Credit life insurance guarantees loan repayment by covering outstanding debt if the borrower passes away, while critical illness insurance provides a lump sum benefit upon diagnosis of serious health conditions like cancer, heart attack, or stroke. Both policies offer financial security but cater to distinct risks: credit life insurance focuses on debt protection, whereas critical illness insurance addresses medical expenses and income loss during recovery. Explore more to understand which insurance aligns with your financial protection needs.

Why it is important

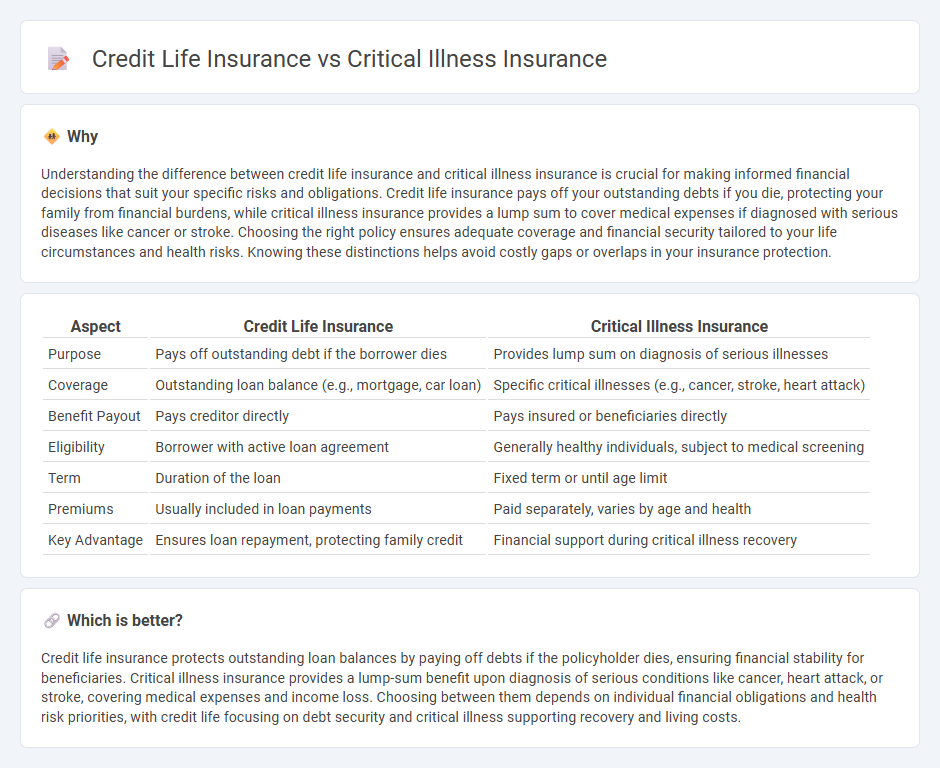

Understanding the difference between credit life insurance and critical illness insurance is crucial for making informed financial decisions that suit your specific risks and obligations. Credit life insurance pays off your outstanding debts if you die, protecting your family from financial burdens, while critical illness insurance provides a lump sum to cover medical expenses if diagnosed with serious diseases like cancer or stroke. Choosing the right policy ensures adequate coverage and financial security tailored to your life circumstances and health risks. Knowing these distinctions helps avoid costly gaps or overlaps in your insurance protection.

Comparison Table

| Aspect | Credit Life Insurance | Critical Illness Insurance |

|---|---|---|

| Purpose | Pays off outstanding debt if the borrower dies | Provides lump sum on diagnosis of serious illnesses |

| Coverage | Outstanding loan balance (e.g., mortgage, car loan) | Specific critical illnesses (e.g., cancer, stroke, heart attack) |

| Benefit Payout | Pays creditor directly | Pays insured or beneficiaries directly |

| Eligibility | Borrower with active loan agreement | Generally healthy individuals, subject to medical screening |

| Term | Duration of the loan | Fixed term or until age limit |

| Premiums | Usually included in loan payments | Paid separately, varies by age and health |

| Key Advantage | Ensures loan repayment, protecting family credit | Financial support during critical illness recovery |

Which is better?

Credit life insurance protects outstanding loan balances by paying off debts if the policyholder dies, ensuring financial stability for beneficiaries. Critical illness insurance provides a lump-sum benefit upon diagnosis of serious conditions like cancer, heart attack, or stroke, covering medical expenses and income loss. Choosing between them depends on individual financial obligations and health risk priorities, with credit life focusing on debt security and critical illness supporting recovery and living costs.

Connection

Credit life insurance and critical illness insurance both provide financial protection by covering loan repayments under specific circumstances, such as death or diagnosis of a serious illness. Credit life insurance pays off outstanding debts if the borrower dies, while critical illness insurance offers a lump sum to cover loan payments or medical expenses if the insured is diagnosed with a covered illness. Together, they reduce the financial burden on borrowers and their families by ensuring loan obligations are met during health or life crises.

Key Terms

Lump Sum Benefit

Critical illness insurance provides a lump sum benefit upon diagnosis of specified serious illnesses, offering financial support to cover medical expenses and living costs without repayment obligations. Credit life insurance pays off outstanding loan balances if the insured passes away, ensuring debts do not burden survivors but does not provide funds for other expenses. Explore detailed comparisons and benefits to choose the best coverage for your financial security.

Outstanding Loan Balance

Critical illness insurance provides a lump-sum payout to cover medical expenses and lost income during a severe health event, protecting your financial stability without being directly tied to loan balances. Credit life insurance specifically pays off your outstanding loan balance if you pass away, ensuring your debts do not burden your family but does not cover medical costs or income loss. Explore detailed comparisons to determine which policy best safeguards your outstanding loan balance and overall financial well-being.

Policyholder

Critical illness insurance provides financial support to the policyholder upon diagnosis of serious medical conditions like cancer or heart attack, ensuring coverage for treatment and recovery expenses. Credit life insurance, on the other hand, pays off outstanding loan balances if the policyholder passes away, securing debt repayment but not offering direct health-related benefits. Explore detailed comparisons to understand which policy best safeguards your financial stability and health needs.

Source and External Links

Critical Illness Insurance - What Is It | Anthem - Critical illness insurance is a supplemental plan providing a lump sum or monthly payments upon diagnosis of a major illness like heart attack, stroke, or cancer, helping cover extra expenses and letting you focus on recovery.

Critical illness insurance - Wikipedia - This insurance pays a lump sum or regular income if diagnosed with a covered critical illness after a survival period, with standardized claim definitions to ensure clarity and comparability across policies.

Critical Illness Insurance Plans | MetLife - MetLife critical illness insurance offers guaranteed coverage without health questions, providing lump-sum financial support paid directly to you to cover expenses beyond medical costs, such as mortgage and childcare.

dowidth.com

dowidth.com