Artificial intelligence underwriting leverages machine learning algorithms to analyze complex datasets, enabling faster and more accurate risk assessments compared to traditional data-driven underwriting methods that rely heavily on historical data and predefined rules. AI underwriting continuously improves through pattern recognition and real-time data integration, enhancing predictive accuracy and reducing human bias. Discover how artificial intelligence is revolutionizing underwriting processes and transforming the insurance industry.

Why it is important

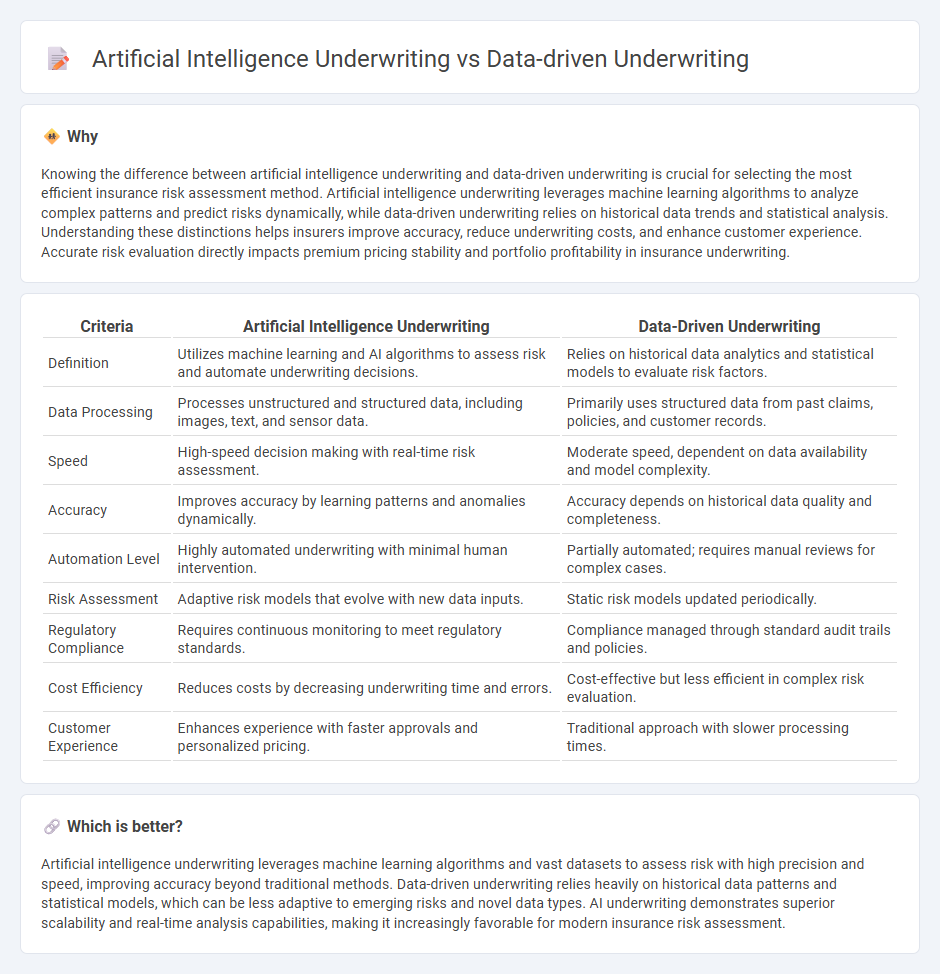

Knowing the difference between artificial intelligence underwriting and data-driven underwriting is crucial for selecting the most efficient insurance risk assessment method. Artificial intelligence underwriting leverages machine learning algorithms to analyze complex patterns and predict risks dynamically, while data-driven underwriting relies on historical data trends and statistical analysis. Understanding these distinctions helps insurers improve accuracy, reduce underwriting costs, and enhance customer experience. Accurate risk evaluation directly impacts premium pricing stability and portfolio profitability in insurance underwriting.

Comparison Table

| Criteria | Artificial Intelligence Underwriting | Data-Driven Underwriting |

|---|---|---|

| Definition | Utilizes machine learning and AI algorithms to assess risk and automate underwriting decisions. | Relies on historical data analytics and statistical models to evaluate risk factors. |

| Data Processing | Processes unstructured and structured data, including images, text, and sensor data. | Primarily uses structured data from past claims, policies, and customer records. |

| Speed | High-speed decision making with real-time risk assessment. | Moderate speed, dependent on data availability and model complexity. |

| Accuracy | Improves accuracy by learning patterns and anomalies dynamically. | Accuracy depends on historical data quality and completeness. |

| Automation Level | Highly automated underwriting with minimal human intervention. | Partially automated; requires manual reviews for complex cases. |

| Risk Assessment | Adaptive risk models that evolve with new data inputs. | Static risk models updated periodically. |

| Regulatory Compliance | Requires continuous monitoring to meet regulatory standards. | Compliance managed through standard audit trails and policies. |

| Cost Efficiency | Reduces costs by decreasing underwriting time and errors. | Cost-effective but less efficient in complex risk evaluation. |

| Customer Experience | Enhances experience with faster approvals and personalized pricing. | Traditional approach with slower processing times. |

Which is better?

Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to assess risk with high precision and speed, improving accuracy beyond traditional methods. Data-driven underwriting relies heavily on historical data patterns and statistical models, which can be less adaptive to emerging risks and novel data types. AI underwriting demonstrates superior scalability and real-time analysis capabilities, making it increasingly favorable for modern insurance risk assessment.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets, enhancing the precision of risk assessment in insurance. Data-driven underwriting utilizes structured and unstructured data sources to inform decision-making processes, enabling more accurate policy pricing and risk classification. Together, these approaches optimize underwriting efficiency by integrating predictive analytics with comprehensive data insights.

Key Terms

Risk Assessment

Data-driven underwriting relies on historical data and statistical models to assess risk, utilizing structured datasets such as credit scores, claims history, and financial records. Artificial intelligence underwriting enhances risk assessment by processing vast amounts of unstructured data, including social media activity and real-time behavioral patterns, to identify subtle risk indicators beyond traditional metrics. Explore how integrating AI transforms underwriting accuracy and decision-making for comprehensive risk evaluation.

Predictive Analytics

Data-driven underwriting leverages historical data and statistical models to assess risk and predict outcomes, while artificial intelligence underwriting employs machine learning algorithms and neural networks to analyze complex datasets and enhance predictive accuracy. Predictive analytics in AI underwriting enables real-time risk evaluation by identifying patterns and trends beyond traditional data sources, increasing precision in credit scoring and fraud detection. Explore how integrating these methodologies transforms underwriting efficiency and decision-making.

Automation

Data-driven underwriting leverages large datasets and statistical models to automate risk assessment processes, enhancing accuracy and efficiency in decision-making. Artificial intelligence underwriting advances this by employing machine learning algorithms and natural language processing to continuously improve predictions and adapt to evolving data patterns. Explore the latest innovations and benefits of automation in underwriting to understand their impact on insurance and finance sectors.

Source and External Links

The Impact of Data-Driven Underwriting on Insurers - Data-driven underwriting uses advanced analytics, AI, and machine learning to evaluate insurance risk more accurately than traditional methods, enabling personalized policies and faster decisions.

How Data Analysis Enhances the Underwriting Process - By leveraging comprehensive historical claims data and predictive modeling, data-driven underwriting improves risk assessment, decision-making consistency, and overall insurer profitability.

Data-led underwriting for commercial insurance - Analytics-backed underwriting platforms use real-time data integration, AI, and scalable risk modeling to enable commercial insurers to continuously monitor risk and optimize pricing dynamically.

dowidth.com

dowidth.com