Usage-based insurance calculates premiums based on real-time data collected from policyholders' driving behavior, promoting safer habits and personalized rates through telematics devices. Event-based insurance provides coverage triggered by specific incidents such as natural disasters or accidents, offering flexible protection tailored to particular risks. Explore the differences between these innovative insurance models to find the best fit for your needs.

Why it is important

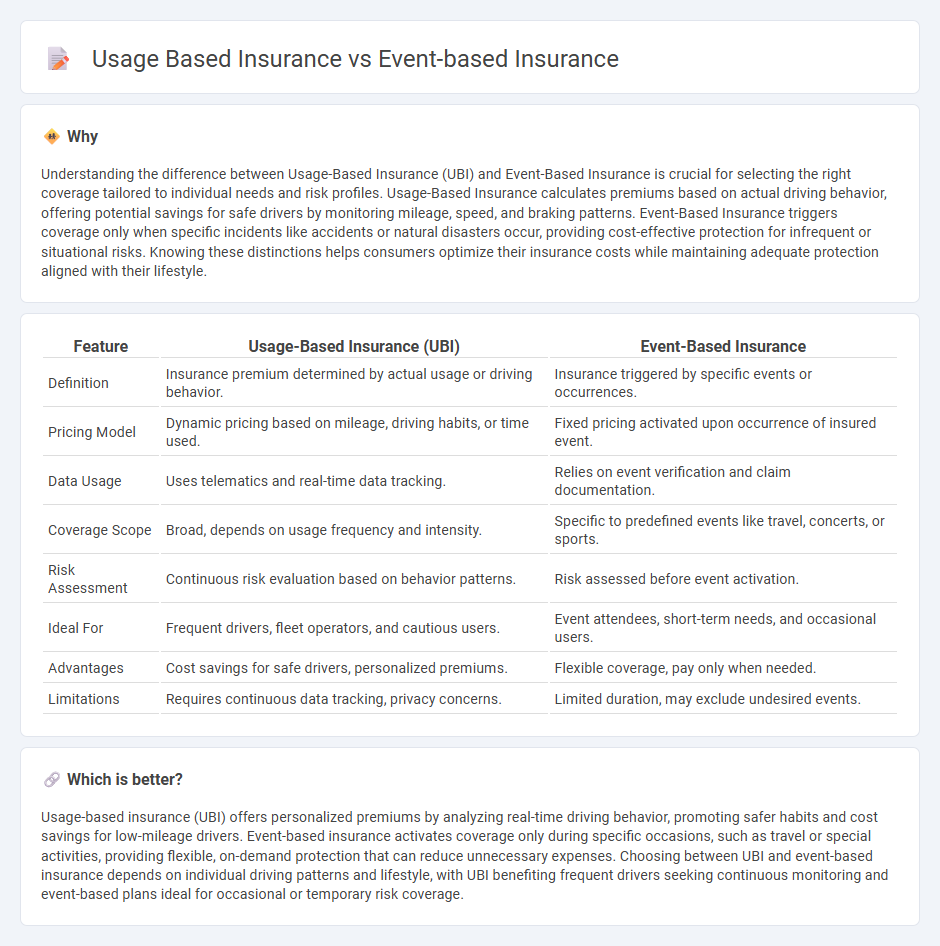

Understanding the difference between Usage-Based Insurance (UBI) and Event-Based Insurance is crucial for selecting the right coverage tailored to individual needs and risk profiles. Usage-Based Insurance calculates premiums based on actual driving behavior, offering potential savings for safe drivers by monitoring mileage, speed, and braking patterns. Event-Based Insurance triggers coverage only when specific incidents like accidents or natural disasters occur, providing cost-effective protection for infrequent or situational risks. Knowing these distinctions helps consumers optimize their insurance costs while maintaining adequate protection aligned with their lifestyle.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Event-Based Insurance |

|---|---|---|

| Definition | Insurance premium determined by actual usage or driving behavior. | Insurance triggered by specific events or occurrences. |

| Pricing Model | Dynamic pricing based on mileage, driving habits, or time used. | Fixed pricing activated upon occurrence of insured event. |

| Data Usage | Uses telematics and real-time data tracking. | Relies on event verification and claim documentation. |

| Coverage Scope | Broad, depends on usage frequency and intensity. | Specific to predefined events like travel, concerts, or sports. |

| Risk Assessment | Continuous risk evaluation based on behavior patterns. | Risk assessed before event activation. |

| Ideal For | Frequent drivers, fleet operators, and cautious users. | Event attendees, short-term needs, and occasional users. |

| Advantages | Cost savings for safe drivers, personalized premiums. | Flexible coverage, pay only when needed. |

| Limitations | Requires continuous data tracking, privacy concerns. | Limited duration, may exclude undesired events. |

Which is better?

Usage-based insurance (UBI) offers personalized premiums by analyzing real-time driving behavior, promoting safer habits and cost savings for low-mileage drivers. Event-based insurance activates coverage only during specific occasions, such as travel or special activities, providing flexible, on-demand protection that can reduce unnecessary expenses. Choosing between UBI and event-based insurance depends on individual driving patterns and lifestyle, with UBI benefiting frequent drivers seeking continuous monitoring and event-based plans ideal for occasional or temporary risk coverage.

Connection

Usage-based insurance (UBI) and event-based insurance both leverage real-time data to personalize coverage and premiums, using telematics and IoT sensors to monitor behavior or specific occurrences. UBI adjusts insurance costs based on metrics such as driving habits or mileage, while event-based insurance activates coverage only during particular events like concerts, travel, or natural disasters. These models enhance risk assessment accuracy, reduce costs, and provide tailored protection by aligning insurance plans with actual usage and event exposure.

Key Terms

Triggering Event

Event-based insurance activates coverage specifically when a predetermined triggering event occurs, offering protection tailored to unique situations such as natural disasters or travel disruptions. Usage-based insurance relies on real-time data collected through telematics or similar technology, adjusting premiums based on actual usage patterns, behavior, or specific driving events. Explore the details of triggering events to understand how these insurance models can optimize your risk management strategy.

Usage Metrics

Usage-based insurance (UBI) leverages real-time driving data such as mileage, speed, and braking patterns to tailor premiums according to individual behavior, offering more personalized and potentially cost-effective coverage compared to traditional event-based policies. Event-based insurance primarily relies on specific incidents like accidents or claims history to determine risk and pricing, often lacking the granular usage insights UBI provides. Discover how integrating usage metrics can revolutionize your insurance approach for more accurate risk assessment and savings.

Premium Calculation

Event-based insurance calculates premiums primarily on the occurrence of predefined events such as accidents or natural disasters, leading to fixed or variable costs depending on event frequency and severity. Usage-based insurance relies on real-time data collected from telematics devices, assessing factors like driving behavior, mileage, and time of use to personalize premiums dynamically. Explore further to understand how each model revolutionizes risk assessment and cost efficiency in insurance.

Source and External Links

Wedding & Special Event Insurance - GEICO - Offers event insurance starting at $75, covering liability and cancellation with limits up to $2 million.

Event Insurance | Thimble - Provides general liability insurance for events, covering bodily injury, property damage, and liquor liability on an hourly, daily, or weekly basis.

Event Insurance - Instant Online Quote - Eventsured - Allows for instant online quotes and purchases of special event liability and cancellation insurance, starting as low as $63.

dowidth.com

dowidth.com