Earthquake microinsurance provides financial protection against seismic events, helping small-scale farmers and communities recover quickly from property and livelihood damage caused by earthquakes. Crop microinsurance specifically covers losses due to weather-related risks like droughts and floods, safeguarding agricultural income and ensuring food security. Explore how tailored microinsurance solutions can enhance resilience in vulnerable regions.

Why it is important

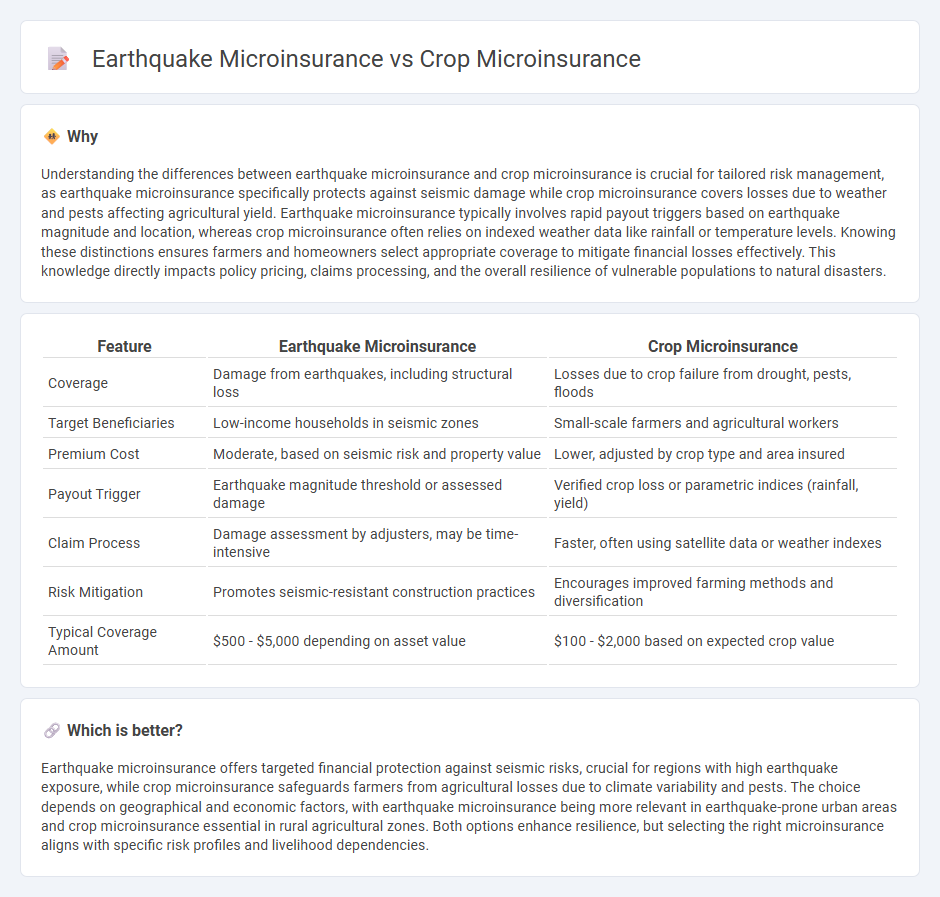

Understanding the differences between earthquake microinsurance and crop microinsurance is crucial for tailored risk management, as earthquake microinsurance specifically protects against seismic damage while crop microinsurance covers losses due to weather and pests affecting agricultural yield. Earthquake microinsurance typically involves rapid payout triggers based on earthquake magnitude and location, whereas crop microinsurance often relies on indexed weather data like rainfall or temperature levels. Knowing these distinctions ensures farmers and homeowners select appropriate coverage to mitigate financial losses effectively. This knowledge directly impacts policy pricing, claims processing, and the overall resilience of vulnerable populations to natural disasters.

Comparison Table

| Feature | Earthquake Microinsurance | Crop Microinsurance |

|---|---|---|

| Coverage | Damage from earthquakes, including structural loss | Losses due to crop failure from drought, pests, floods |

| Target Beneficiaries | Low-income households in seismic zones | Small-scale farmers and agricultural workers |

| Premium Cost | Moderate, based on seismic risk and property value | Lower, adjusted by crop type and area insured |

| Payout Trigger | Earthquake magnitude threshold or assessed damage | Verified crop loss or parametric indices (rainfall, yield) |

| Claim Process | Damage assessment by adjusters, may be time-intensive | Faster, often using satellite data or weather indexes |

| Risk Mitigation | Promotes seismic-resistant construction practices | Encourages improved farming methods and diversification |

| Typical Coverage Amount | $500 - $5,000 depending on asset value | $100 - $2,000 based on expected crop value |

Which is better?

Earthquake microinsurance offers targeted financial protection against seismic risks, crucial for regions with high earthquake exposure, while crop microinsurance safeguards farmers from agricultural losses due to climate variability and pests. The choice depends on geographical and economic factors, with earthquake microinsurance being more relevant in earthquake-prone urban areas and crop microinsurance essential in rural agricultural zones. Both options enhance resilience, but selecting the right microinsurance aligns with specific risk profiles and livelihood dependencies.

Connection

Earthquake microinsurance and crop microinsurance both serve as specialized financial tools designed to protect vulnerable populations from natural disaster risks, particularly in agrarian economies. They mitigate economic losses by providing immediate compensation for damages caused by seismic activities or adverse weather impacting crops. These microinsurance products often utilize localized risk assessment models and mobile payment platforms to ensure accessibility and affordability for small-scale farmers and residents in earthquake-prone regions.

Key Terms

**Crop Microinsurance:**

Crop microinsurance protects smallholder farmers against losses from adverse weather events, pests, and diseases that damage crops, ensuring financial stability and food security. It typically covers risks such as drought, flood, hailstorms, and pest infestations, tailored to the specific needs of agricultural communities. Explore how crop microinsurance can safeguard livelihoods and enhance resilience in vulnerable farming regions.

Yield Index

Crop microinsurance tailored with Yield Index aims to stabilize farmers' income by compensating for yield shortfalls due to adverse weather or pests, effectively mitigating risks tied to agricultural productivity. Earthquake microinsurance, in contrast, offers financial relief based on seismic intensity or damage indices, focusing on structural losses rather than production output. Explore more about how Yield Index mechanisms optimize risk management in agricultural microinsurance versus property damage models in earthquake coverage.

Weather Triggers

Crop microinsurance primarily relies on weather triggers such as drought, excessive rainfall, or hailstorms to provide financial protection to farmers against yield losses. Earthquake microinsurance, conversely, is centered on seismic activity detection and does not involve weather-related triggers, focusing instead on ground shaking intensity and location. Explore more about how these distinct triggers influence insurance policy design and risk management strategies.

Source and External Links

Micro Farm Program Fact Sheet - This program provides a risk management safety net for small farms with up to $350,000 in approved revenue, covering various commodities and markets.

Promoting Agricultural Microinsurance - A proposed bill in Colombia aims to formalize and encourage micro-insurance for small farmers by creating a specific insurance product tailored to their needs.

Affordable Crop Insurance for Small-Scale Farmers - Microinsurance offers affordable and flexible crop insurance options for small-scale farmers, leveraging digital innovations to improve food security.

dowidth.com

dowidth.com