Cyber risk insurance protects businesses from financial losses due to data breaches, cyberattacks, and other digital threats, covering costs like notification, remediation, and legal fees. Directors and Officers (D&O) insurance safeguards corporate leaders against personal losses arising from claims of wrongful acts in their managerial roles, including mismanagement and breaches of fiduciary duty. Explore the differences and benefits of each policy to better protect your organization.

Why it is important

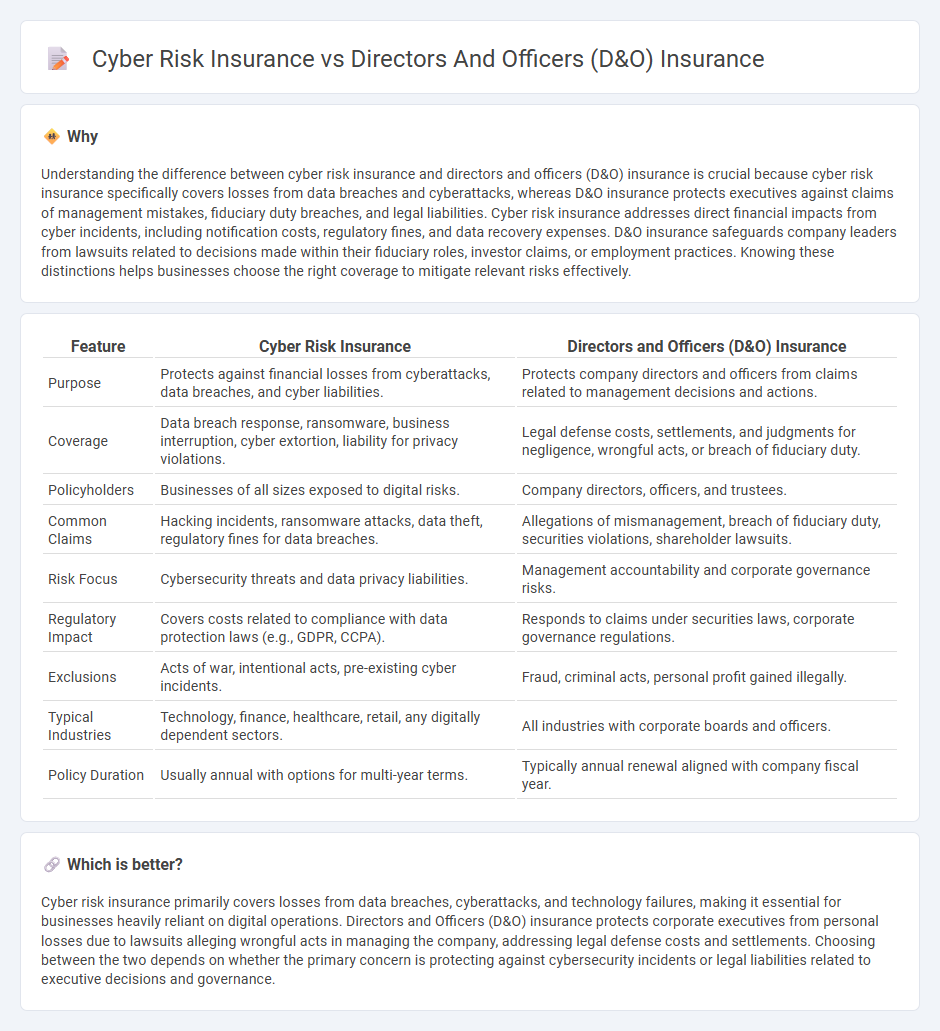

Understanding the difference between cyber risk insurance and directors and officers (D&O) insurance is crucial because cyber risk insurance specifically covers losses from data breaches and cyberattacks, whereas D&O insurance protects executives against claims of management mistakes, fiduciary duty breaches, and legal liabilities. Cyber risk insurance addresses direct financial impacts from cyber incidents, including notification costs, regulatory fines, and data recovery expenses. D&O insurance safeguards company leaders from lawsuits related to decisions made within their fiduciary roles, investor claims, or employment practices. Knowing these distinctions helps businesses choose the right coverage to mitigate relevant risks effectively.

Comparison Table

| Feature | Cyber Risk Insurance | Directors and Officers (D&O) Insurance |

|---|---|---|

| Purpose | Protects against financial losses from cyberattacks, data breaches, and cyber liabilities. | Protects company directors and officers from claims related to management decisions and actions. |

| Coverage | Data breach response, ransomware, business interruption, cyber extortion, liability for privacy violations. | Legal defense costs, settlements, and judgments for negligence, wrongful acts, or breach of fiduciary duty. |

| Policyholders | Businesses of all sizes exposed to digital risks. | Company directors, officers, and trustees. |

| Common Claims | Hacking incidents, ransomware attacks, data theft, regulatory fines for data breaches. | Allegations of mismanagement, breach of fiduciary duty, securities violations, shareholder lawsuits. |

| Risk Focus | Cybersecurity threats and data privacy liabilities. | Management accountability and corporate governance risks. |

| Regulatory Impact | Covers costs related to compliance with data protection laws (e.g., GDPR, CCPA). | Responds to claims under securities laws, corporate governance regulations. |

| Exclusions | Acts of war, intentional acts, pre-existing cyber incidents. | Fraud, criminal acts, personal profit gained illegally. |

| Typical Industries | Technology, finance, healthcare, retail, any digitally dependent sectors. | All industries with corporate boards and officers. |

| Policy Duration | Usually annual with options for multi-year terms. | Typically annual renewal aligned with company fiscal year. |

Which is better?

Cyber risk insurance primarily covers losses from data breaches, cyberattacks, and technology failures, making it essential for businesses heavily reliant on digital operations. Directors and Officers (D&O) insurance protects corporate executives from personal losses due to lawsuits alleging wrongful acts in managing the company, addressing legal defense costs and settlements. Choosing between the two depends on whether the primary concern is protecting against cybersecurity incidents or legal liabilities related to executive decisions and governance.

Connection

Cyber risk insurance and Directors and Officers (D&O) insurance are interconnected through their shared focus on protecting corporate leadership from liabilities arising in the digital age. Cyber risk insurance addresses financial losses and legal exposures from cyberattacks, while D&O insurance covers claims related to management decisions and fiduciary duties, including failures to manage cyber risks effectively. The increasing frequency of data breaches often triggers D&O claims, making combined coverage essential for comprehensive risk management.

Key Terms

**Directors and Officers (D&O) Insurance:**

Directors and Officers (D&O) insurance provides coverage for legal expenses and damages arising from claims against company executives for alleged wrongful acts in their managerial capacity. This policy protects individuals from claims related to breach of fiduciary duty, misrepresentation, or errors in corporate governance. Explore the critical distinctions and benefits of D&O insurance to safeguard leadership effectively.

Fiduciary Duty

Directors and Officers (D&O) insurance primarily covers fiduciary duty claims arising from alleged breaches of duty, mismanagement, or failure to comply with regulatory obligations by company leaders. Cyber risk insurance, while addressing data breaches and cyberattacks, rarely extends protection specifically for fiduciary duty violations related to cybersecurity oversight failures. To understand how each policy safeguards fiduciary responsibilities and mitigates associated risks, explore the detailed coverage comparisons further.

Wrongful Act

Directors and Officers (D&O) insurance primarily covers losses arising from wrongful acts such as breaches of fiduciary duty, mismanagement, or errors in corporate governance by company leaders. Cyber risk insurance focuses on liabilities and damages stemming from cyber incidents, including data breaches, network security failures, and privacy violations, rather than traditional fiduciary wrongdoings. Explore detailed comparisons to understand which insurance best protects your company's specific exposure to wrongful acts.

Source and External Links

What is D&O insurance? Learn more here | Allianz Commercial - Directors and Officers (D&O) insurance protects company executives and board members from claims related to their decisions and actions in their roles, covering defense costs and settlements, including coverage for past, current, and future directors, but excludes fraudulent or criminal acts.

directors and officers (D&O) liability insurance - IRMI - D&O liability insurance safeguards directors and officers against personal financial losses from lawsuits arising from their management decisions, and is generally written on a claims-made basis, protecting both individuals and sometimes the organization from legal costs and claims.

D&O Insurance Explained - Insurance Training Center - D&O insurance defends directors and officers from financial losses due to third-party claims related to their duties, including defense costs, judgments, settlements, and fines, even when allegations are false, and it may also protect the organization depending on the policy.

dowidth.com

dowidth.com