Digital claim automation streamlines the insurance claims process by leveraging artificial intelligence and machine learning to quickly assess, validate, and resolve claims with greater accuracy and efficiency compared to traditional email-based claims handling. Email-based claims often result in slower response times, higher error rates, and increased administrative workload due to manual data entry and fragmented communication. Discover how digital claim automation can transform your insurance operations and enhance customer satisfaction.

Why it is important

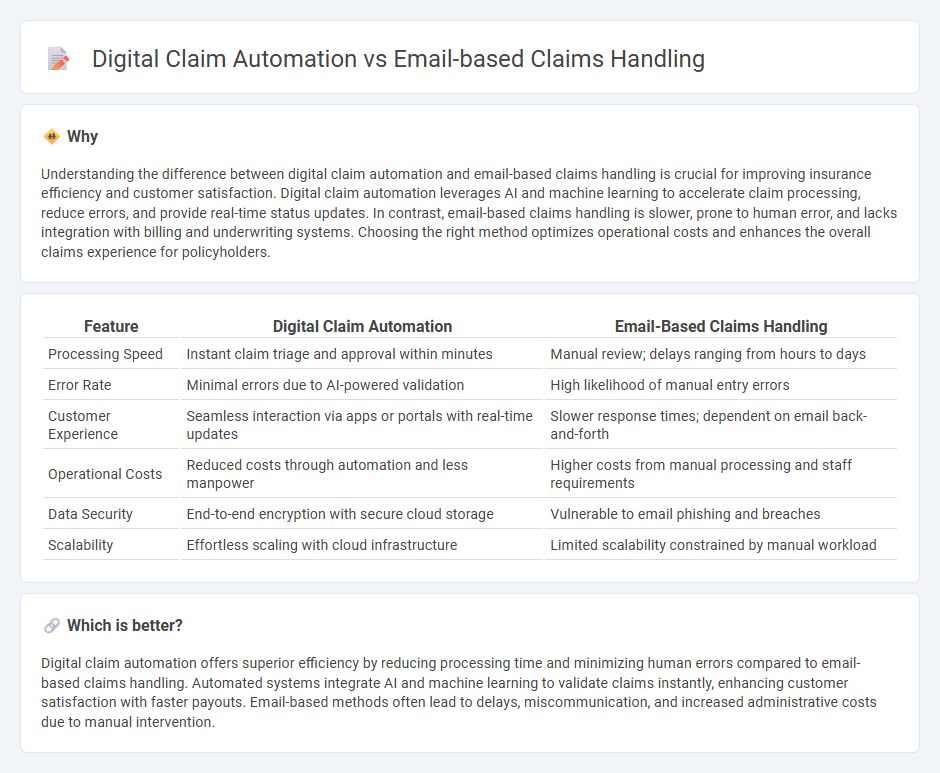

Understanding the difference between digital claim automation and email-based claims handling is crucial for improving insurance efficiency and customer satisfaction. Digital claim automation leverages AI and machine learning to accelerate claim processing, reduce errors, and provide real-time status updates. In contrast, email-based claims handling is slower, prone to human error, and lacks integration with billing and underwriting systems. Choosing the right method optimizes operational costs and enhances the overall claims experience for policyholders.

Comparison Table

| Feature | Digital Claim Automation | Email-Based Claims Handling |

|---|---|---|

| Processing Speed | Instant claim triage and approval within minutes | Manual review; delays ranging from hours to days |

| Error Rate | Minimal errors due to AI-powered validation | High likelihood of manual entry errors |

| Customer Experience | Seamless interaction via apps or portals with real-time updates | Slower response times; dependent on email back-and-forth |

| Operational Costs | Reduced costs through automation and less manpower | Higher costs from manual processing and staff requirements |

| Data Security | End-to-end encryption with secure cloud storage | Vulnerable to email phishing and breaches |

| Scalability | Effortless scaling with cloud infrastructure | Limited scalability constrained by manual workload |

Which is better?

Digital claim automation offers superior efficiency by reducing processing time and minimizing human errors compared to email-based claims handling. Automated systems integrate AI and machine learning to validate claims instantly, enhancing customer satisfaction with faster payouts. Email-based methods often lead to delays, miscommunication, and increased administrative costs due to manual intervention.

Connection

Digital claim automation streamlines the insurance claims process by utilizing software algorithms to assess, validate, and approve claims efficiently. Email-based claims handling acts as a communication channel that integrates with automated systems, enabling seamless submission, tracking, and notification of claim statuses. This connectivity enhances accuracy, reduces processing time, and improves customer experience in insurance claim management.

Key Terms

Manual Processing

Manual processing in email-based claims handling often results in slower response times and higher error rates due to dependence on human intervention for data entry and verification. Digital claim automation leverages AI and machine learning to streamline workflows, reduce manual input, and enhance accuracy and efficiency. Discover how automating claims can transform your insurance operations and improve customer satisfaction.

Artificial Intelligence (AI)

Email-based claims handling relies on manual data entry and processing, leading to increased errors and slower resolution times. Digital claim automation leverages Artificial Intelligence (AI) to streamline data extraction, fraud detection, and predictive analytics, significantly enhancing accuracy and efficiency. Explore how integrating AI-driven automation can transform claims management for faster, smarter outcomes.

Straight-Through Processing (STP)

Email-based claims handling often results in slower processing times due to manual data entry and increased error rates, hindering efficiency. Digital claim automation leverages Straight-Through Processing (STP) to enable faster, error-free claims management by automating data validation and workflow approvals. Explore how STP can transform your claims operations for improved accuracy and speed.

Source and External Links

How AI-Powered Emails are Reducing Claims Processing Delays - This article discusses how AI-driven email automation can streamline the claims process by automating routine correspondence and enhancing real-time communication.

Handling Insurance Claims Through Email - This resource provides guidance on the etiquette and importance of email in handling insurance claims, emphasizing the permanence and legal implications of email communications.

Claims Management Software - Claimable - Claimable offers cloud-based claims software that centralizes and automates claims workflows, including email management, to improve efficiency and collaboration in the claims process.

dowidth.com

dowidth.com