Insurtech platforms leverage cutting-edge technology and data analytics to streamline insurance processes, enhance customer experience, and provide personalized coverage options. Reinsurers focus on providing insurance to insurance companies, managing risk by underwriting and spreading large-scale liabilities across multiple insurers. Discover how the synergy between insurtech platforms and reinsurers is transforming the insurance landscape.

Why it is important

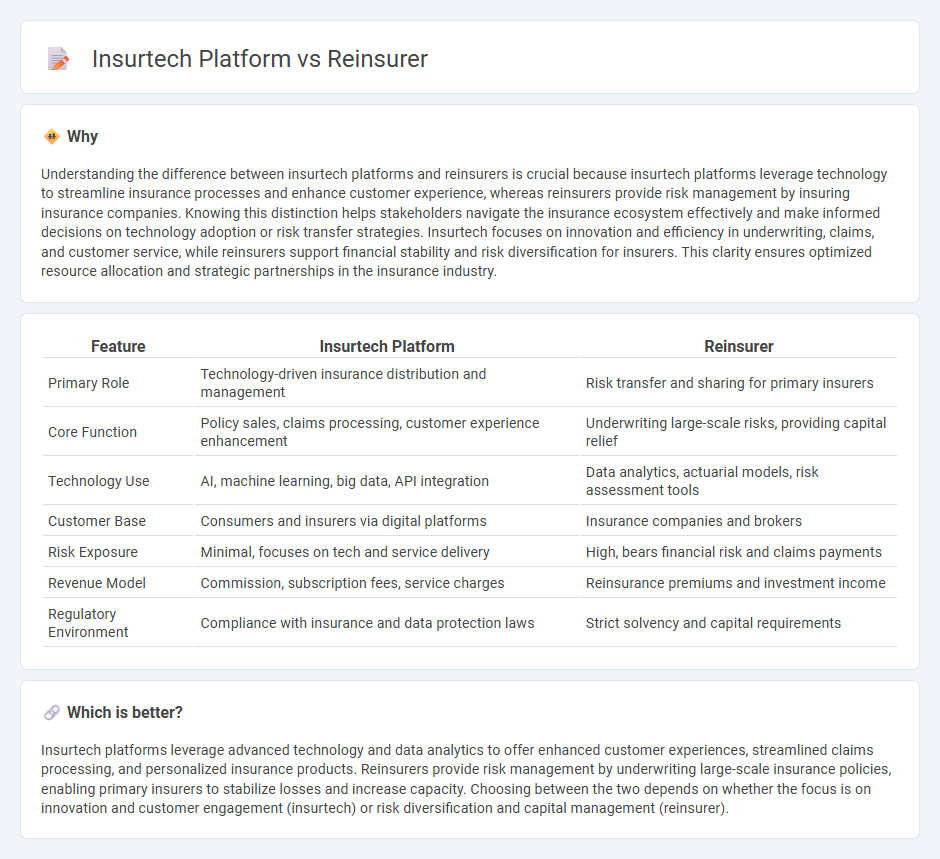

Understanding the difference between insurtech platforms and reinsurers is crucial because insurtech platforms leverage technology to streamline insurance processes and enhance customer experience, whereas reinsurers provide risk management by insuring insurance companies. Knowing this distinction helps stakeholders navigate the insurance ecosystem effectively and make informed decisions on technology adoption or risk transfer strategies. Insurtech focuses on innovation and efficiency in underwriting, claims, and customer service, while reinsurers support financial stability and risk diversification for insurers. This clarity ensures optimized resource allocation and strategic partnerships in the insurance industry.

Comparison Table

| Feature | Insurtech Platform | Reinsurer |

|---|---|---|

| Primary Role | Technology-driven insurance distribution and management | Risk transfer and sharing for primary insurers |

| Core Function | Policy sales, claims processing, customer experience enhancement | Underwriting large-scale risks, providing capital relief |

| Technology Use | AI, machine learning, big data, API integration | Data analytics, actuarial models, risk assessment tools |

| Customer Base | Consumers and insurers via digital platforms | Insurance companies and brokers |

| Risk Exposure | Minimal, focuses on tech and service delivery | High, bears financial risk and claims payments |

| Revenue Model | Commission, subscription fees, service charges | Reinsurance premiums and investment income |

| Regulatory Environment | Compliance with insurance and data protection laws | Strict solvency and capital requirements |

Which is better?

Insurtech platforms leverage advanced technology and data analytics to offer enhanced customer experiences, streamlined claims processing, and personalized insurance products. Reinsurers provide risk management by underwriting large-scale insurance policies, enabling primary insurers to stabilize losses and increase capacity. Choosing between the two depends on whether the focus is on innovation and customer engagement (insurtech) or risk diversification and capital management (reinsurer).

Connection

Insurtech platforms leverage advanced technology to streamline insurance processes, enabling reinsurers to access real-time data and risk analytics for more accurate underwriting and pricing. Reinsurers collaborate with insurtech firms to enhance risk management strategies and optimize claims processing through automation and predictive modeling. This integration fosters greater efficiency, reduces operational costs, and improves decision-making across the insurance value chain.

Key Terms

Risk Transfer

Reinsurers specialize in risk transfer by assuming portions of insurance risks from primary insurers, providing financial stability and capacity to cover large or unforeseen claims. Insurtech platforms leverage technology to optimize risk assessment, automate underwriting, and facilitate dynamic risk transfer processes through digital marketplaces. Explore how these innovations are reshaping risk transfer strategies in the insurance industry.

Underwriting

Reinsurers specialize in underwriting risk by evaluating large portfolios to spread potential losses, leveraging extensive actuarial data and long-standing market experience. Insurtech platforms use advanced algorithms and AI to streamline underwriting processes, enabling faster risk assessment and personalized policy pricing. Explore how these distinct approaches are transforming underwriting in the insurance industry.

Digital Distribution

Reinsurers support insurance companies by assuming risks and providing financial stability, while insurtech platforms leverage digital distribution channels to enhance customer engagement and streamline policy sales. Digital distribution in insurtech involves the use of AI, mobile apps, and online marketplaces to increase accessibility and efficiency in the insurance buying process. Explore the evolving roles of reinsurers and insurtech platforms in transforming digital distribution within the insurance industry.

Source and External Links

REINSURANCE - The American Council of Life Insurers - A reinsurer is an insurer that assumes all or part of the risk from another insurance company (the ceding insurer), helping the ceding insurer manage capital and protect against large or unusual claims.

Reinsurance Companies - Overview, Roles, Revenue - Reinsurers enable insurance companies to transfer risk, reduce required capital, and underwrite more policies by taking on portions of the original insurer's liabilities.

Insurance Topics | Reinsurance - NAIC - Reinsurers, often called "insurance for insurance companies," assume risks from primary insurers through contracts, which can help insurers expand capacity, stabilize results, and protect against catastrophic losses.

dowidth.com

dowidth.com