Digital nomad insurance offers comprehensive coverage tailored for remote workers traveling long-term, including health, equipment, and liability protection. Backpacker insurance focuses on short-term, adventure-related risks such as emergency medical care and trip interruptions. Discover how to choose the right insurance plan based on your travel lifestyle and needs.

Why it is important

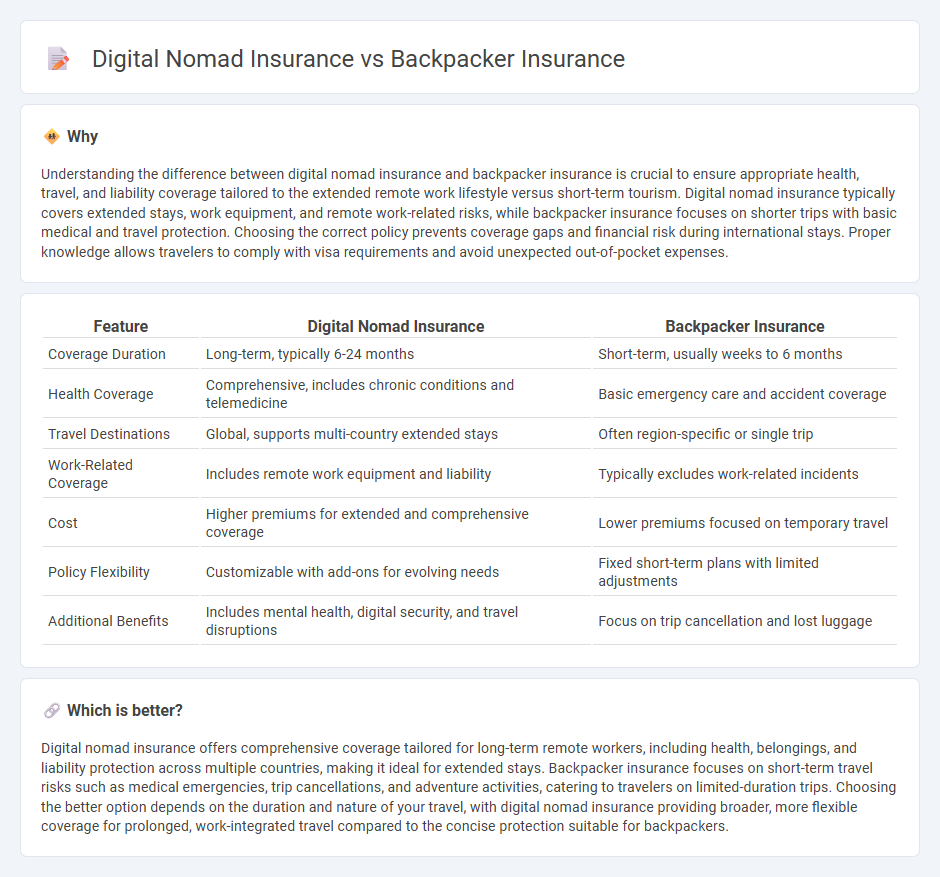

Understanding the difference between digital nomad insurance and backpacker insurance is crucial to ensure appropriate health, travel, and liability coverage tailored to the extended remote work lifestyle versus short-term tourism. Digital nomad insurance typically covers extended stays, work equipment, and remote work-related risks, while backpacker insurance focuses on shorter trips with basic medical and travel protection. Choosing the correct policy prevents coverage gaps and financial risk during international stays. Proper knowledge allows travelers to comply with visa requirements and avoid unexpected out-of-pocket expenses.

Comparison Table

| Feature | Digital Nomad Insurance | Backpacker Insurance |

|---|---|---|

| Coverage Duration | Long-term, typically 6-24 months | Short-term, usually weeks to 6 months |

| Health Coverage | Comprehensive, includes chronic conditions and telemedicine | Basic emergency care and accident coverage |

| Travel Destinations | Global, supports multi-country extended stays | Often region-specific or single trip |

| Work-Related Coverage | Includes remote work equipment and liability | Typically excludes work-related incidents |

| Cost | Higher premiums for extended and comprehensive coverage | Lower premiums focused on temporary travel |

| Policy Flexibility | Customizable with add-ons for evolving needs | Fixed short-term plans with limited adjustments |

| Additional Benefits | Includes mental health, digital security, and travel disruptions | Focus on trip cancellation and lost luggage |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for long-term remote workers, including health, belongings, and liability protection across multiple countries, making it ideal for extended stays. Backpacker insurance focuses on short-term travel risks such as medical emergencies, trip cancellations, and adventure activities, catering to travelers on limited-duration trips. Choosing the better option depends on the duration and nature of your travel, with digital nomad insurance providing broader, more flexible coverage for prolonged, work-integrated travel compared to the concise protection suitable for backpackers.

Connection

Digital nomad insurance and backpacker insurance both provide tailored coverage for travelers seeking flexibility and protection on the move, addressing risks such as medical emergencies, trip interruptions, and loss of belongings. Both insurance types offer global or multi-country coverage, recognizing the unpredictable routes and extended stays typical of nomadic lifestyles. Emphasizing comprehensive health and travel protection, these insurances ensure seamless transitions between destinations without coverage gaps.

Key Terms

Trip Duration Limit

Backpacker insurance typically covers shorter trip durations, often ranging from a few weeks up to six months, making it ideal for temporary travel. Digital nomad insurance is designed for extended stays, offering coverage for trips that can last several months to years, accommodating remote work lifestyles. Explore how trip duration limits impact your coverage needs to choose the best insurance for your travel style.

Coverage Region

Backpacker insurance typically covers short-term travel in a limited set of countries, focusing on popular tourist destinations and often excluding long-term stays or remote work scenarios. Digital nomad insurance offers broader coverage, including multiple countries and extended periods, catering specifically to remote workers who live and work across diverse international locations. Explore detailed comparisons to find the ideal insurance coverage region for your travel and work lifestyle.

Work Activity Coverage

Backpacker insurance typically covers travel-related risks like theft and medical emergencies but often excludes comprehensive work activity coverage essential for remote professionals. Digital nomad insurance is specifically designed to protect against risks associated with freelancing or remote work, including liability claims, equipment protection, and income interruption during work activities. Explore the differences in coverage details to ensure your work and travel are fully protected.

Source and External Links

Travel Insurance Plans For Backpackers - Travel Guard offers various travel insurance options tailored for backpacking that include medical expenses, baggage coverage, and 24/7 emergency travel assistance, providing peace of mind during your trip.

Compare Backpacker Insurance Quotes 2025 - Backpacker insurance typically covers extended multi-country trips lasting up to 18-24 months, includes coverage for various activities, and may cover paid or unpaid work, making it suitable for long-term travelers.

Backpacker Travel Insurance | True Traveller(r) - True Traveller offers flexible backpacker insurance policies up to 2 years, covering medical expenses, repatriation, personal liability, and up to 92 activities; policies suspend while at home and allow returning home multiple times without losing coverage.

dowidth.com

dowidth.com