Flood insurance integration involves embedding coverage for water damage caused by flooding into broader property or home insurance policies, ensuring seamless claims processing and risk assessment for homeowners in flood-prone areas. Pet insurance integration combines animal health coverage with existing health or lifestyle insurance plans, providing comprehensive protection for veterinary expenses and ensuring streamlined policy management. Discover how these integration strategies optimize protection and convenience across diverse insurance needs.

Why it is important

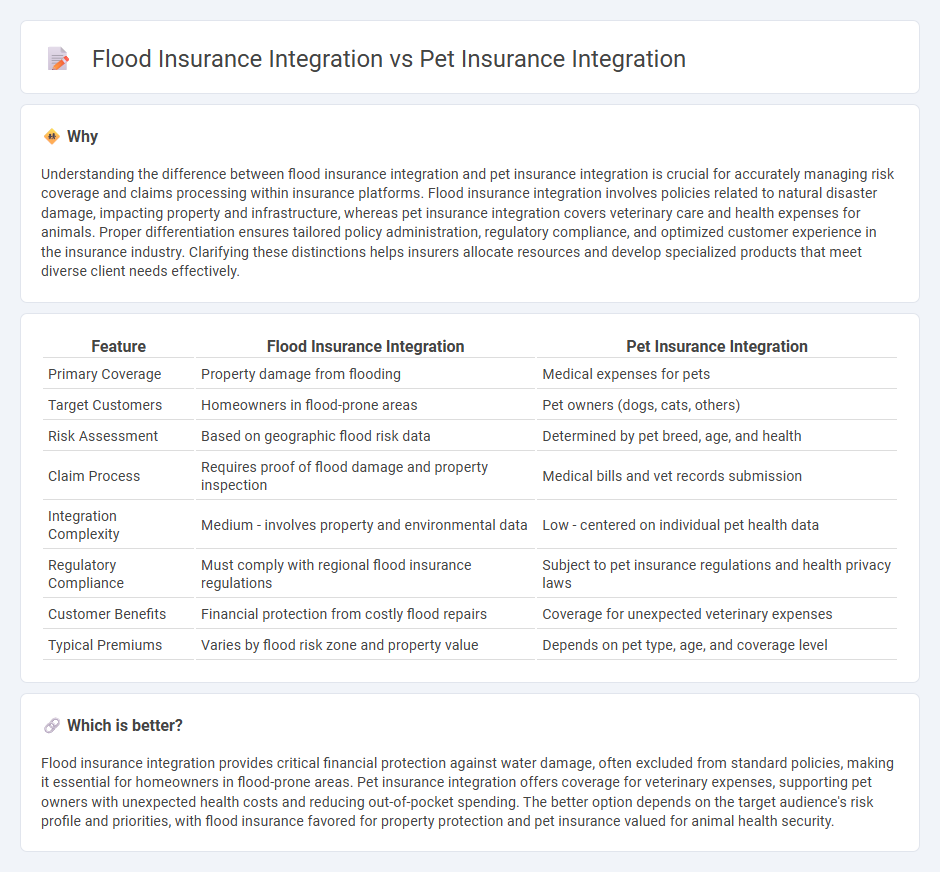

Understanding the difference between flood insurance integration and pet insurance integration is crucial for accurately managing risk coverage and claims processing within insurance platforms. Flood insurance integration involves policies related to natural disaster damage, impacting property and infrastructure, whereas pet insurance integration covers veterinary care and health expenses for animals. Proper differentiation ensures tailored policy administration, regulatory compliance, and optimized customer experience in the insurance industry. Clarifying these distinctions helps insurers allocate resources and develop specialized products that meet diverse client needs effectively.

Comparison Table

| Feature | Flood Insurance Integration | Pet Insurance Integration |

|---|---|---|

| Primary Coverage | Property damage from flooding | Medical expenses for pets |

| Target Customers | Homeowners in flood-prone areas | Pet owners (dogs, cats, others) |

| Risk Assessment | Based on geographic flood risk data | Determined by pet breed, age, and health |

| Claim Process | Requires proof of flood damage and property inspection | Medical bills and vet records submission |

| Integration Complexity | Medium - involves property and environmental data | Low - centered on individual pet health data |

| Regulatory Compliance | Must comply with regional flood insurance regulations | Subject to pet insurance regulations and health privacy laws |

| Customer Benefits | Financial protection from costly flood repairs | Coverage for unexpected veterinary expenses |

| Typical Premiums | Varies by flood risk zone and property value | Depends on pet type, age, and coverage level |

Which is better?

Flood insurance integration provides critical financial protection against water damage, often excluded from standard policies, making it essential for homeowners in flood-prone areas. Pet insurance integration offers coverage for veterinary expenses, supporting pet owners with unexpected health costs and reducing out-of-pocket spending. The better option depends on the target audience's risk profile and priorities, with flood insurance favored for property protection and pet insurance valued for animal health security.

Connection

Flood insurance integration and pet insurance integration enhance comprehensive risk management by offering tailored coverage solutions within unified insurance platforms. Both types of integration leverage advanced data analytics and customer segmentation to streamline claims processing and improve policy customization. Insurers benefit from cross-selling opportunities and increased customer retention by bundling these specialized coverages.

Key Terms

Pet Insurance Integration:

Pet insurance integration streamlines claims processing and policy management by connecting veterinary clinics and insurance providers through seamless digital platforms, reducing administrative burdens and improving customer experience. It enables real-time data sharing for treatment updates and claim approvals, enhancing accuracy and speeding up reimbursements. Discover how integrating pet insurance can optimize operations and customer satisfaction for your business.

Veterinary Network Integration

Veterinary network integration streamlines pet insurance by providing direct access to a connected network of veterinary clinics, facilitating seamless claims processing and enhancing policyholder experience. In contrast, flood insurance integration primarily involves linking with weather data and property databases to assess flood risk and validate claims, with limited applicability to veterinary services. Explore how advanced veterinary network integration can optimize pet insurance solutions for improved customer satisfaction and operational efficiency.

Claims Automation

Pet insurance integration streamlines claims automation by enabling seamless submission, verification, and processing of veterinary bills, reducing manual errors and speeding up reimbursements. Flood insurance integration focuses on automating damage assessments and claim payouts using advanced data analytics and satellite imaging to expedite settlements. Discover how automated claims processes in both pet and flood insurance can improve customer satisfaction and operational efficiency.

Source and External Links

New partnership between pet insurance organizations - This collaboration integrates Odie's pet insurance offerings into Insuritas' BUNDLE embedded insurance platform, providing a convenient option for customers.

Synchrony Introduces First-of-its-Kind Technology Connecting Pet Insurance and CareCredit - This innovation simplifies pet care payments by directly reimbursing insurance claims to the CareCredit card, streamlining the payment process for pet owners.

Pawlicy Advisor Launches Integration with ezyVet - This integration enhances service offerings and improves client satisfaction by empowering pet owners to make informed decisions about pet health and insurance coverage.

dowidth.com

dowidth.com