Behavioral policy pricing leverages customer behavior data such as driving habits and purchase patterns to tailor insurance premiums, improving risk assessment accuracy. AI-driven pricing goes beyond traditional methods by utilizing machine learning algorithms to analyze vast datasets, detect patterns, and dynamically adjust rates in real-time. Explore how integrating behavioral insights with AI technology transforms insurance pricing efficiency and personalization.

Why it is important

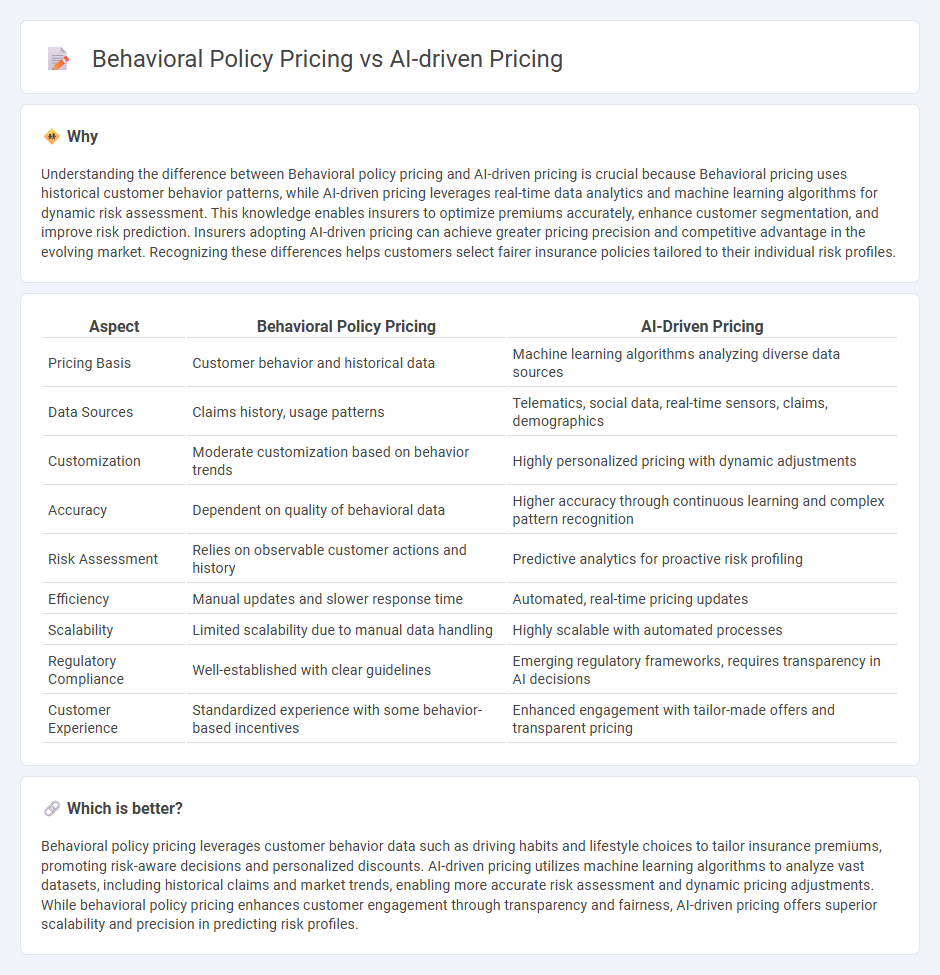

Understanding the difference between Behavioral policy pricing and AI-driven pricing is crucial because Behavioral pricing uses historical customer behavior patterns, while AI-driven pricing leverages real-time data analytics and machine learning algorithms for dynamic risk assessment. This knowledge enables insurers to optimize premiums accurately, enhance customer segmentation, and improve risk prediction. Insurers adopting AI-driven pricing can achieve greater pricing precision and competitive advantage in the evolving market. Recognizing these differences helps customers select fairer insurance policies tailored to their individual risk profiles.

Comparison Table

| Aspect | Behavioral Policy Pricing | AI-Driven Pricing |

|---|---|---|

| Pricing Basis | Customer behavior and historical data | Machine learning algorithms analyzing diverse data sources |

| Data Sources | Claims history, usage patterns | Telematics, social data, real-time sensors, claims, demographics |

| Customization | Moderate customization based on behavior trends | Highly personalized pricing with dynamic adjustments |

| Accuracy | Dependent on quality of behavioral data | Higher accuracy through continuous learning and complex pattern recognition |

| Risk Assessment | Relies on observable customer actions and history | Predictive analytics for proactive risk profiling |

| Efficiency | Manual updates and slower response time | Automated, real-time pricing updates |

| Scalability | Limited scalability due to manual data handling | Highly scalable with automated processes |

| Regulatory Compliance | Well-established with clear guidelines | Emerging regulatory frameworks, requires transparency in AI decisions |

| Customer Experience | Standardized experience with some behavior-based incentives | Enhanced engagement with tailor-made offers and transparent pricing |

Which is better?

Behavioral policy pricing leverages customer behavior data such as driving habits and lifestyle choices to tailor insurance premiums, promoting risk-aware decisions and personalized discounts. AI-driven pricing utilizes machine learning algorithms to analyze vast datasets, including historical claims and market trends, enabling more accurate risk assessment and dynamic pricing adjustments. While behavioral policy pricing enhances customer engagement through transparency and fairness, AI-driven pricing offers superior scalability and precision in predicting risk profiles.

Connection

Behavioral policy pricing leverages customer data and behavioral insights to tailor insurance premiums, enabling more precise risk assessment. AI-driven pricing systems process vast datasets, including behavioral patterns, to optimize pricing algorithms and predict individual risk more accurately. Together, these approaches enhance underwriting efficiency and offer personalized insurance solutions based on real-time behavioral analytics.

Key Terms

Risk Assessment

AI-driven pricing leverages machine learning algorithms to analyze vast datasets, identifying risk patterns and predicting customer behavior with high precision to optimize pricing strategies dynamically. Behavioral policy pricing, on the other hand, incorporates psychological and behavioral economics principles to adjust pricing based on consumer decision-making processes and perceived risk tolerance. Explore the comparative impacts of these approaches on risk assessment for enhanced pricing models.

Predictive Analytics

AI-driven pricing leverages advanced machine learning algorithms and predictive analytics to dynamically adjust prices based on real-time market trends, competitor actions, and consumer behavior patterns, maximizing revenue and profitability. Behavioral policy pricing uses consumer psychology insights and historical purchase data to set prices that influence buying decisions through perceived value and incentives, but often lacks the real-time adaptiveness of AI models. Discover how integrating predictive analytics in pricing strategies can revolutionize your market competitiveness and customer engagement.

Personalization

AI-driven pricing leverages machine learning algorithms and vast datasets to tailor prices dynamically based on individual consumer behavior, market demand, and competitive factors, ensuring optimal revenue generation. In contrast, behavioral policy pricing relies on psychological cues and consumer decision-making patterns to create personalized offers that influence buying habits through targeted incentives and discounts. Explore how integrating AI with behavioral insights can revolutionize personalization in pricing strategies.

Source and External Links

How AI is shaping dynamic pricing | AI-based pricing solutions - AI-driven pricing uses real-time data and machine learning to dynamically adjust prices for optimal profitability, scalability, and market responsiveness, empowering businesses to stay competitive and maximize revenue.

AI Pricing Guide - AI automates pricing by analyzing demand, inventory, competitor activity, and market trends, enabling value-based strategies that preserve margins and enhance customer-centric decision-making.

Overcoming Retail Complexity with AI-Powered Pricing - Retailers using AI-powered pricing models report 5-10% gross profit increases, as AI translates complex market conditions into dynamic, optimal prices that sustain revenue growth and strengthen customer perception.

dowidth.com

dowidth.com