Telematics insurance collects real-time driving data via devices or smartphone apps to assess risk and personalize premiums based on actual behavior. Usage-based insurance (UBI) similarly adjusts rates according to monitored factors such as mileage, speed, and driving patterns, often leveraging telematics technology for data accuracy. Explore the distinct benefits and applications of telematics insurance versus usage-based insurance to determine the best fit for your coverage needs.

Why it is important

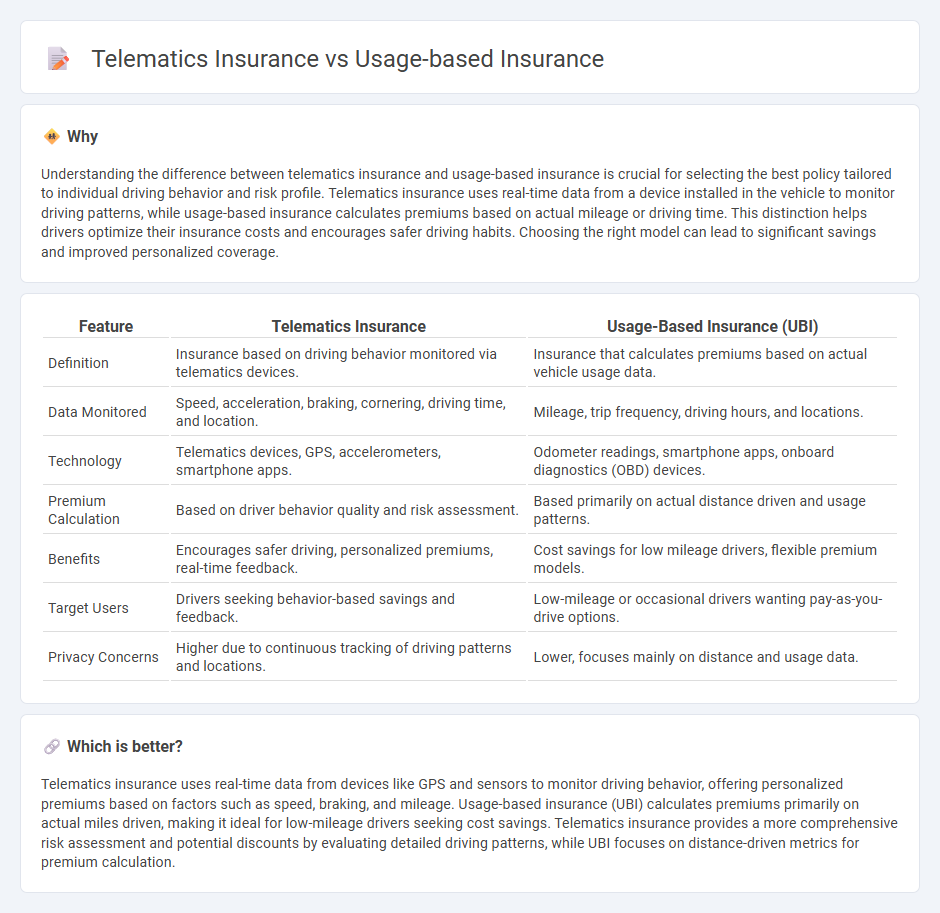

Understanding the difference between telematics insurance and usage-based insurance is crucial for selecting the best policy tailored to individual driving behavior and risk profile. Telematics insurance uses real-time data from a device installed in the vehicle to monitor driving patterns, while usage-based insurance calculates premiums based on actual mileage or driving time. This distinction helps drivers optimize their insurance costs and encourages safer driving habits. Choosing the right model can lead to significant savings and improved personalized coverage.

Comparison Table

| Feature | Telematics Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Insurance based on driving behavior monitored via telematics devices. | Insurance that calculates premiums based on actual vehicle usage data. |

| Data Monitored | Speed, acceleration, braking, cornering, driving time, and location. | Mileage, trip frequency, driving hours, and locations. |

| Technology | Telematics devices, GPS, accelerometers, smartphone apps. | Odometer readings, smartphone apps, onboard diagnostics (OBD) devices. |

| Premium Calculation | Based on driver behavior quality and risk assessment. | Based primarily on actual distance driven and usage patterns. |

| Benefits | Encourages safer driving, personalized premiums, real-time feedback. | Cost savings for low mileage drivers, flexible premium models. |

| Target Users | Drivers seeking behavior-based savings and feedback. | Low-mileage or occasional drivers wanting pay-as-you-drive options. |

| Privacy Concerns | Higher due to continuous tracking of driving patterns and locations. | Lower, focuses mainly on distance and usage data. |

Which is better?

Telematics insurance uses real-time data from devices like GPS and sensors to monitor driving behavior, offering personalized premiums based on factors such as speed, braking, and mileage. Usage-based insurance (UBI) calculates premiums primarily on actual miles driven, making it ideal for low-mileage drivers seeking cost savings. Telematics insurance provides a more comprehensive risk assessment and potential discounts by evaluating detailed driving patterns, while UBI focuses on distance-driven metrics for premium calculation.

Connection

Telematics insurance relies on real-time data collected from vehicle sensors to monitor driving behavior, which forms the core of Usage-Based Insurance (UBI) models. By analyzing metrics such as speed, acceleration, braking patterns, and mileage, insurers can personalize premiums based on actual risk profiles rather than static factors. This connection enables more accurate risk assessment, encouraging safer driving habits and potential cost savings for policyholders.

Key Terms

Driving Behavior

Usage-based insurance (UBI) and telematics insurance both rely on driving behavior data to determine premiums, with UBI often focusing on mileage and overall usage while telematics insurance provides a more detailed analysis including speed, acceleration, braking patterns, and cornering habits. Telematics devices collect real-time, granular data through GPS and onboard diagnostics, allowing insurers to offer personalized rates based on actual driving performance and risk assessment. Discover how integrating advanced telematics technology can enhance risk management and cost savings in your auto insurance policy.

Data Collection

Usage-based insurance relies on periodic data collection from drivers, such as mileage and driving habits, through devices installed in vehicles or smartphone apps. Telematics insurance collects real-time, detailed data including speed, acceleration, braking patterns, and location using advanced GPS and sensors, enabling more precise risk assessment. Discover how these data collection methods impact insurance premiums and driver behavior monitoring in depth.

Personalized Premiums

Usage-based insurance (UBI) calculates premiums based on actual driving behavior, leveraging data such as mileage, speed, and braking patterns to offer personalized rates. Telematics insurance employs advanced GPS and sensor technology to collect real-time driving data, enabling insurers to tailor premiums with greater accuracy and encourage safer driving habits. Explore how personalized premiums from these insurance types can optimize your coverage and savings.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance calculates auto insurance rates by analyzing how often and safely you drive using telematics devices or apps, adjusting premiums based on driving behavior and mileage.

Usage-based insurance | Office of the Insurance Commissioner - Usage-based insurance or telematics monitors driving habits such as miles driven, location, time of day, acceleration, and braking to personalize insurance premiums, offering potential savings or increases based on the data collected.

Usage Based Insurance: Everything You Need To Know - Usage-based insurance includes mileage-based and behavior-based plans, rewarding safer, low-mileage drivers with customized premiums and possible discounts of 10%-25% for good driving habits.

dowidth.com

dowidth.com