Insurtech platforms leverage advanced technologies such as AI, blockchain, and big data to streamline insurance processes, improve customer experience, and enhance risk assessment. Insurance telematics platforms focus specifically on collecting and analyzing real-time data from devices like GPS and IoT sensors to personalize policies and optimize premiums based on actual user behavior. Explore the differences and benefits of these innovative insurance solutions to better understand their impact on the industry.

Why it is important

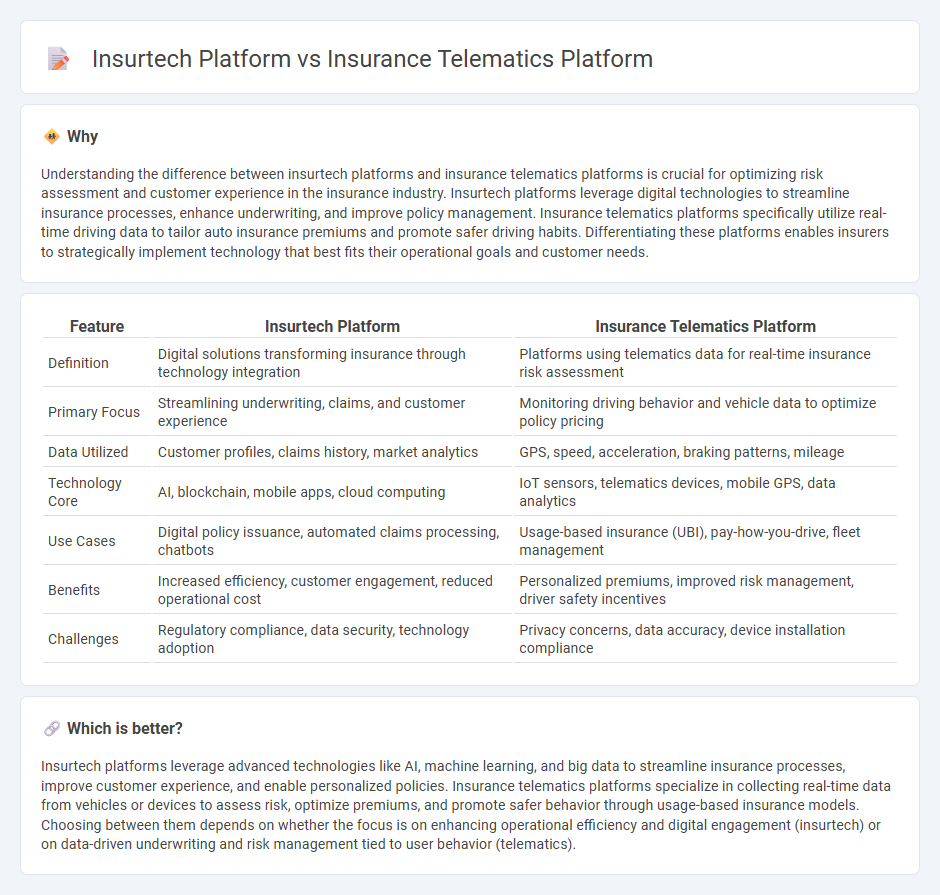

Understanding the difference between insurtech platforms and insurance telematics platforms is crucial for optimizing risk assessment and customer experience in the insurance industry. Insurtech platforms leverage digital technologies to streamline insurance processes, enhance underwriting, and improve policy management. Insurance telematics platforms specifically utilize real-time driving data to tailor auto insurance premiums and promote safer driving habits. Differentiating these platforms enables insurers to strategically implement technology that best fits their operational goals and customer needs.

Comparison Table

| Feature | Insurtech Platform | Insurance Telematics Platform |

|---|---|---|

| Definition | Digital solutions transforming insurance through technology integration | Platforms using telematics data for real-time insurance risk assessment |

| Primary Focus | Streamlining underwriting, claims, and customer experience | Monitoring driving behavior and vehicle data to optimize policy pricing |

| Data Utilized | Customer profiles, claims history, market analytics | GPS, speed, acceleration, braking patterns, mileage |

| Technology Core | AI, blockchain, mobile apps, cloud computing | IoT sensors, telematics devices, mobile GPS, data analytics |

| Use Cases | Digital policy issuance, automated claims processing, chatbots | Usage-based insurance (UBI), pay-how-you-drive, fleet management |

| Benefits | Increased efficiency, customer engagement, reduced operational cost | Personalized premiums, improved risk management, driver safety incentives |

| Challenges | Regulatory compliance, data security, technology adoption | Privacy concerns, data accuracy, device installation compliance |

Which is better?

Insurtech platforms leverage advanced technologies like AI, machine learning, and big data to streamline insurance processes, improve customer experience, and enable personalized policies. Insurance telematics platforms specialize in collecting real-time data from vehicles or devices to assess risk, optimize premiums, and promote safer behavior through usage-based insurance models. Choosing between them depends on whether the focus is on enhancing operational efficiency and digital engagement (insurtech) or on data-driven underwriting and risk management tied to user behavior (telematics).

Connection

Insurtech platforms leverage advanced data analytics and digital tools to streamline insurance processes, while insurance telematics platforms collect real-time driving data through IoT devices. Together, they enable personalized insurance policies by analyzing driver behavior, reducing risk, and improving claims accuracy. Integration of these technologies enhances customer experience, promotes risk-based pricing, and drives innovation in the insurance industry.

Key Terms

**Insurance Telematics Platform:**

Insurance telematics platforms utilize real-time data from vehicle sensors to monitor driving behavior, enabling personalized risk assessments and usage-based insurance pricing. These platforms enhance claim processing accuracy and promote safer driving habits by providing actionable insights to insurers and policyholders. Explore how insurance telematics platforms transform risk management and customer engagement in modern insurance.

Usage-Based Insurance (UBI)

Insurance telematics platforms utilize real-time driving data collected through connected devices to enable Usage-Based Insurance (UBI) models, enhancing risk assessment and personalized premium pricing based on actual user behavior. Insurtech platforms encompass broader technological innovations within the insurance sector, integrating AI, blockchain, and data analytics to streamline underwriting, claims processing, and customer experience, with UBI being one specialized application. Discover how these platforms revolutionize risk management and customer engagement in modern insurance.

Telematics Data Analytics

Insurance telematics platforms specialize in collecting and analyzing driving behavior data through connected devices to optimize risk assessment, pricing, and claims management. Insurtech platforms offer a broader range of digital solutions, including policy management, customer engagement, and AI-driven underwriting, with telematics data analytics as one component. Explore in-depth insights on how telematics data analytics transforms insurance risk modeling and customer personalization.

Source and External Links

Telematics-Based Insurance by Upstream - Upstream offers a cloud-based telematics platform that enables insurance companies to provide usage-based insurance without relying on in-vehicle hardware, enhancing risk underwriting, automating crash reporting, and improving actuarial analytics.

Telematics Insurance: How it Works, Benefits + Providers - This resource explains that insurance telematics uses GPS or mobile apps to collect driving behavior data, enabling personalized premiums based on real-time driver behavior, promoting fair pricing and risk management.

Data-Driven Insurance Telematics Solutions by Earnix - Earnix provides an intelligent telematics and IoT platform for insurers to develop personalized insurance products, improve pricing accuracy, and accelerate market delivery using detailed driving behavior data.

dowidth.com

dowidth.com