Cyber risk insurance protects businesses from financial losses due to data breaches, cyberattacks, and digital disruptions, focusing on technology-driven threats. Environmental liability insurance covers damages and cleanup costs related to pollution, hazardous waste, and environmental accidents affecting land, water, or air quality. Explore the differences and benefits of each insurance type to safeguard your organization effectively.

Why it is important

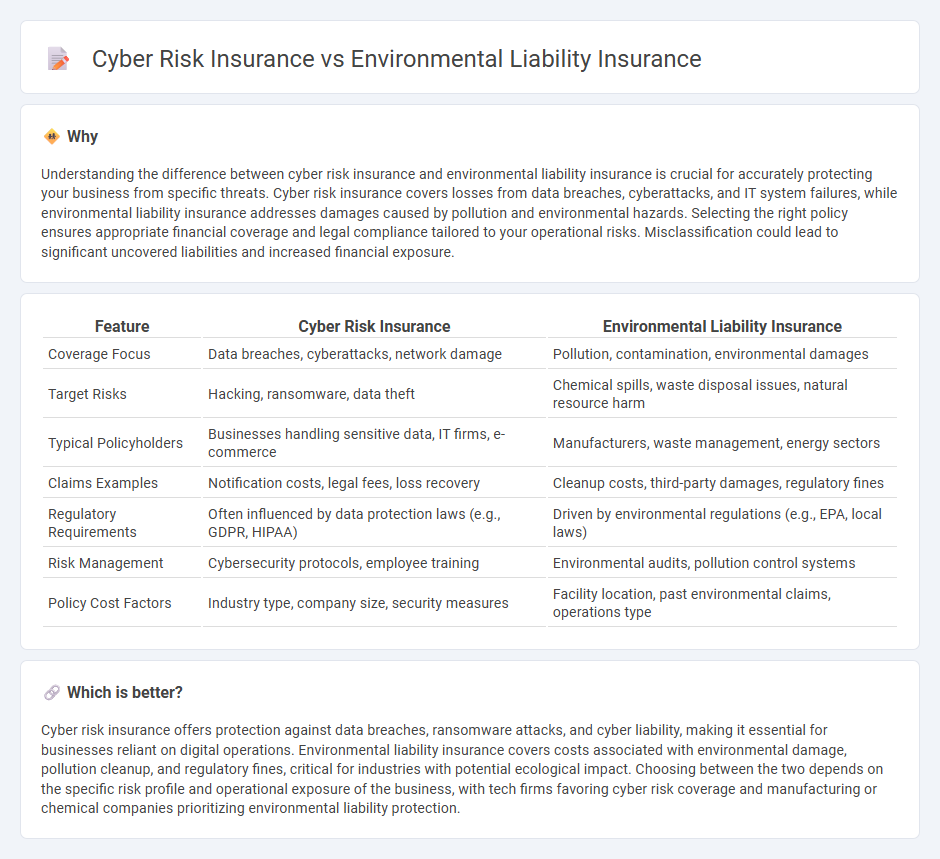

Understanding the difference between cyber risk insurance and environmental liability insurance is crucial for accurately protecting your business from specific threats. Cyber risk insurance covers losses from data breaches, cyberattacks, and IT system failures, while environmental liability insurance addresses damages caused by pollution and environmental hazards. Selecting the right policy ensures appropriate financial coverage and legal compliance tailored to your operational risks. Misclassification could lead to significant uncovered liabilities and increased financial exposure.

Comparison Table

| Feature | Cyber Risk Insurance | Environmental Liability Insurance |

|---|---|---|

| Coverage Focus | Data breaches, cyberattacks, network damage | Pollution, contamination, environmental damages |

| Target Risks | Hacking, ransomware, data theft | Chemical spills, waste disposal issues, natural resource harm |

| Typical Policyholders | Businesses handling sensitive data, IT firms, e-commerce | Manufacturers, waste management, energy sectors |

| Claims Examples | Notification costs, legal fees, loss recovery | Cleanup costs, third-party damages, regulatory fines |

| Regulatory Requirements | Often influenced by data protection laws (e.g., GDPR, HIPAA) | Driven by environmental regulations (e.g., EPA, local laws) |

| Risk Management | Cybersecurity protocols, employee training | Environmental audits, pollution control systems |

| Policy Cost Factors | Industry type, company size, security measures | Facility location, past environmental claims, operations type |

Which is better?

Cyber risk insurance offers protection against data breaches, ransomware attacks, and cyber liability, making it essential for businesses reliant on digital operations. Environmental liability insurance covers costs associated with environmental damage, pollution cleanup, and regulatory fines, critical for industries with potential ecological impact. Choosing between the two depends on the specific risk profile and operational exposure of the business, with tech firms favoring cyber risk coverage and manufacturing or chemical companies prioritizing environmental liability protection.

Connection

Cyber risk insurance and environmental liability insurance intersect through the growing reliance on digital systems to monitor and manage environmental compliance, where cyberattacks can lead to uncontrolled environmental damage and liability claims. Both coverages address risks emerging from technology-driven exposures, such as data breaches affecting environmental monitoring devices or ransomware disrupting emergency response systems. Insurers often evaluate cyber vulnerabilities within environmental risk frameworks to provide comprehensive protection against financial losses stemming from interconnected technological and ecological threats.

Key Terms

**Environmental Liability Insurance:**

Environmental liability insurance provides financial protection against pollution-related damages, covering cleanup costs, legal fees, and third-party claims resulting from environmental contamination. It is crucial for businesses involved in manufacturing, waste management, and construction to mitigate risks associated with soil, water, or air pollution. Explore the key benefits and coverage options of environmental liability insurance to safeguard your operations and comply with regulatory requirements.

Pollution Cleanup Costs

Environmental liability insurance covers pollution cleanup costs arising from contamination events, including soil, groundwater, and air pollution, ensuring financial protection against regulatory claims. Cyber risk insurance primarily addresses data breaches, cyberattacks, and related digital threats, typically excluding environmental pollution liabilities. Explore comprehensive policies to better understand how environmental liability and cyber risk insurance differ in managing pollution cleanup costs.

Third-Party Bodily Injury

Environmental liability insurance specifically covers third-party bodily injury resulting from pollution incidents, including exposure to hazardous substances and contamination-related health effects. In contrast, cyber risk insurance generally excludes bodily injury claims, as it primarily addresses data breaches, cyberattacks, and related financial losses rather than physical harm. To explore the distinctions and coverage details further, review comprehensive resources on environmental and cyber liability policies.

Source and External Links

Environmental Liability | DUAL North America - DUAL offers environmental liability insurance with customizable coverage for contractors, consultants, and facilities, including pollution liability, professional liability, and umbrella excess options, with A.M. Best rated carriers and nationwide availability.

Pollution Liability Insurance - Zurich North America - Zurich provides pollution liability (environmental) insurance that helps businesses manage risks from unexpected pollution incidents not covered by standard policies, including cleanup costs, bodily injury, and property damage, with solutions tailored by local underwriting teams.

Environmental and Contractors Professional Liability Insurance - Travelers' modular environmental and contractors professional liability policy covers pollution incidents, contractors' professional exposures, and can be enhanced with endorsements for crisis management, asbestos, and non-owned disposal site risks.

dowidth.com

dowidth.com