Insurtech platforms leverage advanced technology, such as AI-driven analytics and automated claims processing, to deliver faster, personalized insurance solutions compared to traditional insurance brokers. These platforms offer seamless digital experiences, real-time policy management, and competitive pricing by reducing operational costs. Explore how insurtech is transforming the insurance landscape and enhancing customer satisfaction.

Why it is important

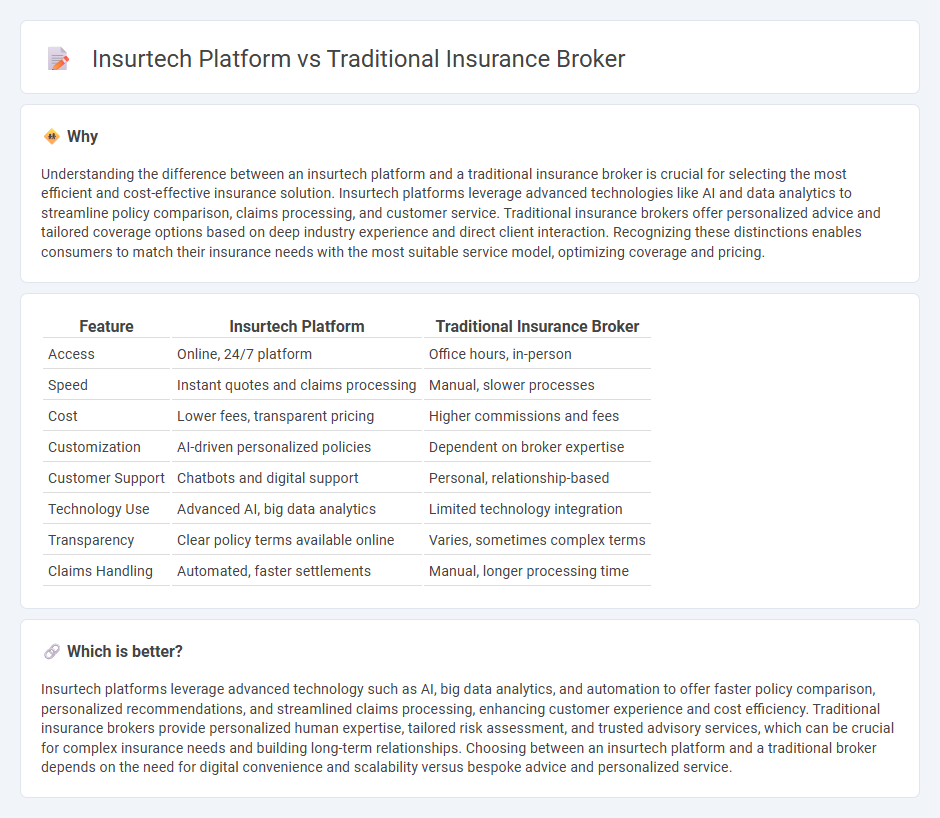

Understanding the difference between an insurtech platform and a traditional insurance broker is crucial for selecting the most efficient and cost-effective insurance solution. Insurtech platforms leverage advanced technologies like AI and data analytics to streamline policy comparison, claims processing, and customer service. Traditional insurance brokers offer personalized advice and tailored coverage options based on deep industry experience and direct client interaction. Recognizing these distinctions enables consumers to match their insurance needs with the most suitable service model, optimizing coverage and pricing.

Comparison Table

| Feature | Insurtech Platform | Traditional Insurance Broker |

|---|---|---|

| Access | Online, 24/7 platform | Office hours, in-person |

| Speed | Instant quotes and claims processing | Manual, slower processes |

| Cost | Lower fees, transparent pricing | Higher commissions and fees |

| Customization | AI-driven personalized policies | Dependent on broker expertise |

| Customer Support | Chatbots and digital support | Personal, relationship-based |

| Technology Use | Advanced AI, big data analytics | Limited technology integration |

| Transparency | Clear policy terms available online | Varies, sometimes complex terms |

| Claims Handling | Automated, faster settlements | Manual, longer processing time |

Which is better?

Insurtech platforms leverage advanced technology such as AI, big data analytics, and automation to offer faster policy comparison, personalized recommendations, and streamlined claims processing, enhancing customer experience and cost efficiency. Traditional insurance brokers provide personalized human expertise, tailored risk assessment, and trusted advisory services, which can be crucial for complex insurance needs and building long-term relationships. Choosing between an insurtech platform and a traditional broker depends on the need for digital convenience and scalability versus bespoke advice and personalized service.

Connection

Insurtech platforms leverage advanced technologies such as AI, machine learning, and data analytics to streamline underwriting, claims processing, and customer engagement, enhancing efficiency for traditional insurance brokers. These platforms provide brokers with digital tools that improve risk assessment and policy management, enabling faster and more personalized service. By integrating insurtech solutions, traditional brokers can expand their market reach and optimize client interactions, creating a synergistic relationship that transforms the insurance distribution model.

Key Terms

**Traditional Insurance Broker:**

Traditional insurance brokers provide personalized risk assessment and tailored policy recommendations by leveraging deep industry expertise and longstanding relationships with insurance carriers. They offer hands-on support throughout the claims process and maintain a physical presence, enhancing trust and personalized service. Discover how traditional brokers balance expertise and personalized service in today's evolving insurance landscape.

Commission

Traditional insurance brokers primarily earn commissions by acting as intermediaries between clients and insurance companies, often receiving a percentage of the policy premium. Insurtech platforms typically offer lower commission rates or utilize alternative revenue models, leveraging technology to reduce costs and increase transparency. Explore how commission structures impact cost efficiency and customer experience in both models.

Underwriting

Traditional insurance brokers rely heavily on manual underwriting processes, which can be time-consuming and prone to human error. Insurtech platforms leverage advanced algorithms and AI-driven data analytics to expedite underwriting decisions, enhancing accuracy and efficiency. Explore the evolving landscape of underwriting innovations to understand how technology is transforming risk assessment.

Source and External Links

The Difference Between a Direct Insurance Broker and an Intermediary - This article discusses the roles of direct insurance brokers and intermediaries, highlighting how they aid in navigating the insurance market.

Insurance Broker - An insurance broker serves as an intermediary who negotiates insurance policies on behalf of clients, often working with multiple insurers.

Who Sells Insurance? The Difference Among Agents, Brokers, and Wholesalers - This article explains the roles of insurance brokers, agents, and wholesalers, highlighting their differences in how they sell insurance.

dowidth.com

dowidth.com