Buy now insurance offers long-term coverage with comprehensive benefits and fixed premiums, providing financial security for extended periods. Short-term insurance delivers flexible, temporary protection tailored for specific needs, such as travel or short-term asset coverage, often with lower upfront costs. Explore the key differences between these options to choose the best insurance plan for your unique requirements.

Why it is important

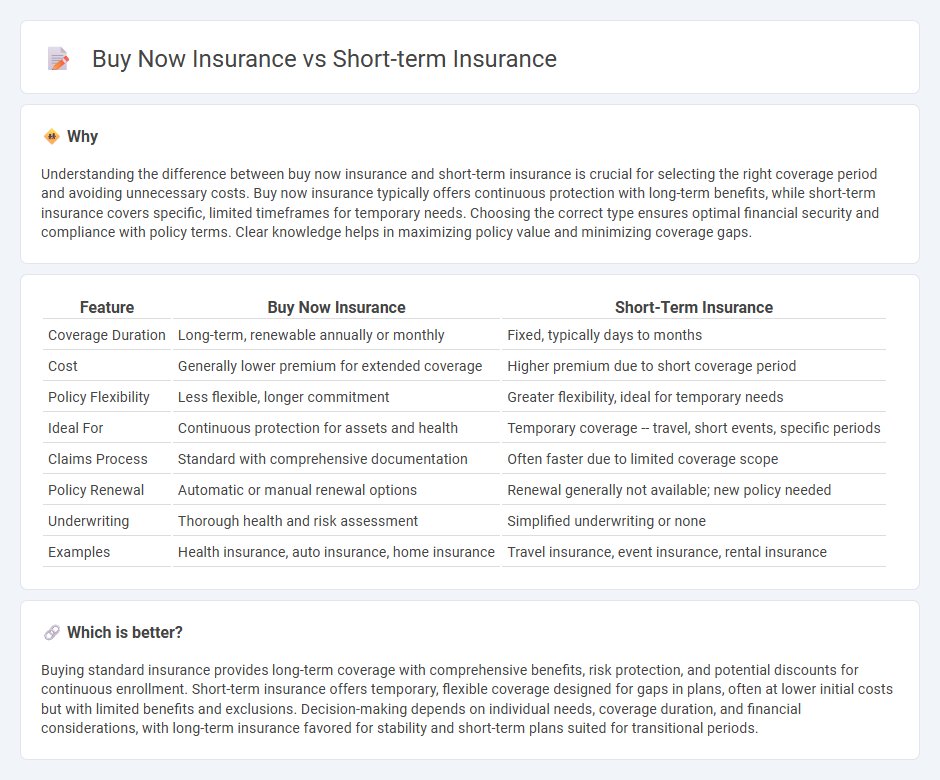

Understanding the difference between buy now insurance and short-term insurance is crucial for selecting the right coverage period and avoiding unnecessary costs. Buy now insurance typically offers continuous protection with long-term benefits, while short-term insurance covers specific, limited timeframes for temporary needs. Choosing the correct type ensures optimal financial security and compliance with policy terms. Clear knowledge helps in maximizing policy value and minimizing coverage gaps.

Comparison Table

| Feature | Buy Now Insurance | Short-Term Insurance |

|---|---|---|

| Coverage Duration | Long-term, renewable annually or monthly | Fixed, typically days to months |

| Cost | Generally lower premium for extended coverage | Higher premium due to short coverage period |

| Policy Flexibility | Less flexible, longer commitment | Greater flexibility, ideal for temporary needs |

| Ideal For | Continuous protection for assets and health | Temporary coverage -- travel, short events, specific periods |

| Claims Process | Standard with comprehensive documentation | Often faster due to limited coverage scope |

| Policy Renewal | Automatic or manual renewal options | Renewal generally not available; new policy needed |

| Underwriting | Thorough health and risk assessment | Simplified underwriting or none |

| Examples | Health insurance, auto insurance, home insurance | Travel insurance, event insurance, rental insurance |

Which is better?

Buying standard insurance provides long-term coverage with comprehensive benefits, risk protection, and potential discounts for continuous enrollment. Short-term insurance offers temporary, flexible coverage designed for gaps in plans, often at lower initial costs but with limited benefits and exclusions. Decision-making depends on individual needs, coverage duration, and financial considerations, with long-term insurance favored for stability and short-term plans suited for transitional periods.

Connection

Buy now insurance leverages instant purchasing technology to provide immediate coverage, while short-term insurance offers protection for limited periods tailored to specific needs. Both concepts prioritize flexibility and convenience by enabling consumers to secure insurance quickly for temporary durations. This connection enhances user experience through streamlined digital platforms that facilitate rapid policy activation and management.

Key Terms

Coverage Duration

Short-term insurance provides limited coverage typically ranging from a few days to several months, ideal for temporary needs such as travel or short-term vehicle use. Buy now insurance usually offers longer-term policies that extend over a year, catering to ongoing protection requirements like homeowner or auto insurance. Explore the differences in coverage duration and benefits to choose the insurance that best fits your needs.

Underwriting Process

Short-term insurance underwriting involves a quick assessment of risk based on immediate factors like recent claims, vehicle condition, and driver history, allowing for rapid policy issuance. Buy now insurance underwriting is more comprehensive, often utilizing predictive analytics, detailed customer profiling, and real-time data verification to tailor coverage precisely. Explore how these distinct underwriting processes impact your insurance choice to make an informed decision.

Premium Structure

Short-term insurance policies typically feature flexible premium structures based on the coverage duration, risk factors, and insured asset, allowing for tailored payments aligned with immediate needs. Buy now insurance often offers fixed or installment-based premium plans designed for long-term financial predictability and enhanced benefits within the purchased coverage term. Explore the detailed premium comparisons and benefits to determine the optimal insurance solution for your specific requirements.

Source and External Links

Short Term Health Insurance | eHealth - Offers temporary, limited health coverage during gaps in permanent insurance, providing affordable rates and quick approval.

Short-Term Health Insurance Plans - Medical Mutual - Provides flexible coverage for transitional periods, with options like different deductibles and copays, and access to a large provider network.

What is Short Term Health Insurance? | Cigna Healthcare - Explains the pros and cons of short-term health insurance, highlighting its ability to fill coverage gaps and lack of comprehensive benefits.

dowidth.com

dowidth.com