Crop microinsurance offers targeted protection for smallholder farmers against specific agricultural risks such as pests, diseases, and unpredictable weather, ensuring livelihood stability and sustainable farming. Natural disaster insurance provides broader coverage against large-scale environmental catastrophes including floods, hurricanes, and earthquakes, mitigating financial losses for individuals and businesses alike. Explore the differences and applications of these insurance types to safeguard your assets effectively.

Why it is important

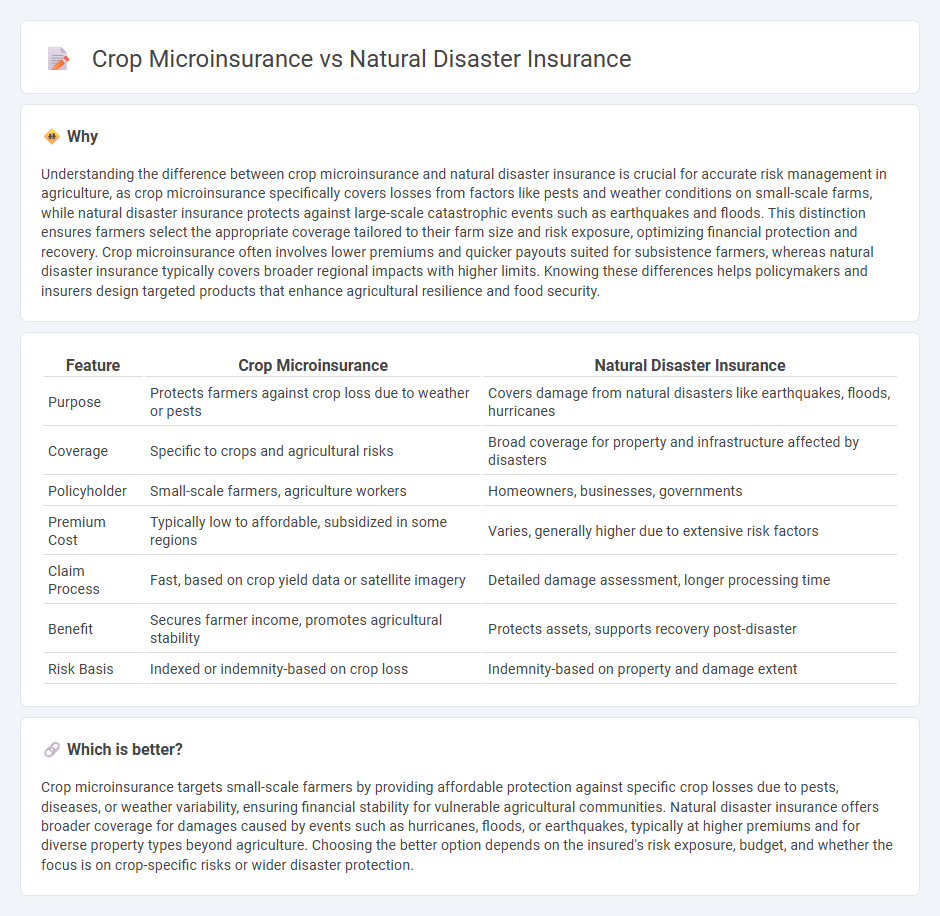

Understanding the difference between crop microinsurance and natural disaster insurance is crucial for accurate risk management in agriculture, as crop microinsurance specifically covers losses from factors like pests and weather conditions on small-scale farms, while natural disaster insurance protects against large-scale catastrophic events such as earthquakes and floods. This distinction ensures farmers select the appropriate coverage tailored to their farm size and risk exposure, optimizing financial protection and recovery. Crop microinsurance often involves lower premiums and quicker payouts suited for subsistence farmers, whereas natural disaster insurance typically covers broader regional impacts with higher limits. Knowing these differences helps policymakers and insurers design targeted products that enhance agricultural resilience and food security.

Comparison Table

| Feature | Crop Microinsurance | Natural Disaster Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to weather or pests | Covers damage from natural disasters like earthquakes, floods, hurricanes |

| Coverage | Specific to crops and agricultural risks | Broad coverage for property and infrastructure affected by disasters |

| Policyholder | Small-scale farmers, agriculture workers | Homeowners, businesses, governments |

| Premium Cost | Typically low to affordable, subsidized in some regions | Varies, generally higher due to extensive risk factors |

| Claim Process | Fast, based on crop yield data or satellite imagery | Detailed damage assessment, longer processing time |

| Benefit | Secures farmer income, promotes agricultural stability | Protects assets, supports recovery post-disaster |

| Risk Basis | Indexed or indemnity-based on crop loss | Indemnity-based on property and damage extent |

Which is better?

Crop microinsurance targets small-scale farmers by providing affordable protection against specific crop losses due to pests, diseases, or weather variability, ensuring financial stability for vulnerable agricultural communities. Natural disaster insurance offers broader coverage for damages caused by events such as hurricanes, floods, or earthquakes, typically at higher premiums and for diverse property types beyond agriculture. Choosing the better option depends on the insured's risk exposure, budget, and whether the focus is on crop-specific risks or wider disaster protection.

Connection

Crop microinsurance and natural disaster insurance both mitigate financial risks farmers face due to adverse weather events like droughts, floods, and storms. Crop microinsurance provides tailored protection to smallholder farmers against crop losses, while natural disaster insurance covers broader environmental hazards impacting agricultural productivity. Together, these insurance products enhance agricultural resilience and ensure income stability in climate-vulnerable regions.

Key Terms

Natural Disaster Insurance:

Natural disaster insurance provides comprehensive financial protection against catastrophic events such as hurricanes, earthquakes, floods, and wildfires, covering significant property and asset losses. Crop microinsurance, on the other hand, specifically targets small-scale farmers, offering affordable coverage for crop damage due to localized disasters like droughts or pest infestations. Explore further to understand how natural disaster insurance safeguards larger assets and supports disaster recovery efforts across diverse sectors.

Catastrophe Coverage

Natural disaster insurance typically offers extensive catastrophe coverage designed to protect against severe events like hurricanes, floods, and earthquakes, providing substantial financial relief for large-scale losses. Crop microinsurance, supported by organizations like the World Bank and tailored for smallholder farmers, delivers targeted coverage for specific agricultural risks such as drought or pest infestations, often with lower premiums and simplified claims processes. Explore in-depth comparisons of coverage limits, premium structures, and claim efficiencies to understand which option best safeguards your assets in catastrophe scenarios.

Risk Assessment

Natural disaster insurance assesses widespread events like floods, hurricanes, and earthquakes impacting large geographic areas, using historical data and catastrophe modeling to estimate potential losses. Crop microinsurance specifically evaluates risks related to individual farms or smallholder plots, incorporating localized weather data, soil conditions, and crop type to provide tailored coverage against droughts, pests, or yield failure. Discover how advanced risk assessment techniques differ between these insurance types to enhance protection for farmers and communities.

Source and External Links

Natural Disaster Insurance: What Does It Cover? - ValuePenguin - Most standard homeowners insurance policies cover damage caused by blizzards, lightning, windstorms, wildfires, and volcanic eruptions, with coverage types including actual cash value, replacement cost value, extended, and guaranteed value to help pay for repairs or replacement.

What Type of Insurance Covers Natural Disasters in Florida? - Natural disaster insurance in Florida covers specific disasters like floods, earthquakes, hurricanes, hail, and windstorms and is often bought as an add-on to standard policies since many exclude major disasters like floods and earthquakes.

Flood Insurance | FEMA.gov - Flood insurance is a separate policy often required for properties in high-risk flood areas, administered by the National Flood Insurance Program (NFIP), and helps property owners and renters recover faster from flood damage not covered by most homeowners insurance.

dowidth.com

dowidth.com