Natural catastrophe bonds transfer risk to capital markets by allowing investors to absorb losses from events like hurricanes or earthquakes, providing insurers with upfront capital and risk diversification. Reinsurance, on the other hand, involves insurers purchasing coverage from reinsurers to share potential claims and enhance financial stability. Explore how these two risk management tools offer distinct strategies for mitigating catastrophic losses.

Why it is important

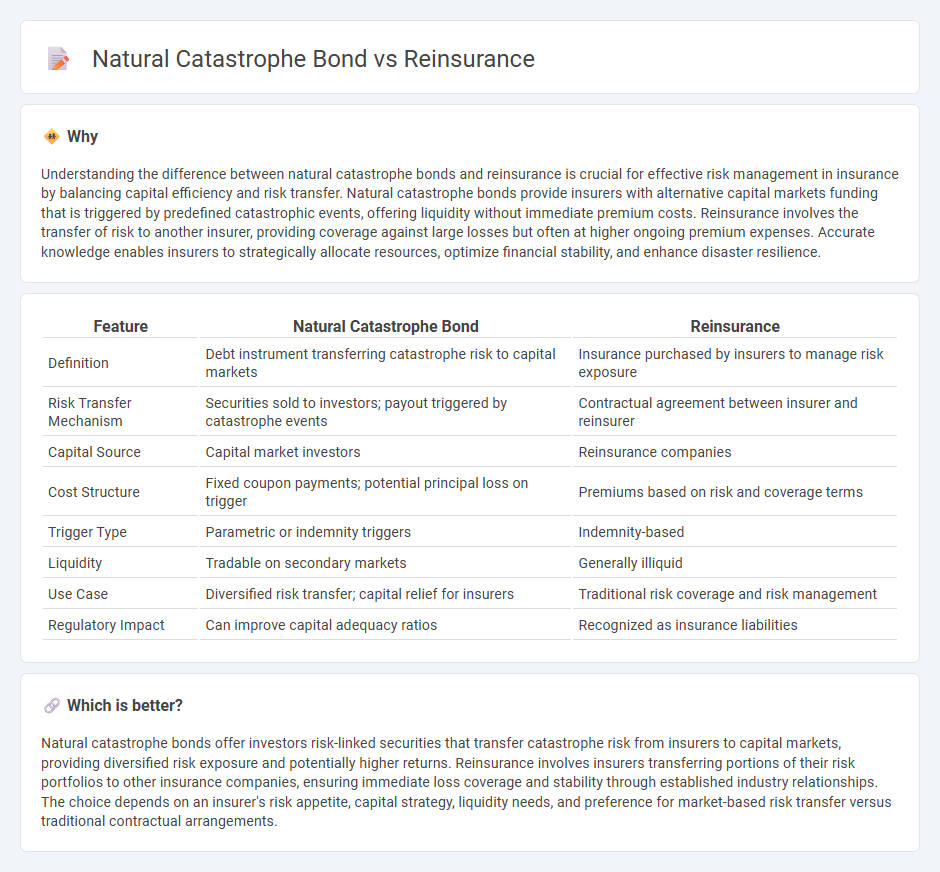

Understanding the difference between natural catastrophe bonds and reinsurance is crucial for effective risk management in insurance by balancing capital efficiency and risk transfer. Natural catastrophe bonds provide insurers with alternative capital markets funding that is triggered by predefined catastrophic events, offering liquidity without immediate premium costs. Reinsurance involves the transfer of risk to another insurer, providing coverage against large losses but often at higher ongoing premium expenses. Accurate knowledge enables insurers to strategically allocate resources, optimize financial stability, and enhance disaster resilience.

Comparison Table

| Feature | Natural Catastrophe Bond | Reinsurance |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk to capital markets | Insurance purchased by insurers to manage risk exposure |

| Risk Transfer Mechanism | Securities sold to investors; payout triggered by catastrophe events | Contractual agreement between insurer and reinsurer |

| Capital Source | Capital market investors | Reinsurance companies |

| Cost Structure | Fixed coupon payments; potential principal loss on trigger | Premiums based on risk and coverage terms |

| Trigger Type | Parametric or indemnity triggers | Indemnity-based |

| Liquidity | Tradable on secondary markets | Generally illiquid |

| Use Case | Diversified risk transfer; capital relief for insurers | Traditional risk coverage and risk management |

| Regulatory Impact | Can improve capital adequacy ratios | Recognized as insurance liabilities |

Which is better?

Natural catastrophe bonds offer investors risk-linked securities that transfer catastrophe risk from insurers to capital markets, providing diversified risk exposure and potentially higher returns. Reinsurance involves insurers transferring portions of their risk portfolios to other insurance companies, ensuring immediate loss coverage and stability through established industry relationships. The choice depends on an insurer's risk appetite, capital strategy, liquidity needs, and preference for market-based risk transfer versus traditional contractual arrangements.

Connection

Natural catastrophe bonds provide insurers and reinsurers with alternative risk transfer solutions by transferring the financial risk of catastrophic events to capital markets. Reinsurance companies often use these bonds to manage their exposure to large-scale natural disasters, enhancing their capacity to cover extreme losses. This connection optimizes capital efficiency and diversifies risk sources within the insurance industry.

Key Terms

Risk Transfer

Reinsurance provides traditional risk transfer by allowing insurers to cede portions of their exposure to reinsurers, thereby mitigating potential large losses from natural catastrophes. Natural catastrophe bonds transfer risk to capital market investors who absorb losses when predefined catastrophic events occur, offering a direct link between risk and investment returns. Explore further to understand how each mechanism aligns with your risk management strategy.

Trigger Event

Reinsurance contracts involve predefined trigger events based on actual losses or damages sustained by the cedant, often measured through indemnity or loss occurrence criteria. Natural catastrophe bonds (cat bonds) use parametric or industry loss triggers, activating payouts when specified physical parameters or third-party loss indices exceed set thresholds. Explore further to understand how trigger mechanisms impact risk transfer efficiency and capital market integration.

Payout Structure

Reinsurance typically involves a direct contractual agreement where insurers pay premiums and receive compensation based on the actual loss amounts, offering flexibility in claims adjustment and loss sharing. Natural catastrophe bonds, or cat bonds, provide a fixed payout triggered by predefined event parameters such as earthquake magnitude or hurricane wind speed, offering transparency and quicker disbursement but limited to preset conditions. Explore the detailed differences in payout structures to choose the optimal risk transfer solution for your needs.

Source and External Links

REINSURANCE - The American Council of Life Insurers - Reinsurance is a risk management tool that insurers use to spread risk and manage capital by transferring some or all of an insurance risk to another insurer, enabling protection of a wider array of individuals and managing risk on large or unusual policies.

Insurance Topics | Reinsurance - NAIC - Reinsurance is insurance for insurance companies where a reinsurer assumes all or part of one or more insurance policies' risks, used to manage risk, capital requirements, expand capacity, stabilize results, provide catastrophe protection, and facilitate exiting business lines.

Background on: Reinsurance | III - Insurance Information Institute - Reinsurance transfers portions of liability from primary insurers to reinsurers, sometimes involving multiple parties and evolving into alternative risk-spreading mechanisms such as catastrophe bonds, blending insurance and investment banking.

dowidth.com

dowidth.com