Drone insurance provides coverage for damages, theft, and liability related to unmanned aerial vehicles, protecting both hobbyists and commercial users from costly losses. Flood insurance specifically safeguards property owners against water damage caused by flooding, a risk typically excluded from standard homeowners insurance policies. Explore the differences between drone insurance and flood insurance to determine which protection best suits your needs.

Why it is important

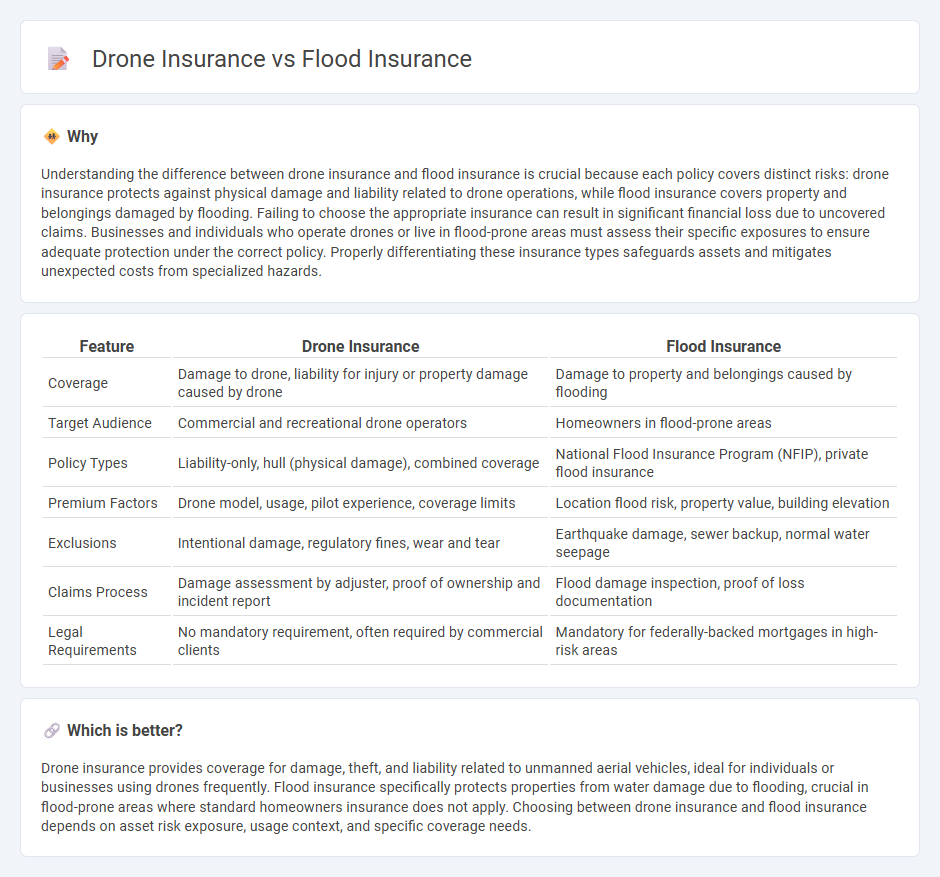

Understanding the difference between drone insurance and flood insurance is crucial because each policy covers distinct risks: drone insurance protects against physical damage and liability related to drone operations, while flood insurance covers property and belongings damaged by flooding. Failing to choose the appropriate insurance can result in significant financial loss due to uncovered claims. Businesses and individuals who operate drones or live in flood-prone areas must assess their specific exposures to ensure adequate protection under the correct policy. Properly differentiating these insurance types safeguards assets and mitigates unexpected costs from specialized hazards.

Comparison Table

| Feature | Drone Insurance | Flood Insurance |

|---|---|---|

| Coverage | Damage to drone, liability for injury or property damage caused by drone | Damage to property and belongings caused by flooding |

| Target Audience | Commercial and recreational drone operators | Homeowners in flood-prone areas |

| Policy Types | Liability-only, hull (physical damage), combined coverage | National Flood Insurance Program (NFIP), private flood insurance |

| Premium Factors | Drone model, usage, pilot experience, coverage limits | Location flood risk, property value, building elevation |

| Exclusions | Intentional damage, regulatory fines, wear and tear | Earthquake damage, sewer backup, normal water seepage |

| Claims Process | Damage assessment by adjuster, proof of ownership and incident report | Flood damage inspection, proof of loss documentation |

| Legal Requirements | No mandatory requirement, often required by commercial clients | Mandatory for federally-backed mortgages in high-risk areas |

Which is better?

Drone insurance provides coverage for damage, theft, and liability related to unmanned aerial vehicles, ideal for individuals or businesses using drones frequently. Flood insurance specifically protects properties from water damage due to flooding, crucial in flood-prone areas where standard homeowners insurance does not apply. Choosing between drone insurance and flood insurance depends on asset risk exposure, usage context, and specific coverage needs.

Connection

Drone insurance and flood insurance are connected through their shared concern for mitigating risk and protecting valuable assets against environmental hazards. Both types of insurance policies cover damages that arise from natural events, such as flooding, which can severely impact drone operations and equipment. Insurers often assess flood risks as a critical factor when underwriting drone insurance, particularly for drones used in flood-prone areas for monitoring and emergency response.

Key Terms

Coverage Scope

Flood insurance primarily covers property damage and losses caused by flooding events, including repaired structural damage and replacement of personal belongings. Drone insurance focuses on liability and physical damage coverage for drones, protecting against accidents, theft, and third-party injuries or property damage during drone operations. Explore detailed comparisons of coverage scope to choose the right insurance that fits your specific needs.

Risk Assessment

Flood insurance primarily focuses on assessing environmental risks such as geographic location, historical flood data, and property elevation to determine coverage needs and premiums. Drone insurance evaluates operational risks including flight zones, pilot experience, drone specifications, and potential liabilities arising from aerial activities. Explore comprehensive risk assessment strategies in both flood and drone insurance to enhance your protection measures.

Policy Exclusions

Flood insurance typically excludes damages caused by other natural disasters, such as earthquakes or hurricanes, and generally does not cover losses due to water backup or mold. Drone insurance policy exclusions often include intentional damage, operator error, and activities that violate local aviation regulations, limiting coverage for commercial uses without proper endorsements. Explore the distinct exclusion clauses of both insurance types to understand your coverage comprehensively.

Source and External Links

Flood Insurance | FEMA.gov - The National Flood Insurance Program (NFIP) offers flood insurance to property owners, renters, and businesses in participating communities, covering buildings, contents, or both, and typically requires a 30-day waiting period for coverage to begin.

Get a Flood Insurance Quote Now | GEICO - GEICO provides quotes for federally administered flood insurance in NFIP-participating communities, with policies backed by the federal government and rates tailored to your property's location.

Flood Insurance - Illinois Department of Insurance - Flood insurance is not typically included in standard homeowners policies, must be purchased separately, and is available to anyone in an NFIP-participating community; if unavailable, private flood insurance is an option, though it may not guarantee renewal.

dowidth.com

dowidth.com