Crop yield insurance protects farmers against losses from reduced crop production due to natural disasters like drought, flood, or pests by providing financial compensation based on actual harvested yields. Prevented planting insurance offers coverage when adverse conditions prevent farmers from planting crops altogether, ensuring income stability despite the inability to cultivate fields. Explore the differences and benefits of these insurance types to safeguard your farming operations effectively.

Why it is important

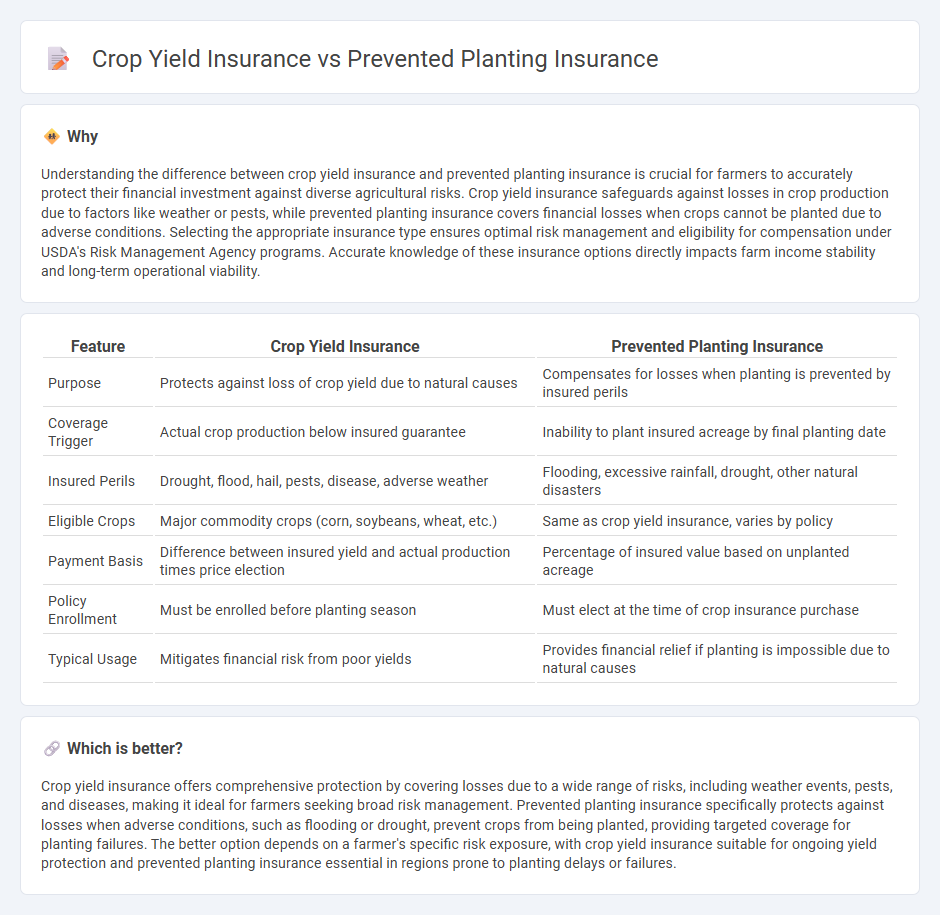

Understanding the difference between crop yield insurance and prevented planting insurance is crucial for farmers to accurately protect their financial investment against diverse agricultural risks. Crop yield insurance safeguards against losses in crop production due to factors like weather or pests, while prevented planting insurance covers financial losses when crops cannot be planted due to adverse conditions. Selecting the appropriate insurance type ensures optimal risk management and eligibility for compensation under USDA's Risk Management Agency programs. Accurate knowledge of these insurance options directly impacts farm income stability and long-term operational viability.

Comparison Table

| Feature | Crop Yield Insurance | Prevented Planting Insurance |

|---|---|---|

| Purpose | Protects against loss of crop yield due to natural causes | Compensates for losses when planting is prevented by insured perils |

| Coverage Trigger | Actual crop production below insured guarantee | Inability to plant insured acreage by final planting date |

| Insured Perils | Drought, flood, hail, pests, disease, adverse weather | Flooding, excessive rainfall, drought, other natural disasters |

| Eligible Crops | Major commodity crops (corn, soybeans, wheat, etc.) | Same as crop yield insurance, varies by policy |

| Payment Basis | Difference between insured yield and actual production times price election | Percentage of insured value based on unplanted acreage |

| Policy Enrollment | Must be enrolled before planting season | Must elect at the time of crop insurance purchase |

| Typical Usage | Mitigates financial risk from poor yields | Provides financial relief if planting is impossible due to natural causes |

Which is better?

Crop yield insurance offers comprehensive protection by covering losses due to a wide range of risks, including weather events, pests, and diseases, making it ideal for farmers seeking broad risk management. Prevented planting insurance specifically protects against losses when adverse conditions, such as flooding or drought, prevent crops from being planted, providing targeted coverage for planting failures. The better option depends on a farmer's specific risk exposure, with crop yield insurance suitable for ongoing yield protection and prevented planting insurance essential in regions prone to planting delays or failures.

Connection

Crop yield insurance and prevented planting insurance both protect farmers from financial losses due to adverse weather conditions or natural disasters. Crop yield insurance compensates for reduced production when actual yields fall below expected levels, while prevented planting insurance provides coverage when farmers are unable to plant crops altogether due to conditions like flooding or drought. These insurance types function together to ensure comprehensive risk management for agricultural production cycles.

Key Terms

Coverage Period

Prevented planting insurance provides coverage when a farmer is unable to plant crops due to adverse weather conditions during the initial planting window, typically offering protection for a defined period before and shortly after the scheduled planting date. Crop yield insurance, on the other hand, covers losses in crop production caused by natural perils throughout the entire growing season until harvest, ensuring financial stability despite yield reductions. Explore detailed comparisons to optimize your farm risk management strategy.

Indemnity Trigger

Prevented planting insurance provides coverage when farmers are unable to plant crops due to uncontrollable events, triggering indemnity based on the inability to plant rather than actual crop performance. Crop yield insurance, by contrast, triggers indemnity payments when actual harvested yield falls below a predetermined level or insured guarantee. Explore further distinctions and benefits of these insurance types to optimize risk management strategies.

Insurable Cause

Prevented planting insurance covers losses when adverse weather conditions or natural disasters, such as flooding or drought, prevent farmers from planting crops on insured acres. Crop yield insurance protects against reduced crop production caused by insurable perils like hail, wind, or pest infestations after planting has occurred. Explore the detailed differences and eligibility criteria to optimize your farm risk management strategies.

Source and External Links

CORN AND COTTON PRODUCERS PREVENTED PLANTING - Prevented planting insurance compensates producers when they cannot plant an insured crop by the final planting date or within the late planting period, offering indemnity payments and options like planting late with reduced insurance guarantees.

Prevent Planting in Illinois: What You Need to Know - Prevented planting is triggered by inability to plant insured crops due to insured causes like excessive moisture or drought by the final planting date, with payments typically 55% for corn and 60% for soybeans of the original guarantee, with options to increase coverage for an additional premium.

Delayed and Prevented Planting Provisions for Multiple Peril Crop Insurance - If prevented from planting, insured producers receive 55% of the original guarantee for corn or 60% for soybeans, with an option to increase to 60% or 65% respectively by paying extra, and must not plant another insurable crop to receive the full prevented planting payment.

dowidth.com

dowidth.com