Crop microinsurance provides financial protection to smallholder farmers against losses due to adverse weather, pests, or disease, ensuring stable income and food security. Health microinsurance offers affordable coverage for medical expenses, improving access to healthcare for low-income individuals and reducing out-of-pocket costs. Explore the key differences and benefits of crop versus health microinsurance to determine the best fit for your needs.

Why it is important

Understanding the difference between crop microinsurance and health microinsurance is crucial for selecting appropriate coverage tailored to specific risks; crop microinsurance protects farmers against losses due to adverse weather or pest damage, while health microinsurance covers medical expenses for individuals with limited access to traditional health insurance. This distinction ensures efficient risk management and financial stability for vulnerable populations in agriculture and healthcare sectors. Knowing these differences enables policymakers and providers to design targeted microinsurance products that meet the distinct needs of rural farmers and low-income individuals. Properly differentiated insurance products improve claim processing and customer satisfaction by addressing sector-specific challenges effectively.

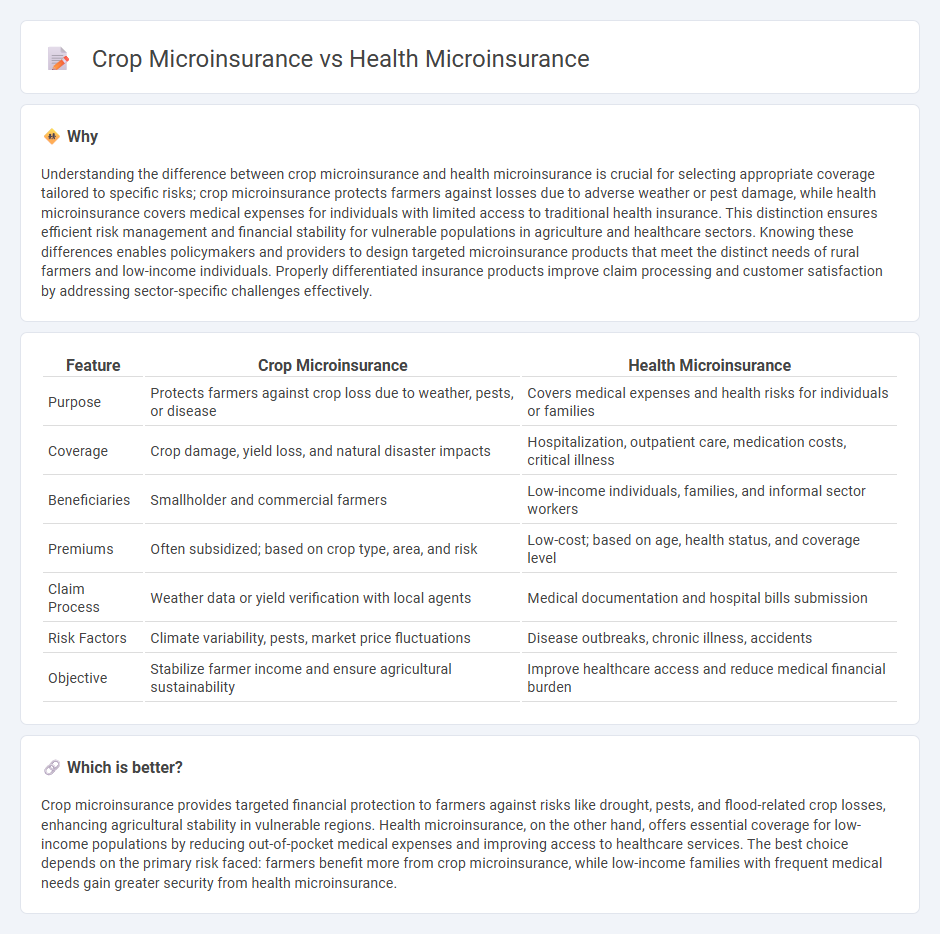

Comparison Table

| Feature | Crop Microinsurance | Health Microinsurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to weather, pests, or disease | Covers medical expenses and health risks for individuals or families |

| Coverage | Crop damage, yield loss, and natural disaster impacts | Hospitalization, outpatient care, medication costs, critical illness |

| Beneficiaries | Smallholder and commercial farmers | Low-income individuals, families, and informal sector workers |

| Premiums | Often subsidized; based on crop type, area, and risk | Low-cost; based on age, health status, and coverage level |

| Claim Process | Weather data or yield verification with local agents | Medical documentation and hospital bills submission |

| Risk Factors | Climate variability, pests, market price fluctuations | Disease outbreaks, chronic illness, accidents |

| Objective | Stabilize farmer income and ensure agricultural sustainability | Improve healthcare access and reduce medical financial burden |

Which is better?

Crop microinsurance provides targeted financial protection to farmers against risks like drought, pests, and flood-related crop losses, enhancing agricultural stability in vulnerable regions. Health microinsurance, on the other hand, offers essential coverage for low-income populations by reducing out-of-pocket medical expenses and improving access to healthcare services. The best choice depends on the primary risk faced: farmers benefit more from crop microinsurance, while low-income families with frequent medical needs gain greater security from health microinsurance.

Connection

Crop microinsurance and health microinsurance both provide financial protection tailored to low-income individuals facing specific risks such as crop failure and medical emergencies. These microinsurance products help vulnerable populations manage unpredictable events by offering affordable premiums and targeted coverage. Integrating them supports holistic risk management by addressing both agricultural losses and health-related expenses, enhancing overall community resilience.

Key Terms

**Health microinsurance:**

Health microinsurance provides affordable coverage for low-income individuals, protecting against medical expenses such as hospitalization, surgeries, and outpatient treatments. It significantly reduces out-of-pocket health costs and improves access to essential healthcare services in underserved communities. Discover how health microinsurance can enhance financial security and promote well-being.

Premium

Health microinsurance premiums are typically based on individual or family health risk factors such as age, pre-existing conditions, and coverage levels, leading to more variable pricing. Crop microinsurance premiums depend largely on factors like type of crop, geographic location, weather patterns, and coverage for yield loss or natural disasters, resulting in premiums influenced by agricultural risk assessments. Explore further to understand how premium structures affect accessibility and sustainability in both microinsurance types.

Coverage limit

Health microinsurance typically offers variable coverage limits depending on the insured's needs and budget, often ranging from $500 to $5,000 to cover medical expenses like hospitalization and outpatient treatments. Crop microinsurance coverage limits are generally based on the value of the insured crops, with payouts linked to estimated losses due to weather events or pests, usually calculated as a percentage of the insured sum representing potential yield loss. Explore detailed policy structures and limit options to understand which microinsurance best fits your risk management needs.

Source and External Links

The Impact of the Health Microinsurance M-FUND - This study discusses how health microinsurance can reduce barriers to healthcare utilization, particularly among disadvantaged migrant workers.

Case Study: Health Insurance Microinsurance Scheme - This case study explores the development of a health insurance microinsurance scheme aimed at providing affordable and sustainable healthcare access.

Health Micro-insurance Compendium - This compendium provides key information on health micro-insurance schemes from various countries, highlighting their strategies and services.

dowidth.com

dowidth.com