Pay per mile insurance offers a flexible pricing model based on the actual miles driven, ideal for low-mileage drivers seeking cost-effective coverage. Named driver insurance provides protection tailored to specific individuals listed on the policy, often used when multiple drivers share a vehicle but require distinct risk assessments. Explore the detailed differences and benefits to choose the best option for your driving habits.

Why it is important

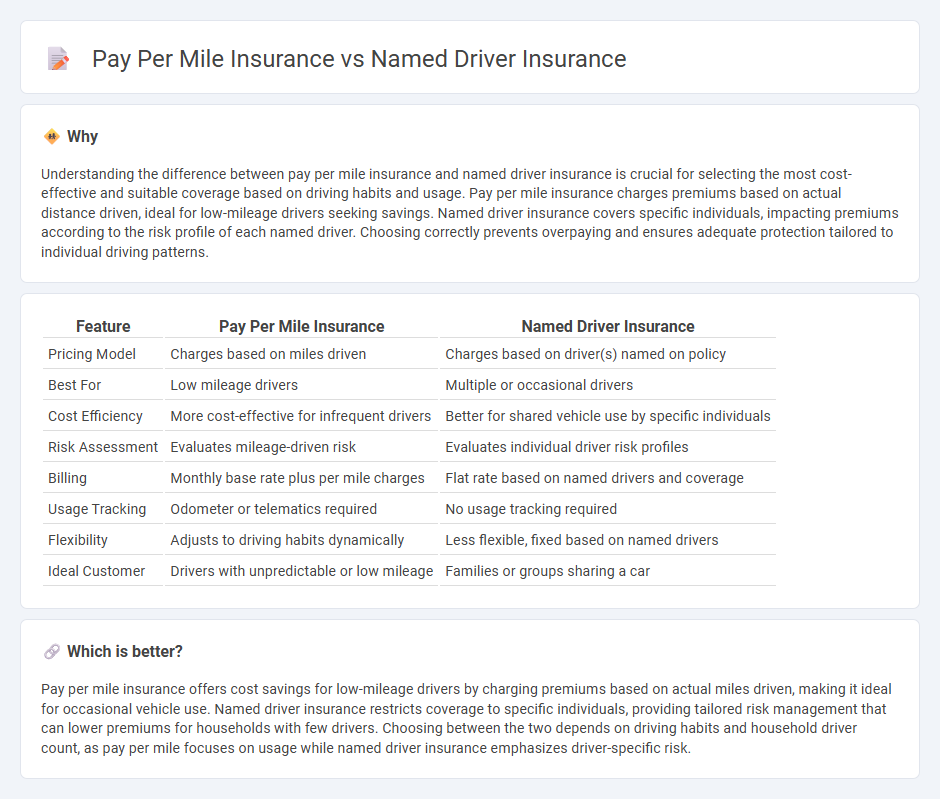

Understanding the difference between pay per mile insurance and named driver insurance is crucial for selecting the most cost-effective and suitable coverage based on driving habits and usage. Pay per mile insurance charges premiums based on actual distance driven, ideal for low-mileage drivers seeking savings. Named driver insurance covers specific individuals, impacting premiums according to the risk profile of each named driver. Choosing correctly prevents overpaying and ensures adequate protection tailored to individual driving patterns.

Comparison Table

| Feature | Pay Per Mile Insurance | Named Driver Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on driver(s) named on policy |

| Best For | Low mileage drivers | Multiple or occasional drivers |

| Cost Efficiency | More cost-effective for infrequent drivers | Better for shared vehicle use by specific individuals |

| Risk Assessment | Evaluates mileage-driven risk | Evaluates individual driver risk profiles |

| Billing | Monthly base rate plus per mile charges | Flat rate based on named drivers and coverage |

| Usage Tracking | Odometer or telematics required | No usage tracking required |

| Flexibility | Adjusts to driving habits dynamically | Less flexible, fixed based on named drivers |

| Ideal Customer | Drivers with unpredictable or low mileage | Families or groups sharing a car |

Which is better?

Pay per mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual miles driven, making it ideal for occasional vehicle use. Named driver insurance restricts coverage to specific individuals, providing tailored risk management that can lower premiums for households with few drivers. Choosing between the two depends on driving habits and household driver count, as pay per mile focuses on usage while named driver insurance emphasizes driver-specific risk.

Connection

Pay per mile insurance and named driver insurance both tailor coverage based on individual driving behaviors and risk profiles, making them cost-effective options. Pay per mile insurance charges premiums according to actual miles driven, while named driver insurance adjusts rates by covering specific drivers listed on the policy. Combining these models enables insurers to precisely assess risk and provide personalized pricing that rewards low mileage and responsible drivers.

Key Terms

Policyholder

Named driver insurance assigns specific drivers to a vehicle, providing coverage only when those individuals are behind the wheel, benefiting policyholders who want to limit coverage to trusted users. Pay per mile insurance charges policyholders based on the exact distance driven, offering cost savings and flexibility for low-mileage drivers and making premiums more personalized. Explore more to determine which car insurance policy aligns best with your driving habits and budget.

Premium

Named driver insurance typically offers lower premiums by restricting coverage to specific drivers, reducing risk exposure for insurers. Pay per mile insurance calculates premiums based on actual mileage driven, making it cost-effective for low-mileage drivers but potentially expensive for frequent drivers. Explore detailed comparisons to determine which premium model suits your driving habits best.

Usage

Named driver insurance covers specific individuals listed on the policy, ensuring their driving usage is accounted for with fixed premiums. Pay per mile insurance charges based on the actual miles driven, offering cost savings for low-usage drivers by monitoring real-time mileage data. Explore the benefits of both options to find the best fit for your driving habits.

Source and External Links

What is a Named Driver Policy? - A named driver insurance policy provides coverage only for drivers specifically listed on the policy, excluding coverage for any unlisted drivers--including those given temporary permission--who may drive the insured vehicle.

Named Driver Policies - Named driver policies cover only the individuals explicitly named in the policy, do not extend to other household members not listed, and may not provide coverage even if the named insured gives another driver permission to use the insured vehicle.

What is a Named Driver? Here's What You Need to Know - Adding a named driver, who is legally allowed to drive, can lower or raise premiums depending on the named driver's age and experience, but only the main driver can typically build up a no claims discount, regardless of who drives the car.

dowidth.com

dowidth.com