Micro-mobility insurance covers electric scooters, bikes, and other small vehicles used for urban transport, providing liability and damage protection tailored to short-term rentals or personal use. Renters insurance protects tenants against personal property loss and liability within a rented residence, offering coverage for belongings, personal liability, and sometimes additional living expenses. Explore key differences and benefits to choose the best insurance option for your lifestyle.

Why it is important

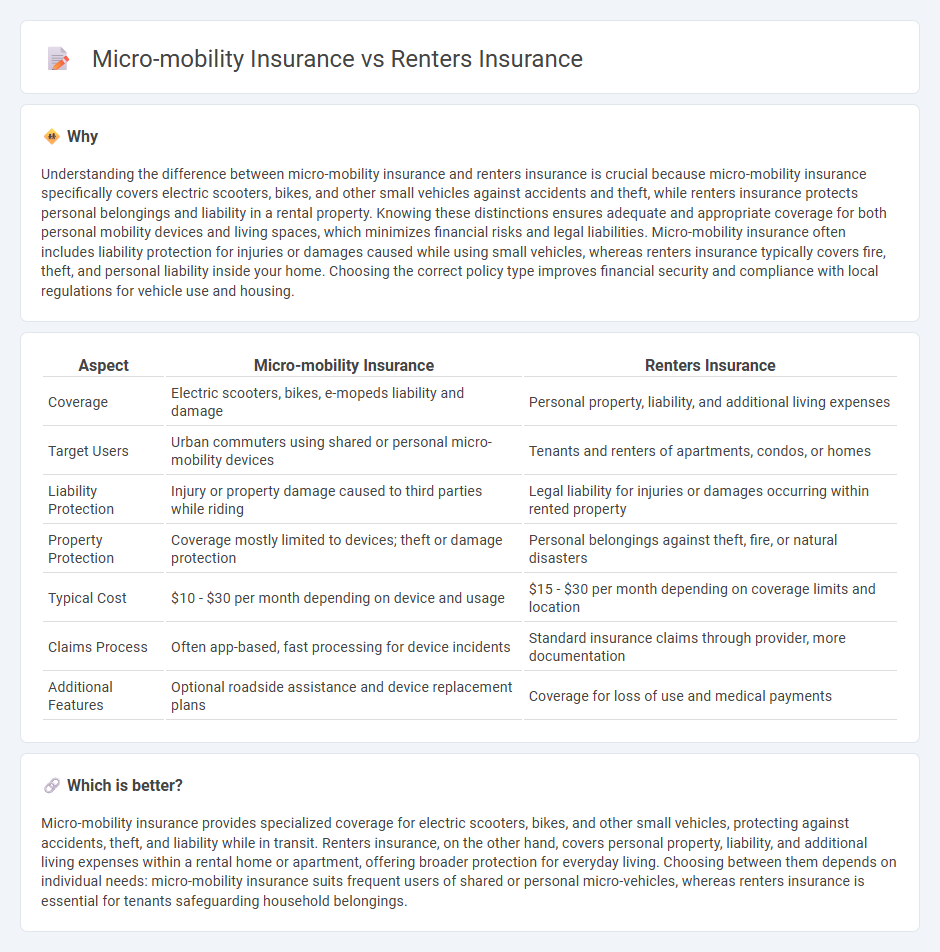

Understanding the difference between micro-mobility insurance and renters insurance is crucial because micro-mobility insurance specifically covers electric scooters, bikes, and other small vehicles against accidents and theft, while renters insurance protects personal belongings and liability in a rental property. Knowing these distinctions ensures adequate and appropriate coverage for both personal mobility devices and living spaces, which minimizes financial risks and legal liabilities. Micro-mobility insurance often includes liability protection for injuries or damages caused while using small vehicles, whereas renters insurance typically covers fire, theft, and personal liability inside your home. Choosing the correct policy type improves financial security and compliance with local regulations for vehicle use and housing.

Comparison Table

| Aspect | Micro-mobility Insurance | Renters Insurance |

|---|---|---|

| Coverage | Electric scooters, bikes, e-mopeds liability and damage | Personal property, liability, and additional living expenses |

| Target Users | Urban commuters using shared or personal micro-mobility devices | Tenants and renters of apartments, condos, or homes |

| Liability Protection | Injury or property damage caused to third parties while riding | Legal liability for injuries or damages occurring within rented property |

| Property Protection | Coverage mostly limited to devices; theft or damage protection | Personal belongings against theft, fire, or natural disasters |

| Typical Cost | $10 - $30 per month depending on device and usage | $15 - $30 per month depending on coverage limits and location |

| Claims Process | Often app-based, fast processing for device incidents | Standard insurance claims through provider, more documentation |

| Additional Features | Optional roadside assistance and device replacement plans | Coverage for loss of use and medical payments |

Which is better?

Micro-mobility insurance provides specialized coverage for electric scooters, bikes, and other small vehicles, protecting against accidents, theft, and liability while in transit. Renters insurance, on the other hand, covers personal property, liability, and additional living expenses within a rental home or apartment, offering broader protection for everyday living. Choosing between them depends on individual needs: micro-mobility insurance suits frequent users of shared or personal micro-vehicles, whereas renters insurance is essential for tenants safeguarding household belongings.

Connection

Micro-mobility insurance and renters insurance intersect through shared risk management for urban residents who rely on electric scooters, bikes, and rental properties. Both insurance types provide liability coverage protecting policyholders from accidents and property damage in densely populated areas. Integrating these policies offers comprehensive protection for millennials and Gen Z consumers who frequently use micro-mobility devices while renting urban homes.

Key Terms

Personal Property Coverage

Renters insurance typically offers personal property coverage that protects belongings against risks like theft, fire, and vandalism within a residence. Micro-mobility insurance, designed for electric scooters and bikes, often excludes personal property but emphasizes liability and damage to the vehicle itself. Explore detailed comparisons to determine which policy best secures your personal items and mobility devices.

Liability Coverage

Renters insurance liability coverage protects policyholders against claims for bodily injury or property damage occurring within their rented home, while micro-mobility insurance specifically covers liabilities from using electric scooters, bikes, or other small vehicles in urban environments. Micro-mobility policies often include protection against accidents caused to pedestrians or other road users, which renters insurance typically excludes. Explore detailed comparisons of these liability coverages to determine which policy best suits your risk profile.

Perils Covered

Renters insurance typically covers perils such as fire, theft, vandalism, and certain natural disasters, providing protection for personal belongings and liability within a rented property. Micro-mobility insurance, on the other hand, focuses on risks specific to shared scooters, bikes, and similar transportation, covering theft, accidental damage, and third-party liability during usage. Explore more to understand which insurance solution best safeguards your assets and liabilities.

Source and External Links

Renters Insurance - Get a Free Quote Online - Renters insurance helps you replace belongings damaged or stolen, covers legal costs if you're sued, and complements your landlord's insurance, which covers only the building structure.

Get A Renters Insurance Quote - Renters insurance protects your personal property against fire, smoke, theft, vandalism, weather, water damage, visitor injuries, and more, while your landlord's policy covers only the building itself.

Renters Insurance: Get a free quote today - Renters insurance covers items like electronics, furniture, and clothing in your rental, offers personal liability protection, and can be bundled with other policies for additional savings.

dowidth.com

dowidth.com