Pet insurance platforms specialize in coverage for veterinary expenses, accidents, and illnesses tailored to different animal breeds and age groups, employing algorithms to personalize plans and premiums. Home insurance platforms focus on protecting property assets against risks like fire, theft, and natural disasters, often integrating smart home technology data to assess risk and expedite claims. Explore the key features and benefits of these insurance platforms to determine which best suits your needs.

Why it is important

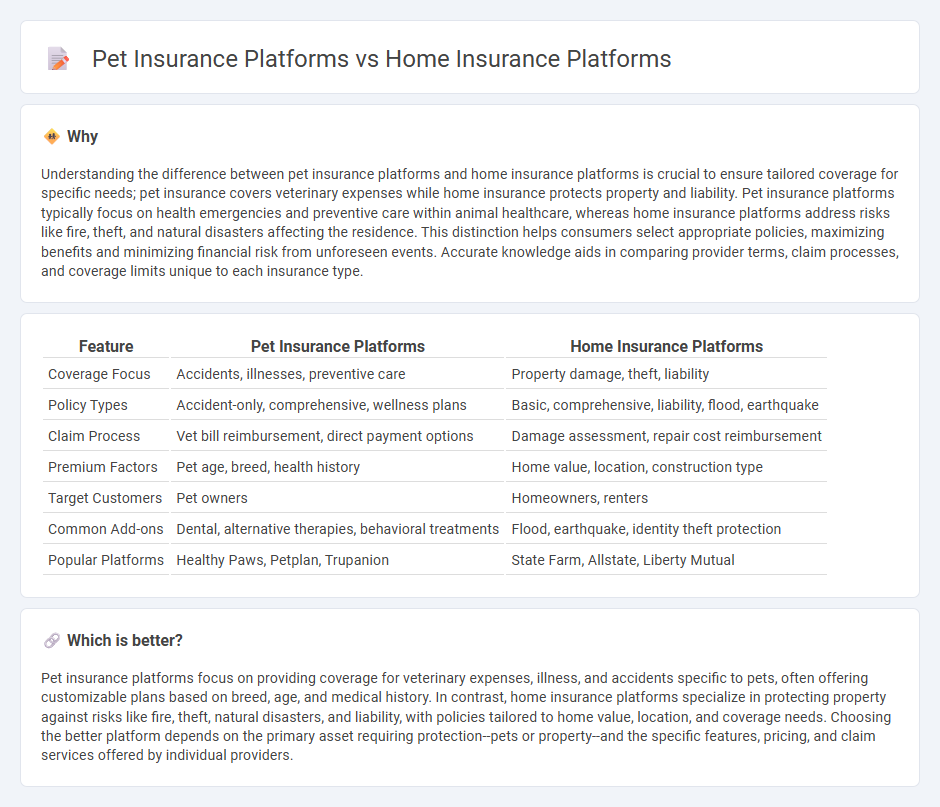

Understanding the difference between pet insurance platforms and home insurance platforms is crucial to ensure tailored coverage for specific needs; pet insurance covers veterinary expenses while home insurance protects property and liability. Pet insurance platforms typically focus on health emergencies and preventive care within animal healthcare, whereas home insurance platforms address risks like fire, theft, and natural disasters affecting the residence. This distinction helps consumers select appropriate policies, maximizing benefits and minimizing financial risk from unforeseen events. Accurate knowledge aids in comparing provider terms, claim processes, and coverage limits unique to each insurance type.

Comparison Table

| Feature | Pet Insurance Platforms | Home Insurance Platforms |

|---|---|---|

| Coverage Focus | Accidents, illnesses, preventive care | Property damage, theft, liability |

| Policy Types | Accident-only, comprehensive, wellness plans | Basic, comprehensive, liability, flood, earthquake |

| Claim Process | Vet bill reimbursement, direct payment options | Damage assessment, repair cost reimbursement |

| Premium Factors | Pet age, breed, health history | Home value, location, construction type |

| Target Customers | Pet owners | Homeowners, renters |

| Common Add-ons | Dental, alternative therapies, behavioral treatments | Flood, earthquake, identity theft protection |

| Popular Platforms | Healthy Paws, Petplan, Trupanion | State Farm, Allstate, Liberty Mutual |

Which is better?

Pet insurance platforms focus on providing coverage for veterinary expenses, illness, and accidents specific to pets, often offering customizable plans based on breed, age, and medical history. In contrast, home insurance platforms specialize in protecting property against risks like fire, theft, natural disasters, and liability, with policies tailored to home value, location, and coverage needs. Choosing the better platform depends on the primary asset requiring protection--pets or property--and the specific features, pricing, and claim services offered by individual providers.

Connection

Pet insurance platforms and home insurance platforms share interconnected risk assessment algorithms that analyze property damage and liability factors to offer bundled policies. Both utilize data on homeowners' environments, such as structural safety and neighborhood crime rates, to tailor coverage plans that include pet-related incidents within the home. Integration of these platforms enhances customer convenience by consolidating premium payments and claims processing under a single provider.

Key Terms

**Home Insurance Platforms:**

Home insurance platforms specialize in providing comprehensive coverage options for homeowners, including protection against property damage, natural disasters, theft, and liability risks. These platforms offer features such as customized policy quotes, seamless claims processing, and risk assessment tools tailored to various property types and locations. Explore the advantages and detailed offerings of top home insurance platforms to safeguard your residential investment effectively.

Property Coverage

Home insurance platforms specialize in comprehensive property coverage, including dwelling protection, personal belongings, and liability against damages caused by fire, theft, or natural disasters. Pet insurance platforms primarily focus on medical and veterinary expenses related to pets, excluding typical property damage or liability coverage tied to homeowners' assets. Explore detailed comparisons to understand how each insurance type protects different aspects of your valuable investments.

Liability Protection

Home insurance platforms primarily offer liability protection against property damage or injuries occurring on the insured property, covering legal fees and compensation. Pet insurance platforms focus on veterinary bills and medical expenses but typically lack comprehensive liability protection for damages or injuries caused by pets. Explore detailed comparisons to understand how liability coverage varies between home insurance and pet insurance platforms.

Source and External Links

The Zebra - Compare multiple home insurance quotes side-by-side, save time, and access expert advice from licensed agents--all at no cost to you.

Hippo Home Insurance - Get tailored, affordable homeowners insurance quotes in under 60 seconds by analyzing your home's unique risks and comparing rates from 70+ top carriers.

Lemonade Homeowners Insurance - Purchase 100% digital homeowners insurance with instant claims processing, flexible policy changes, and bundling discounts for other insurance products.

dowidth.com

dowidth.com