Pet insurance covers veterinary expenses for illnesses, injuries, and routine care of pets, while accident insurance focuses on providing financial protection for unexpected injuries in humans due to accidents. Both insurance types differ in coverage scope, policy limits, and claim processes tailored to their specific risks. Explore detailed comparisons to determine which insurance best suits your needs.

Why it is important

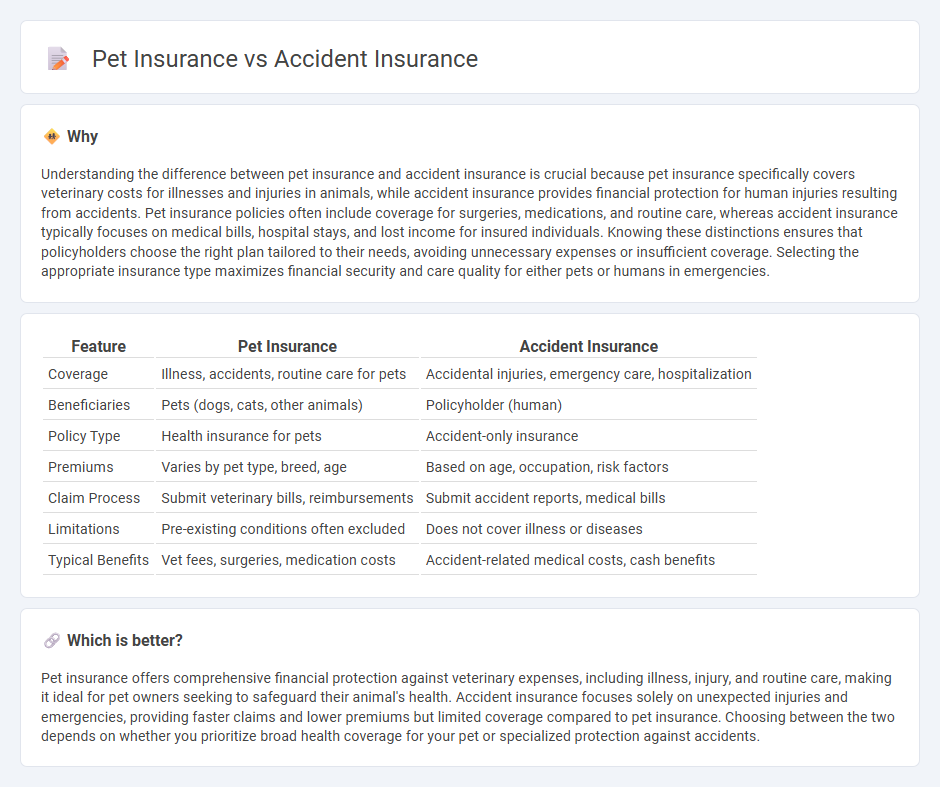

Understanding the difference between pet insurance and accident insurance is crucial because pet insurance specifically covers veterinary costs for illnesses and injuries in animals, while accident insurance provides financial protection for human injuries resulting from accidents. Pet insurance policies often include coverage for surgeries, medications, and routine care, whereas accident insurance typically focuses on medical bills, hospital stays, and lost income for insured individuals. Knowing these distinctions ensures that policyholders choose the right plan tailored to their needs, avoiding unnecessary expenses or insufficient coverage. Selecting the appropriate insurance type maximizes financial security and care quality for either pets or humans in emergencies.

Comparison Table

| Feature | Pet Insurance | Accident Insurance |

|---|---|---|

| Coverage | Illness, accidents, routine care for pets | Accidental injuries, emergency care, hospitalization |

| Beneficiaries | Pets (dogs, cats, other animals) | Policyholder (human) |

| Policy Type | Health insurance for pets | Accident-only insurance |

| Premiums | Varies by pet type, breed, age | Based on age, occupation, risk factors |

| Claim Process | Submit veterinary bills, reimbursements | Submit accident reports, medical bills |

| Limitations | Pre-existing conditions often excluded | Does not cover illness or diseases |

| Typical Benefits | Vet fees, surgeries, medication costs | Accident-related medical costs, cash benefits |

Which is better?

Pet insurance offers comprehensive financial protection against veterinary expenses, including illness, injury, and routine care, making it ideal for pet owners seeking to safeguard their animal's health. Accident insurance focuses solely on unexpected injuries and emergencies, providing faster claims and lower premiums but limited coverage compared to pet insurance. Choosing between the two depends on whether you prioritize broad health coverage for your pet or specialized protection against accidents.

Connection

Pet insurance and accident insurance both serve to mitigate unexpected financial burdens resulting from unforeseen events, offering coverage for medical expenses that arise from injuries or illnesses. While pet insurance specifically covers veterinary care for animals, accident insurance provides benefits for bodily injuries sustained by policyholders in various incidents. These insurance types emphasize risk management by providing financial protection and peace of mind against sudden health-related costs.

Key Terms

Coverage

Accident insurance primarily covers medical expenses resulting from unexpected injuries like fractures, burns, or poisoning, while pet insurance provides broader coverage including illness, surgery, and wellness care. Accident policies often exclude routine veterinary visits and chronic conditions, whereas pet insurance plans can be tailored to include these aspects for comprehensive protection. Explore detailed comparisons to choose the best insurance that fits your pet's health needs and budget.

Beneficiary

Accident insurance primarily benefits the policyholder or their designated beneficiaries by covering medical expenses and related costs arising from accidents. Pet insurance provides financial protection for pet owners by reimbursing veterinary bills and care costs for covered illnesses or injuries affecting their pets. Explore detailed comparisons to understand which insurance best suits your needs and the specific beneficiary protections offered.

Premium

Accident insurance premiums typically vary based on age, occupation, and coverage limits, often being more affordable for younger, low-risk individuals. Pet insurance premiums depend on factors such as the pet's breed, age, health history, and coverage options, with higher costs for older or predisposed breeds. Explore detailed premium comparisons and coverage benefits to choose the best insurance plan tailored to your needs.

Source and External Links

Accident Insurance - What Is It | Anthem - This webpage explains how accident insurance provides cash benefits for unexpected injuries and helps fill gaps in medical coverage.

Accident insurance: What It Is, Coverage, and Is It Worth It | Guardian - This article discusses the benefits of accident insurance, which include financial protection for extra expenses following accidents like broken bones or burns.

What Is Accident Insurance? Coverage & Benefits Explained - MetLife - This resource explains how accident insurance provides financial support for unexpected medical expenses and living costs following accidental injuries.

dowidth.com

dowidth.com