Catastrophe bonds are risk-linked securities that transfer catastrophe risk from insurers to investors, providing capital relief and risk diversification. Insurance-linked securities (ILS) encompass a broader category, including catastrophe bonds, but also other instruments like industry loss warranties and sidecars. Discover how catastrophe bonds and ILS reshape risk financing and investment strategies.

Why it is important

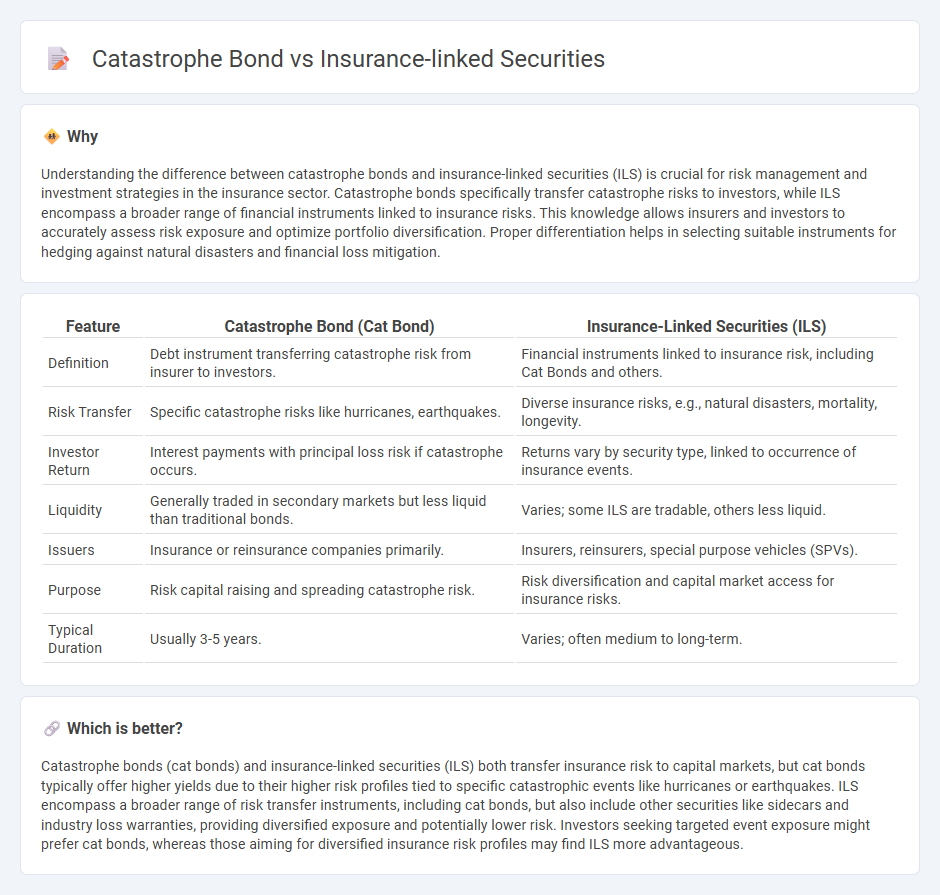

Understanding the difference between catastrophe bonds and insurance-linked securities (ILS) is crucial for risk management and investment strategies in the insurance sector. Catastrophe bonds specifically transfer catastrophe risks to investors, while ILS encompass a broader range of financial instruments linked to insurance risks. This knowledge allows insurers and investors to accurately assess risk exposure and optimize portfolio diversification. Proper differentiation helps in selecting suitable instruments for hedging against natural disasters and financial loss mitigation.

Comparison Table

| Feature | Catastrophe Bond (Cat Bond) | Insurance-Linked Securities (ILS) |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk from insurer to investors. | Financial instruments linked to insurance risk, including Cat Bonds and others. |

| Risk Transfer | Specific catastrophe risks like hurricanes, earthquakes. | Diverse insurance risks, e.g., natural disasters, mortality, longevity. |

| Investor Return | Interest payments with principal loss risk if catastrophe occurs. | Returns vary by security type, linked to occurrence of insurance events. |

| Liquidity | Generally traded in secondary markets but less liquid than traditional bonds. | Varies; some ILS are tradable, others less liquid. |

| Issuers | Insurance or reinsurance companies primarily. | Insurers, reinsurers, special purpose vehicles (SPVs). |

| Purpose | Risk capital raising and spreading catastrophe risk. | Risk diversification and capital market access for insurance risks. |

| Typical Duration | Usually 3-5 years. | Varies; often medium to long-term. |

Which is better?

Catastrophe bonds (cat bonds) and insurance-linked securities (ILS) both transfer insurance risk to capital markets, but cat bonds typically offer higher yields due to their higher risk profiles tied to specific catastrophic events like hurricanes or earthquakes. ILS encompass a broader range of risk transfer instruments, including cat bonds, but also include other securities like sidecars and industry loss warranties, providing diversified exposure and potentially lower risk. Investors seeking targeted event exposure might prefer cat bonds, whereas those aiming for diversified insurance risk profiles may find ILS more advantageous.

Connection

Catastrophe bonds (cat bonds) are a type of insurance-linked security (ILS) designed to transfer catastrophe risk from insurers to the capital markets, providing insurers with alternative risk financing. These bonds pay high yields to investors but can lose principal if a specified catastrophe event, such as a hurricane or earthquake, occurs, thus linking their performance directly to insurance risks. The integration of cat bonds into the ILS market enhances risk diversification and liquidity for insurance companies facing large-scale disaster exposures.

Key Terms

Risk Transfer

Insurance-linked securities (ILS) and catastrophe bonds (cat bonds) serve as risk transfer mechanisms by allowing insurers to offload catastrophe risks to capital market investors. While ILS encompass a broad range of instruments including cat bonds, sidecars, and industry loss warranties, cat bonds specifically transfer defined catastrophe risks through bond issuance that triggers principal loss upon event occurrence. Explore the distinct risk transfer features and investment structures of ILS and catastrophe bonds to fully understand their role in risk management.

Securitization

Insurance-linked securities (ILS) and catastrophe bonds (cat bonds) represent key instruments within the securitization market, transferring insurance risk to capital markets. ILS encompass a broad range of financial products, whereas cat bonds are a specific type of ILS designed to raise capital for insurers against catastrophic events. Explore the distinctions and mechanisms in securitization to optimize risk management strategies.

Trigger Event

Insurance-linked securities (ILS) are financial instruments that transfer insurance risk to investors, with catastrophe bonds (cat bonds) being a prominent subtype specifically triggered by predefined catastrophic events like hurricanes or earthquakes. The trigger event in cat bonds often involves parametric measures or industry loss indices, activating principal loss to investors, whereas general ILS may have more diverse trigger mechanisms including indemnity or modeled loss triggers. Explore deeper into the mechanics of trigger events in these risk transfer vehicles to better understand how they protect insurers and attract market capital.

Source and External Links

What are insurance-linked securities (or ILS)? - Artemis.bm - Insurance-linked securities are financial instruments sold to investors, whose value depends on insured loss events, primarily used by insurers and reinsurers to transfer risk and raise capital from the global capital markets, forming an established alternative asset class with low correlation to traditional markets.

What are insurance linked securities (or ILS)? - Schroders Capital - ILS allow transfer of insurance risk from the insurance industry to capital market investors, offering long-term, sustainable, inflation-shielded returns with varied instruments like catastrophe bonds and private notes, featuring resilience to climate change and high risk-managed returns.

Insurance-linked security - Wikipedia - An insurance-linked security is a financial asset whose return is driven by insurance loss events, especially natural catastrophes, providing risk transfer for insurers and reinsurance and creating an asset class whose returns are uncorrelated to other markets.

dowidth.com

dowidth.com