Drone insurance covers risks related to unmanned aerial vehicles, including physical damage, liability, and theft, essential for commercial operators navigating increasing regulatory requirements. Cyber insurance protects businesses against digital threats such as data breaches, ransomware attacks, and IT infrastructure failures, offering financial support and incident response services. Discover how each policy addresses specific risk landscapes to safeguard your assets and operations effectively.

Why it is important

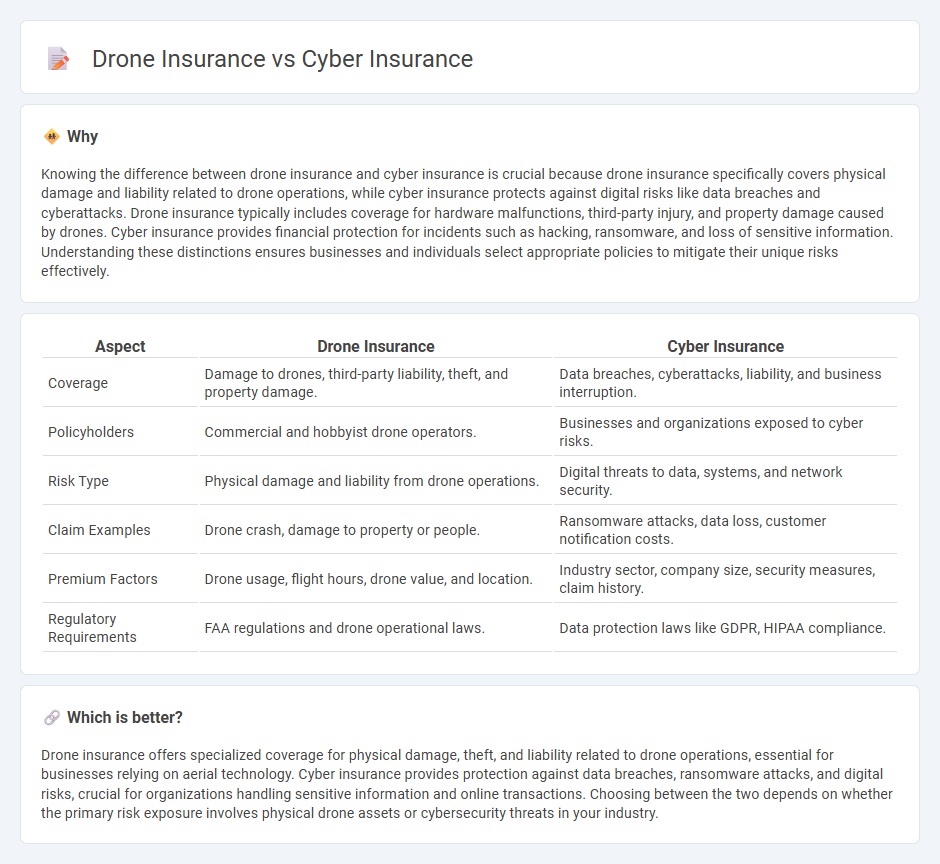

Knowing the difference between drone insurance and cyber insurance is crucial because drone insurance specifically covers physical damage and liability related to drone operations, while cyber insurance protects against digital risks like data breaches and cyberattacks. Drone insurance typically includes coverage for hardware malfunctions, third-party injury, and property damage caused by drones. Cyber insurance provides financial protection for incidents such as hacking, ransomware, and loss of sensitive information. Understanding these distinctions ensures businesses and individuals select appropriate policies to mitigate their unique risks effectively.

Comparison Table

| Aspect | Drone Insurance | Cyber Insurance |

|---|---|---|

| Coverage | Damage to drones, third-party liability, theft, and property damage. | Data breaches, cyberattacks, liability, and business interruption. |

| Policyholders | Commercial and hobbyist drone operators. | Businesses and organizations exposed to cyber risks. |

| Risk Type | Physical damage and liability from drone operations. | Digital threats to data, systems, and network security. |

| Claim Examples | Drone crash, damage to property or people. | Ransomware attacks, data loss, customer notification costs. |

| Premium Factors | Drone usage, flight hours, drone value, and location. | Industry sector, company size, security measures, claim history. |

| Regulatory Requirements | FAA regulations and drone operational laws. | Data protection laws like GDPR, HIPAA compliance. |

Which is better?

Drone insurance offers specialized coverage for physical damage, theft, and liability related to drone operations, essential for businesses relying on aerial technology. Cyber insurance provides protection against data breaches, ransomware attacks, and digital risks, crucial for organizations handling sensitive information and online transactions. Choosing between the two depends on whether the primary risk exposure involves physical drone assets or cybersecurity threats in your industry.

Connection

Drone insurance and cyber insurance are interconnected through their shared focus on managing emerging technological risks, particularly involving data breaches and system failures. Drones equipped with advanced sensors and communication technology generate vast amounts of data susceptible to cyber attacks, making cyber liability coverage essential for drone operators. Integrating drone insurance with cyber insurance provides comprehensive protection against physical damage, liability, and cyber threats, ensuring resilience in a digitally driven environment.

Key Terms

Cyber Insurance:

Cyber insurance protects businesses from financial losses due to data breaches, ransomware attacks, and other cyber threats, covering costs like legal fees, notification expenses, and business interruption. It is essential for companies handling sensitive information or relying heavily on digital infrastructure to mitigate the risks of cybercrime. Explore more about how cyber insurance can safeguard your organization against evolving cyber risks.

Data Breach

Cyber insurance provides critical coverage for data breaches by protecting businesses against financial losses from unauthorized access, data theft, and recovery expenses. Drone insurance typically covers physical damages and liability related to drone operations but rarely includes comprehensive protection against data breaches that may result from drone-collected information. Explore the distinct risk management benefits of cyber insurance versus drone insurance in your data security strategy.

Ransomware

Cyber insurance covers ransomware attacks by providing financial protection against data breaches, extortion, and system downtime caused by malicious ransomware encrypting critical business information. Drone insurance primarily focuses on physical damage, liability, and theft, but typically excludes cyber risks like ransomware that target digital systems controlling drones or storing flight data. Explore comprehensive solutions to safeguard both your digital assets and drone operations from ransomware threats.

Source and External Links

What is Cyber Insurance? | IBM - Cyber insurance, also known as cyber liability or cybersecurity insurance, covers financial losses from cyber incidents like ransomware attacks and data breaches, including costs for damaged systems, lost revenue, and legal expenses.

Cyber insurance - Wikipedia - Cyber insurance is a specialty product protecting businesses from IT-related risks, offering financial recovery after security breaches and often requiring IT security audits before policy issuance to assess and mitigate vulnerabilities.

What Is Cyber Insurance? - Cisco - Cyber insurance helps businesses hedge against the effects of cybercrime by covering a range of losses from attacks, but it should complement, not replace, cybersecurity defenses and is tailored based on the company's current security posture.

dowidth.com

dowidth.com