Parametric insurance provides predetermined payouts based on specific event triggers such as earthquake magnitude or rainfall levels, eliminating the need for traditional claims assessments. Excess of loss insurance offers coverage that activates only after losses exceed a specified retention limit, protecting insurers or reinsurers from catastrophic financial exposure. Explore the key differences and benefits of parametric versus excess of loss insurance to optimize your risk management strategy.

Why it is important

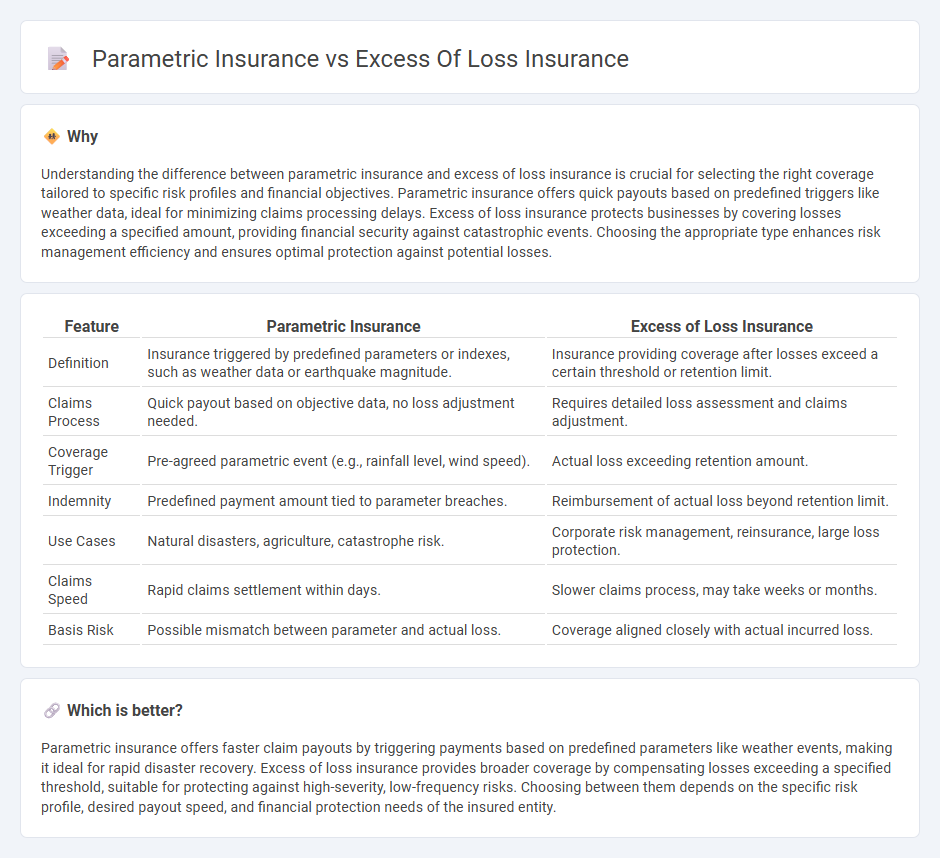

Understanding the difference between parametric insurance and excess of loss insurance is crucial for selecting the right coverage tailored to specific risk profiles and financial objectives. Parametric insurance offers quick payouts based on predefined triggers like weather data, ideal for minimizing claims processing delays. Excess of loss insurance protects businesses by covering losses exceeding a specified amount, providing financial security against catastrophic events. Choosing the appropriate type enhances risk management efficiency and ensures optimal protection against potential losses.

Comparison Table

| Feature | Parametric Insurance | Excess of Loss Insurance |

|---|---|---|

| Definition | Insurance triggered by predefined parameters or indexes, such as weather data or earthquake magnitude. | Insurance providing coverage after losses exceed a certain threshold or retention limit. |

| Claims Process | Quick payout based on objective data, no loss adjustment needed. | Requires detailed loss assessment and claims adjustment. |

| Coverage Trigger | Pre-agreed parametric event (e.g., rainfall level, wind speed). | Actual loss exceeding retention amount. |

| Indemnity | Predefined payment amount tied to parameter breaches. | Reimbursement of actual loss beyond retention limit. |

| Use Cases | Natural disasters, agriculture, catastrophe risk. | Corporate risk management, reinsurance, large loss protection. |

| Claims Speed | Rapid claims settlement within days. | Slower claims process, may take weeks or months. |

| Basis Risk | Possible mismatch between parameter and actual loss. | Coverage aligned closely with actual incurred loss. |

Which is better?

Parametric insurance offers faster claim payouts by triggering payments based on predefined parameters like weather events, making it ideal for rapid disaster recovery. Excess of loss insurance provides broader coverage by compensating losses exceeding a specified threshold, suitable for protecting against high-severity, low-frequency risks. Choosing between them depends on the specific risk profile, desired payout speed, and financial protection needs of the insured entity.

Connection

Parametric insurance and excess of loss insurance both provide financial protection against losses, but they operate differently: parametric insurance pays out based on predefined triggers or parameters, such as weather indices or earthquake magnitudes, while excess of loss insurance covers losses that exceed a specified threshold or retention limit. Both types of insurance can be integrated within a risk management strategy, with parametric insurance offering quick payouts to cover initial losses and excess of loss insurance providing coverage for catastrophic losses beyond the insured's retention. This connection enhances an organization's resilience by combining immediate liquidity with protection against severe financial impact.

Key Terms

**Excess of Loss Insurance:**

Excess of loss insurance provides coverage for losses that exceed a specified retention limit, protecting insurers or companies from catastrophic financial impact by reimbursing claims above this threshold. This type of reinsurance is essential for managing unpredictable, high-severity risks such as natural disasters, ensuring financial stability during major claims. Explore further to understand how excess of loss insurance secures risk portfolios compared to parametric insurance solutions.

Attachment Point

Excess of loss insurance triggers coverage only when losses exceed a specified attachment point, typically measured in monetary terms, providing protection against large, infrequent losses. Parametric insurance, in contrast, activates payment based on predefined parameters or indices such as rainfall levels or wind speeds, rather than actual losses, allowing for quicker claims processing without the need for loss adjustment above an attachment point. Explore the nuances of attachment points in both insurance types to understand their impact on risk management strategies.

Limit of Liability

Excess of loss insurance provides coverage above a specified loss threshold, with a clear Limit of Liability defined by the insurer's maximum payout per event or policy period. Parametric insurance, however, offers predetermined payouts based on the occurrence of specific parameters or triggers, often without a traditional Limit of Liability but rather capped by the agreed payout amount. Explore detailed comparisons to understand how these limits impact risk management strategies.

Source and External Links

What is Excess of Loss Insurance? | Allianz Trade US - An excess of loss policy covers losses that exceed a specified threshold, providing protection beyond regular insurance coverage.

An Introduction to Catastrophe Excess of Loss Reinsurance - Excess of Loss policies are split into two types: Risk XL and CATXL, both covering losses above a certain specified amount.

What Is Excess of Loss Reinsurance? - This video explains excess of loss reinsurance, where a reinsurer compensates a ceding company for losses exceeding a specified limit.

dowidth.com

dowidth.com