Climate risk insurance offers financial protection against losses from natural disasters linked to climate change, using actual damage assessments to trigger payouts. Parameter insurance provides faster, more transparent claims through predefined parameters like rainfall levels or wind speeds, eliminating the need for on-site damage verification. Explore the differences and benefits of each to determine which solution best fits your climate risk management strategy.

Why it is important

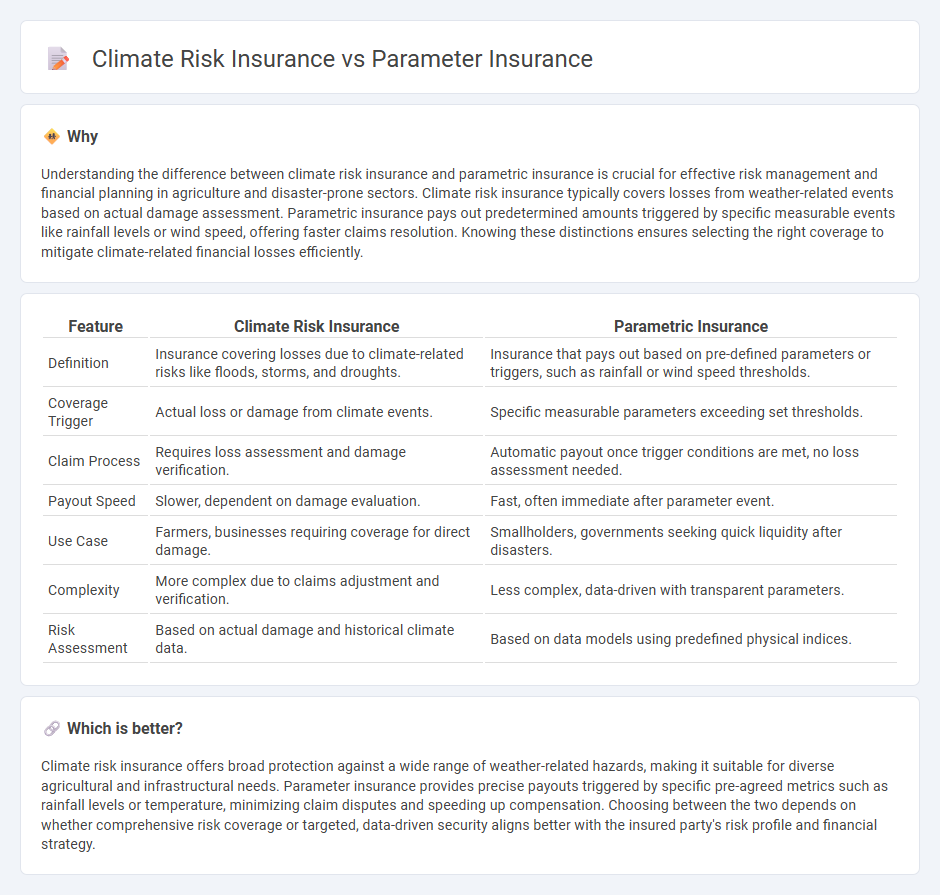

Understanding the difference between climate risk insurance and parametric insurance is crucial for effective risk management and financial planning in agriculture and disaster-prone sectors. Climate risk insurance typically covers losses from weather-related events based on actual damage assessment. Parametric insurance pays out predetermined amounts triggered by specific measurable events like rainfall levels or wind speed, offering faster claims resolution. Knowing these distinctions ensures selecting the right coverage to mitigate climate-related financial losses efficiently.

Comparison Table

| Feature | Climate Risk Insurance | Parametric Insurance |

|---|---|---|

| Definition | Insurance covering losses due to climate-related risks like floods, storms, and droughts. | Insurance that pays out based on pre-defined parameters or triggers, such as rainfall or wind speed thresholds. |

| Coverage Trigger | Actual loss or damage from climate events. | Specific measurable parameters exceeding set thresholds. |

| Claim Process | Requires loss assessment and damage verification. | Automatic payout once trigger conditions are met, no loss assessment needed. |

| Payout Speed | Slower, dependent on damage evaluation. | Fast, often immediate after parameter event. |

| Use Case | Farmers, businesses requiring coverage for direct damage. | Smallholders, governments seeking quick liquidity after disasters. |

| Complexity | More complex due to claims adjustment and verification. | Less complex, data-driven with transparent parameters. |

| Risk Assessment | Based on actual damage and historical climate data. | Based on data models using predefined physical indices. |

Which is better?

Climate risk insurance offers broad protection against a wide range of weather-related hazards, making it suitable for diverse agricultural and infrastructural needs. Parameter insurance provides precise payouts triggered by specific pre-agreed metrics such as rainfall levels or temperature, minimizing claim disputes and speeding up compensation. Choosing between the two depends on whether comprehensive risk coverage or targeted, data-driven security aligns better with the insured party's risk profile and financial strategy.

Connection

Climate risk insurance and parameter insurance are interconnected as both address financial protection against climate-related hazards by using predefined triggers or parameters, such as rainfall levels or temperature thresholds, instead of actual loss assessments. Parameter insurance offers faster payouts and reduces moral hazard by automating compensation based on measurable data, enhancing the effectiveness of climate risk insurance in managing uncertainty and economic impact from extreme weather events. This connection supports resilience building for vulnerable communities and sectors highly exposed to climate variability.

Key Terms

Trigger Events

Parameter insurance relies on predefined trigger events based on measurable indices such as rainfall levels, temperature thresholds, or wind speeds, activating payouts without the need for damage assessment. Climate risk insurance covers losses from broader climatic events like floods, droughts, or hurricanes, often requiring proofs of incurred damages to initiate compensation. Explore the distinct mechanisms and benefits of each to better understand their roles in risk management.

Indemnity

Parameter insurance pays out based on predetermined index triggers such as rainfall levels or temperature thresholds, eliminating the need for loss assessment. Climate risk insurance often involves indemnity-based coverage, compensating policyholders for actual verified losses to assets or income due to climate-related events. Explore more to understand the advantages and applications of each insurance type in managing climate risks effectively.

Risk Modeling

Parameter insurance uses predefined triggers based on measurable events, such as rainfall or temperature thresholds, to expedite claims processing and reduce moral hazard. Climate risk insurance integrates advanced risk modeling techniques, including climate simulations and probabilistic assessments, to better capture the complexities of climate-related hazards. Discover more about how these insurance models shape risk management strategies in a changing climate.

Source and External Links

What is Parametric Insurance? - Swiss Re Corporate Solutions - Provides an overview of parametric insurance, explaining how it covers the probability of loss-causing events instead of actual losses.

Parametric Insurance - Wikipedia - Describes parametric insurance as a non-traditional insurance offering payouts based on specified trigger events, differing from traditional indemnity insurance.

Parametric Insurance Solutions - Amwins - Explains how parametric policies pay based on predefined event thresholds, simplifying the proof of loss process.

dowidth.com

dowidth.com