Artificial intelligence underwriting leverages machine learning algorithms and vast data sets to assess risk with high accuracy and efficiency, enabling personalized policy pricing and faster decision-making. Parametric underwriting relies on predefined parameters and triggers, such as weather events or natural disasters, to automate claim payouts and reduce administrative costs. Explore how these innovative underwriting methods transform the future of insurance risk management.

Why it is important

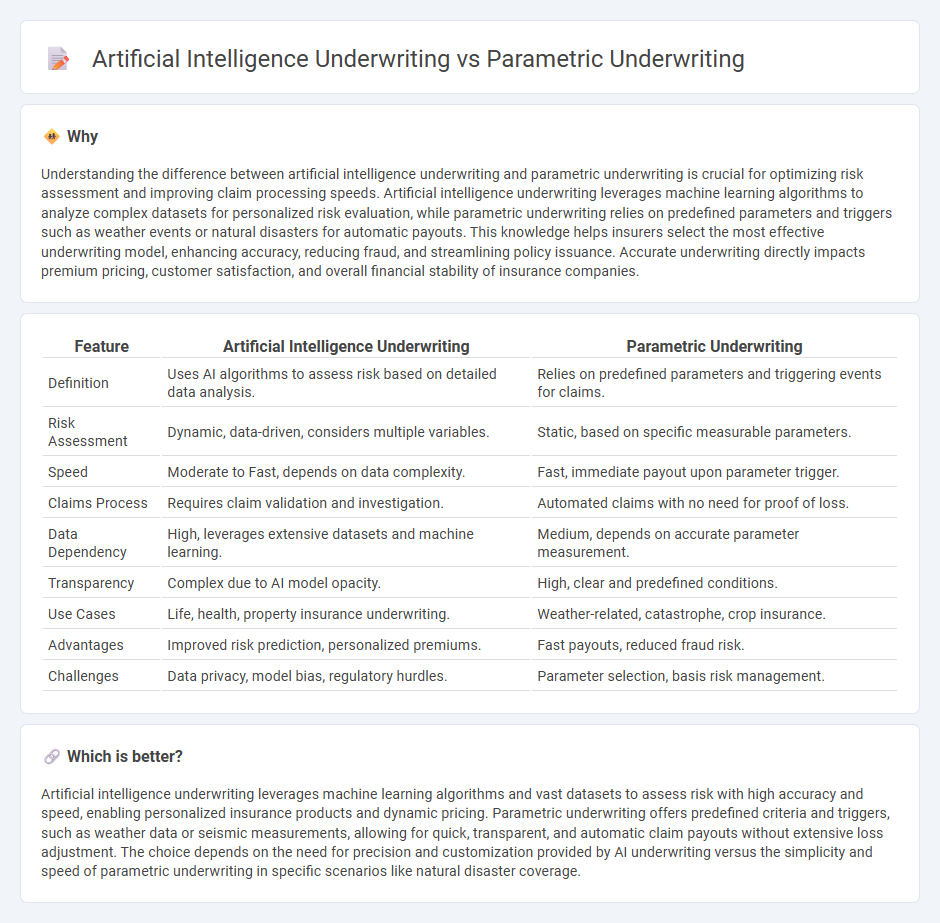

Understanding the difference between artificial intelligence underwriting and parametric underwriting is crucial for optimizing risk assessment and improving claim processing speeds. Artificial intelligence underwriting leverages machine learning algorithms to analyze complex datasets for personalized risk evaluation, while parametric underwriting relies on predefined parameters and triggers such as weather events or natural disasters for automatic payouts. This knowledge helps insurers select the most effective underwriting model, enhancing accuracy, reducing fraud, and streamlining policy issuance. Accurate underwriting directly impacts premium pricing, customer satisfaction, and overall financial stability of insurance companies.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Parametric Underwriting |

|---|---|---|

| Definition | Uses AI algorithms to assess risk based on detailed data analysis. | Relies on predefined parameters and triggering events for claims. |

| Risk Assessment | Dynamic, data-driven, considers multiple variables. | Static, based on specific measurable parameters. |

| Speed | Moderate to Fast, depends on data complexity. | Fast, immediate payout upon parameter trigger. |

| Claims Process | Requires claim validation and investigation. | Automated claims with no need for proof of loss. |

| Data Dependency | High, leverages extensive datasets and machine learning. | Medium, depends on accurate parameter measurement. |

| Transparency | Complex due to AI model opacity. | High, clear and predefined conditions. |

| Use Cases | Life, health, property insurance underwriting. | Weather-related, catastrophe, crop insurance. |

| Advantages | Improved risk prediction, personalized premiums. | Fast payouts, reduced fraud risk. |

| Challenges | Data privacy, model bias, regulatory hurdles. | Parameter selection, basis risk management. |

Which is better?

Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to assess risk with high accuracy and speed, enabling personalized insurance products and dynamic pricing. Parametric underwriting offers predefined criteria and triggers, such as weather data or seismic measurements, allowing for quick, transparent, and automatic claim payouts without extensive loss adjustment. The choice depends on the need for precision and customization provided by AI underwriting versus the simplicity and speed of parametric underwriting in specific scenarios like natural disaster coverage.

Connection

Artificial intelligence underwriting enhances traditional insurance processes by leveraging machine learning algorithms to analyze vast datasets, improving risk assessment and decision-making accuracy. Parametric underwriting uses predefined parameters and triggers, enabling quick claims settlements based on specific event metrics without extensive loss investigation. Combining AI with parametric underwriting streamlines policy issuance and claims processing, increasing efficiency and reducing operational costs for insurers.

Key Terms

**Parametric Underwriting:**

Parametric underwriting relies on predefined parameters and measurable event triggers to assess risk quickly, minimizing the need for extensive claims investigations. This approach offers transparency and speed, especially suitable for natural disaster insurance where payouts depend on objective data like earthquake magnitude or rainfall levels. Explore how parametric underwriting transforms insurance accuracy and efficiency.

Trigger Event

Parametric underwriting uses predetermined trigger events, such as weather conditions or financial thresholds, to automatically initiate claims and payouts without assessing individual losses, enhancing speed and transparency. Artificial intelligence underwriting analyzes vast datasets with machine learning algorithms to evaluate risk dynamically, considering multiple factors beyond fixed triggers to provide personalized risk assessments. Discover how combining parametric triggers with AI-driven insights revolutionizes underwriting efficiency and accuracy.

Predefined Payout

Parametric underwriting leverages predefined payout models triggered by specific events such as rainfall levels or earthquake magnitudes, ensuring swift and transparent claims settlement without traditional loss adjustment. Artificial intelligence underwriting, by contrast, utilizes complex algorithms and data analytics to assess risk profiles dynamically, often incorporating vast datasets beyond predefined parameters. Explore deeper insights into how these approaches transform insurance claims efficiency and customer experience.

Source and External Links

Parametric Insurance for Climate Risks - Descartes Underwriting - Parametric insurance pays out automatically when a predefined event (e.g., flood, earthquake) occurs, using objective data points as triggers, and is underwritten using advanced modeling and technology for precise risk assessment.

Comprehensive Guide to Parametric Insurance - Swiss Re Corporate Solutions - Parametric underwriting involves setting clear, objective triggers (such as earthquake magnitude or rainfall level) and rapid, transparent payouts based on these triggers, regardless of actual physical loss, filling gaps left by traditional indemnity insurance.

Parametric: A Complement to Traditional Property Coverage - Aon - Parametric underwriting allows risk managers to define exactly which events will trigger a claim and the payout amount, offering fast, dispute-free settlements and flexible coverage for otherwise uninsurable risks.

dowidth.com

dowidth.com