Ghost broking represents a fraudulent practice where intermediaries sell insurance policies without proper authorization, often resulting in invalid coverage and financial loss for policyholders. Moral hazard arises when insured individuals engage in riskier behavior because they are protected by insurance, potentially leading to higher claims and increased premiums. Explore the differences between ghost broking and moral hazard to better safeguard your insurance interests.

Why it is important

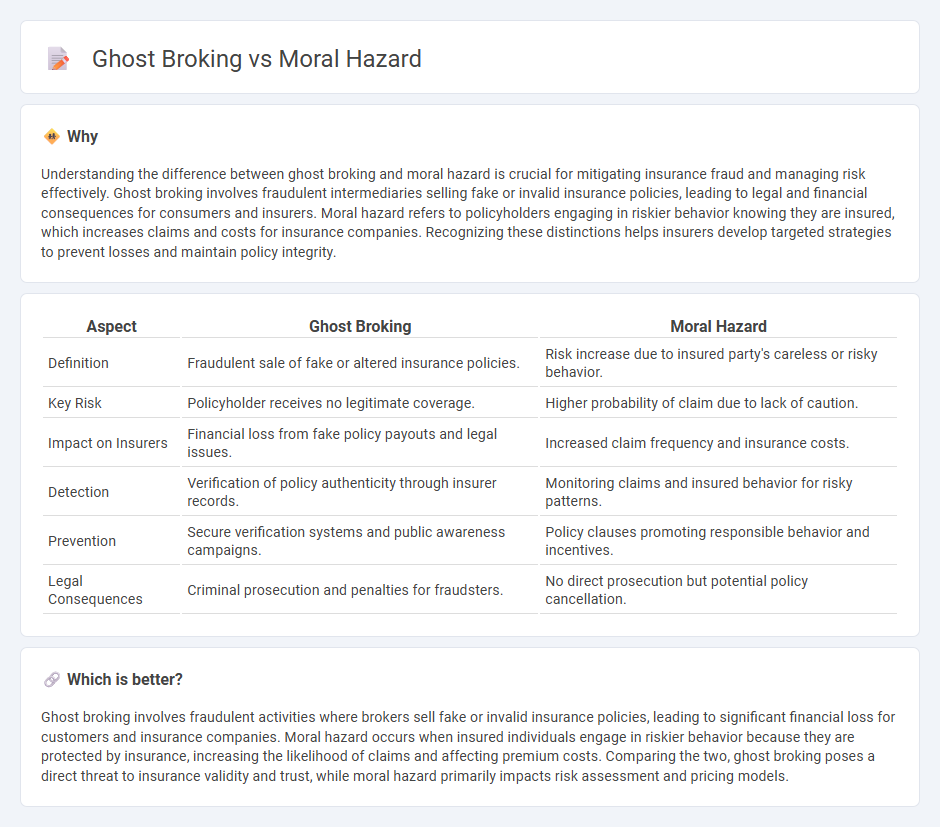

Understanding the difference between ghost broking and moral hazard is crucial for mitigating insurance fraud and managing risk effectively. Ghost broking involves fraudulent intermediaries selling fake or invalid insurance policies, leading to legal and financial consequences for consumers and insurers. Moral hazard refers to policyholders engaging in riskier behavior knowing they are insured, which increases claims and costs for insurance companies. Recognizing these distinctions helps insurers develop targeted strategies to prevent losses and maintain policy integrity.

Comparison Table

| Aspect | Ghost Broking | Moral Hazard |

|---|---|---|

| Definition | Fraudulent sale of fake or altered insurance policies. | Risk increase due to insured party's careless or risky behavior. |

| Key Risk | Policyholder receives no legitimate coverage. | Higher probability of claim due to lack of caution. |

| Impact on Insurers | Financial loss from fake policy payouts and legal issues. | Increased claim frequency and insurance costs. |

| Detection | Verification of policy authenticity through insurer records. | Monitoring claims and insured behavior for risky patterns. |

| Prevention | Secure verification systems and public awareness campaigns. | Policy clauses promoting responsible behavior and incentives. |

| Legal Consequences | Criminal prosecution and penalties for fraudsters. | No direct prosecution but potential policy cancellation. |

Which is better?

Ghost broking involves fraudulent activities where brokers sell fake or invalid insurance policies, leading to significant financial loss for customers and insurance companies. Moral hazard occurs when insured individuals engage in riskier behavior because they are protected by insurance, increasing the likelihood of claims and affecting premium costs. Comparing the two, ghost broking poses a direct threat to insurance validity and trust, while moral hazard primarily impacts risk assessment and pricing models.

Connection

Ghost broking involves fraudulent intermediaries who sell fake or altered insurance policies, exploiting customers by providing inadequate coverage. This deceptive practice directly amplifies moral hazard, as policyholders may intentionally engage in riskier behavior knowing their insurance is compromised or ineffective. The interplay between ghost broking and moral hazard increases financial losses for insurers and undermines trust in the insurance industry.

Key Terms

Risk behavior

Moral hazard involves risk behavior where individuals or entities take higher risks because they do not bear the full consequences, often seen in insurance markets when policyholders overconsume or underreport risks. Ghost broking exploits this by illegally selling forged or invalid insurance policies, increasing fraudulent claims and exposing both individuals and insurers to significant financial losses. Understanding these risk behaviors is crucial to combating insurance fraud and promoting safer financial practices--learn more about prevention strategies and regulations.

Fraud

Moral hazard in insurance occurs when a policyholder engages in riskier behavior knowing they are protected, increasing the likelihood of fraudulent claims. Ghost broking involves criminals selling fake or invalid insurance policies, defrauding customers and insurers alike. Explore the key differences and preventative measures to better understand these fraud types.

Misrepresentation

Moral hazard involves a party taking greater risks because they do not bear the full consequences, often leading to misrepresentation of facts in insurance claims. Ghost broking is a fraudulent practice where intermediaries illegally sell insurance policies, misrepresenting their legitimacy and leaving clients unprotected. Explore the nuances of misrepresentation in both to understand their impact on insurance fraud.

Source and External Links

Moral Hazard - Definition, Examples, Types, History - Moral hazard refers to situations where individuals or entities take more risks because they don't bear the full costs of their actions, often due to protection from an external party.

Moral hazard - This concept involves economic actors increasing their exposure to risk when they don't bear the full costs associated with that risk, commonly observed in insurance markets.

Moral Hazard in Health Insurance: What We Know and How We... - Moral hazard in health insurance occurs when individuals consume more healthcare services because they bear a smaller share of the costs, complicating the optimal design of insurance contracts.

dowidth.com

dowidth.com