Pay-as-you-drive insurance calculates premiums based on actual miles driven, offering cost savings for low-usage drivers through real-time tracking technology. Low-mileage discount insurance provides reduced rates for policyholders who drive below a specific annual mileage threshold, verified through reported estimates or odometer readings. Explore detailed comparisons to determine which option best fits your driving habits and budget.

Why it is important

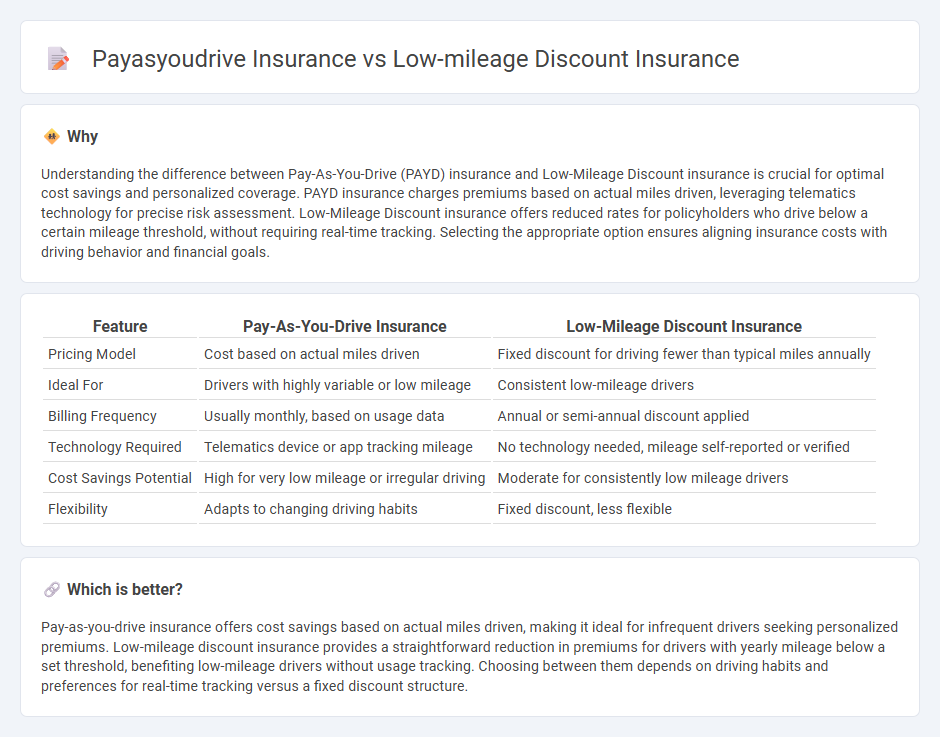

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Low-Mileage Discount insurance is crucial for optimal cost savings and personalized coverage. PAYD insurance charges premiums based on actual miles driven, leveraging telematics technology for precise risk assessment. Low-Mileage Discount insurance offers reduced rates for policyholders who drive below a certain mileage threshold, without requiring real-time tracking. Selecting the appropriate option ensures aligning insurance costs with driving behavior and financial goals.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Low-Mileage Discount Insurance |

|---|---|---|

| Pricing Model | Cost based on actual miles driven | Fixed discount for driving fewer than typical miles annually |

| Ideal For | Drivers with highly variable or low mileage | Consistent low-mileage drivers |

| Billing Frequency | Usually monthly, based on usage data | Annual or semi-annual discount applied |

| Technology Required | Telematics device or app tracking mileage | No technology needed, mileage self-reported or verified |

| Cost Savings Potential | High for very low mileage or irregular driving | Moderate for consistently low mileage drivers |

| Flexibility | Adapts to changing driving habits | Fixed discount, less flexible |

Which is better?

Pay-as-you-drive insurance offers cost savings based on actual miles driven, making it ideal for infrequent drivers seeking personalized premiums. Low-mileage discount insurance provides a straightforward reduction in premiums for drivers with yearly mileage below a set threshold, benefiting low-mileage drivers without usage tracking. Choosing between them depends on driving habits and preferences for real-time tracking versus a fixed discount structure.

Connection

Pay-as-you-drive insurance calculates premiums based on actual miles driven, rewarding low-mileage drivers with lower costs. Low-mileage discount insurance offers reduced rates for policyholders who drive fewer miles annually, often verified through odometer readings or telematics. Both insurance types incentivize reduced driving by aligning premiums with the distance traveled, promoting cost savings and safer road behavior.

Key Terms

Mileage Tracking

Low-mileage discount insurance offers reduced premiums based on annual miles driven, verified primarily through odometer readings, while pay-as-you-drive insurance uses real-time mileage tracking via telematics devices or mobile apps to calculate costs dynamically. Pay-as-you-drive policies provide granular data on driving behavior, enabling more personalized rate adjustments and potentially greater savings for infrequent drivers. Explore how these mileage tracking methods impact your insurance premiums and coverage options.

Premium Calculation

Low-mileage discount insurance calculates premiums based on the annual miles driven, offering lower rates to drivers who use their vehicles infrequently, typically tracked through odometer readings. Pay-as-you-drive insurance uses telematics technology to monitor actual driving behavior, including distance, time, and sometimes driving habits like speed and braking, resulting in dynamic premium adjustments. Explore how each method impacts your insurance costs and find the best fit for your driving patterns.

Usage Validation

Low-mileage discount insurance calculates premiums based on actual mileage reported, rewarding drivers who consistently drive fewer miles with lower rates. Pay-as-you-drive insurance utilizes telematics technology to monitor real-time driving behavior, including distance, speed, and time of driving, offering a more personalized and accurate risk assessment. Explore detailed comparisons and benefits of these insurance models to choose the best fit for your driving habits.

Source and External Links

Save Big with the Best New York Low Mileage Insurance - This article discusses how New York drivers can qualify for low-mileage insurance discounts by maintaining annual mileage below 12,000 miles, with top insurers offering competitive discounts.

Best Low-Mileage Car Insurance Options (2025) - This page provides an overview of low-mileage car insurance options, including traditional discounts, pay-per-mile insurance, and usage-based insurance, to help drivers choose the best coverage based on their mileage.

Best Car Insurance for Low-Mileage Drivers - This guide explores how low-mileage drivers can save up to 30% on car insurance by leveraging discounts and different types of insurance policies, including traditional and usage-based options.

dowidth.com

dowidth.com