Drone insurance provides specialized coverage for unmanned aerial vehicles, protecting against risks such as theft, damage, and liability during flight operations. Marine insurance safeguards vessels, cargo, and liabilities associated with maritime activities, covering risks like hull damage, cargo loss, and marine accidents. Explore the key differences and benefits of drone insurance versus marine insurance to determine the best protection for your assets.

Why it is important

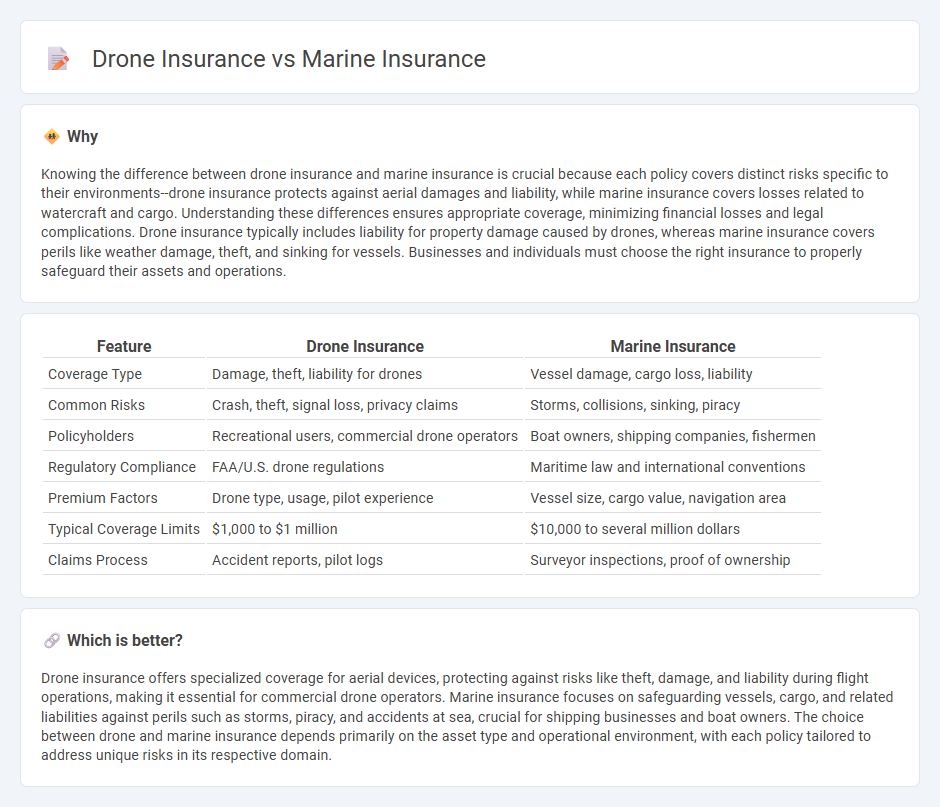

Knowing the difference between drone insurance and marine insurance is crucial because each policy covers distinct risks specific to their environments--drone insurance protects against aerial damages and liability, while marine insurance covers losses related to watercraft and cargo. Understanding these differences ensures appropriate coverage, minimizing financial losses and legal complications. Drone insurance typically includes liability for property damage caused by drones, whereas marine insurance covers perils like weather damage, theft, and sinking for vessels. Businesses and individuals must choose the right insurance to properly safeguard their assets and operations.

Comparison Table

| Feature | Drone Insurance | Marine Insurance |

|---|---|---|

| Coverage Type | Damage, theft, liability for drones | Vessel damage, cargo loss, liability |

| Common Risks | Crash, theft, signal loss, privacy claims | Storms, collisions, sinking, piracy |

| Policyholders | Recreational users, commercial drone operators | Boat owners, shipping companies, fishermen |

| Regulatory Compliance | FAA/U.S. drone regulations | Maritime law and international conventions |

| Premium Factors | Drone type, usage, pilot experience | Vessel size, cargo value, navigation area |

| Typical Coverage Limits | $1,000 to $1 million | $10,000 to several million dollars |

| Claims Process | Accident reports, pilot logs | Surveyor inspections, proof of ownership |

Which is better?

Drone insurance offers specialized coverage for aerial devices, protecting against risks like theft, damage, and liability during flight operations, making it essential for commercial drone operators. Marine insurance focuses on safeguarding vessels, cargo, and related liabilities against perils such as storms, piracy, and accidents at sea, crucial for shipping businesses and boat owners. The choice between drone and marine insurance depends primarily on the asset type and operational environment, with each policy tailored to address unique risks in its respective domain.

Connection

Drone insurance and marine insurance intersect through risk management in complex operational environments involving air and water. Both cover liabilities and damages related to transportation, with drone insurance protecting aerial equipment used in maritime surveillance, shipping inspections, or offshore oil rig monitoring. This synergy ensures comprehensive protection against physical loss, property damage, and third-party claims across aerial and marine domains.

Key Terms

**Marine Insurance:**

Marine insurance covers risks associated with the transportation of goods and vessels over water, protecting against losses such as damage to cargo, hull, and liability for maritime perils. It includes policies for cargo, hull, and freight, tailored to shipping, logistics, and offshore industries, ensuring financial security in complex marine operations. Explore more to understand how marine insurance safeguards maritime assets and operations effectively.

Hull Coverage

Marine insurance hull coverage protects vessels against physical damage caused by perils like storms, collisions, and grounding, ensuring the safety of ships, yachts, and cargo boats. Drone insurance hull coverage safeguards drones from damages due to crashes, mechanical failures, and environmental hazards, crucial for commercial and recreational UAV operators. Explore comprehensive marine and drone hull coverage options to secure valuable assets against diverse risks.

Cargo Insurance

Cargo insurance under marine insurance specifically covers loss or damage to goods transported over water, protecting against risks like sinking, piracy, and weather events. Drone insurance cargo coverage focuses on securing aerial delivery or transport of goods, addressing risks from crashes, signal loss, and mechanical failures during flight. Explore comprehensive comparisons of marine versus drone cargo insurance to identify the best coverage for your transportation needs.

Source and External Links

Inland & Ocean Marine Insurance - Markel - Markel provides flexible and customizable inland and ocean marine insurance solutions tailored to boats, yachts, marinas, and marine businesses with over 45 years of expertise.

Ocean Marine Insurance Policy & Coverage - Travelers - Ocean marine insurance protects goods onboard shipping vessels during transit domestically or internationally and covers marine liabilities, commercial hull, protection, and indemnity.

What Is Marine Insurance? - Hylant - Marine insurance covers risks associated with transporting cargo over water and includes specific coverages like docks, piers, wharves, and bumbershoot coverage for excess liability protection.

dowidth.com

dowidth.com