Flood insurance integration focuses on providing coverage for damages caused by inland flooding events, targeting residential and commercial properties vulnerable to excessive rainfall and river overflow. Marine insurance integration covers risks associated with ships, cargo, and maritime activities, including loss or damage during transit over sea or inland waterways. Explore the key differences and benefits of these insurance integrations to safeguard your assets effectively.

Why it is important

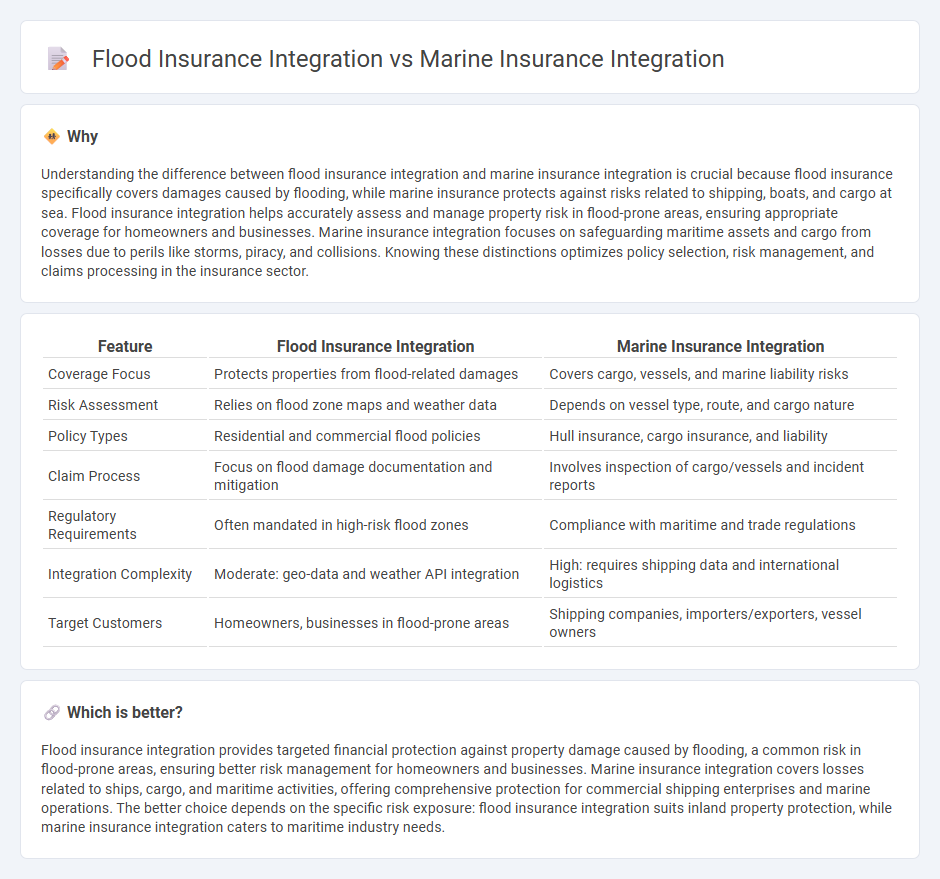

Understanding the difference between flood insurance integration and marine insurance integration is crucial because flood insurance specifically covers damages caused by flooding, while marine insurance protects against risks related to shipping, boats, and cargo at sea. Flood insurance integration helps accurately assess and manage property risk in flood-prone areas, ensuring appropriate coverage for homeowners and businesses. Marine insurance integration focuses on safeguarding maritime assets and cargo from losses due to perils like storms, piracy, and collisions. Knowing these distinctions optimizes policy selection, risk management, and claims processing in the insurance sector.

Comparison Table

| Feature | Flood Insurance Integration | Marine Insurance Integration |

|---|---|---|

| Coverage Focus | Protects properties from flood-related damages | Covers cargo, vessels, and marine liability risks |

| Risk Assessment | Relies on flood zone maps and weather data | Depends on vessel type, route, and cargo nature |

| Policy Types | Residential and commercial flood policies | Hull insurance, cargo insurance, and liability |

| Claim Process | Focus on flood damage documentation and mitigation | Involves inspection of cargo/vessels and incident reports |

| Regulatory Requirements | Often mandated in high-risk flood zones | Compliance with maritime and trade regulations |

| Integration Complexity | Moderate: geo-data and weather API integration | High: requires shipping data and international logistics |

| Target Customers | Homeowners, businesses in flood-prone areas | Shipping companies, importers/exporters, vessel owners |

Which is better?

Flood insurance integration provides targeted financial protection against property damage caused by flooding, a common risk in flood-prone areas, ensuring better risk management for homeowners and businesses. Marine insurance integration covers losses related to ships, cargo, and maritime activities, offering comprehensive protection for commercial shipping enterprises and marine operations. The better choice depends on the specific risk exposure: flood insurance integration suits inland property protection, while marine insurance integration caters to maritime industry needs.

Connection

Flood insurance integration and marine insurance integration share a crucial connection through their focus on mitigating water-related risks for properties and assets. Both types of insurance utilize specialized risk assessment models to evaluate exposure to water damage caused by natural disasters or maritime incidents. Integrating these policies enhances comprehensive coverage strategies, protecting policyholders against flooding from storms as well as marine perils such as cargo loss or vessel damage.

Key Terms

**Marine Insurance Integration:**

Marine insurance integration involves incorporating coverage for watercraft, cargo, and liability risks associated with maritime activities into broader insurance platforms, ensuring seamless management of policies and claims. This type of integration is critical for businesses engaged in shipping, logistics, and offshore operations to mitigate financial losses from marine perils such as storms, piracy, or accidents. Explore in-depth how marine insurance integration enhances risk management and operational efficiency in maritime industries.

Hull Coverage

Marine insurance integration for Hull Coverage involves protecting the physical structure of vessels against risks such as collision, theft, and natural disasters, emphasizing coverage specificity to maritime assets. Flood insurance integration, by contrast, centers on mitigating water damage to land-based properties and infrastructure, with less relevance to maritime vessels. Explore detailed comparisons to understand how each insurance type addresses Hull Coverage uniquely.

Cargo Policy

Marine insurance integration in cargo policy primarily covers the risks of loss or damage to goods during sea transit, including perils like sinking, piracy, and rough seas. Flood insurance integration, while often part of broader property policies, addresses damage caused by inland or coastal flooding but typically excludes maritime transport risks. Explore detailed comparisons and specific policy benefits to better understand the nuances of cargo protection.

Source and External Links

The Evolution of Marine Insurance: How Emerging Technologies Are Shaping the Future of Freight Coverage - Marine insurance integration leverages technologies like blockchain for transparency and fraud prevention, AI for risk assessment and claims processing, and drones/satellite imagery for remote incident assessment, significantly enhancing automation, risk management, and customer experience.

Chart a Course for Success with Seamless Marine - Seamless Marine provides robust integration capabilities, real-time data flow, multi-currency fleet vessel policy management, CRM features, and secure cloud-based access, enabling streamlined insurance operations and improved risk management for marine insurance providers.

How AI and Technology are Transforming Marine Insurance - The integration of AI, IoT, and blockchain technologies in marine insurance improves risk assessment accuracy, fraud detection, and claims processing speed, enabling more efficient and precise underwriting and better customer protection.

dowidth.com

dowidth.com