managing larger or longer-term contracts. Gig worker insurance, often designed for freelance or short-term jobs, focuses on specific liability risks related to distinct tasks, providing customizable and usually more affordable coverage options tailored to varying gig activities. Explore detailed comparisons to determine the ideal liability coverage that matches your professional needs and risk profile.

Workers' Compensation

Workers' Compensation insurance for contractors typically covers injuries sustained on the jobsite, providing wage replacement and medical benefits, whereas gig worker insurance often lacks mandatory Workers' Compensation protection due to their independent status. Contractors are legally required in most states to carry Workers' Compensation, reducing liability risks and ensuring compliance, while gig workers may need to seek specialized or voluntary coverage to safeguard against workplace injuries. Explore detailed comparisons and tailored insurance solutions to ensure appropriate protection for your work arrangement.

Policyholder Classification

Contractor insurance primarily serves independent contractors who enter defined contracts with businesses, providing coverage tailored to project-based work and liability risks specific to their trade. Gig worker insurance is designed for individuals engaging in multiple short-term, task-based jobs across platforms, offering flexible protection that accommodates varying income streams and work types. Explore more on how policyholder classification influences insurance options and coverage nuances for these distinct worker categories.

Source and External Links

A Guide To Contractor Insurance in 2024 - Provides a comprehensive overview of contractor insurance essentials, including liability, equipment, and workers' compensation coverages.

Cheap Contractors Liability Insurance - Offers a platform to compare and find affordable contractor liability insurance options tailored to specific business needs.

Best Cheap Contractor Business Insurance - Highlights top insurance providers for contractors, including The Hartford and biBerk, offering competitive pricing and comprehensive coverage options.

dowidth.com

dowidth.com