Crop microinsurance protects farmers by covering losses related to weather, pests, and crop failure, ensuring financial stability for small-scale agriculture. Enterprise microinsurance targets small business owners, providing coverage for property damage, liability, and business interruption to support business continuity. Discover the key differences and benefits of each to choose the right coverage for your needs.

Why it is important

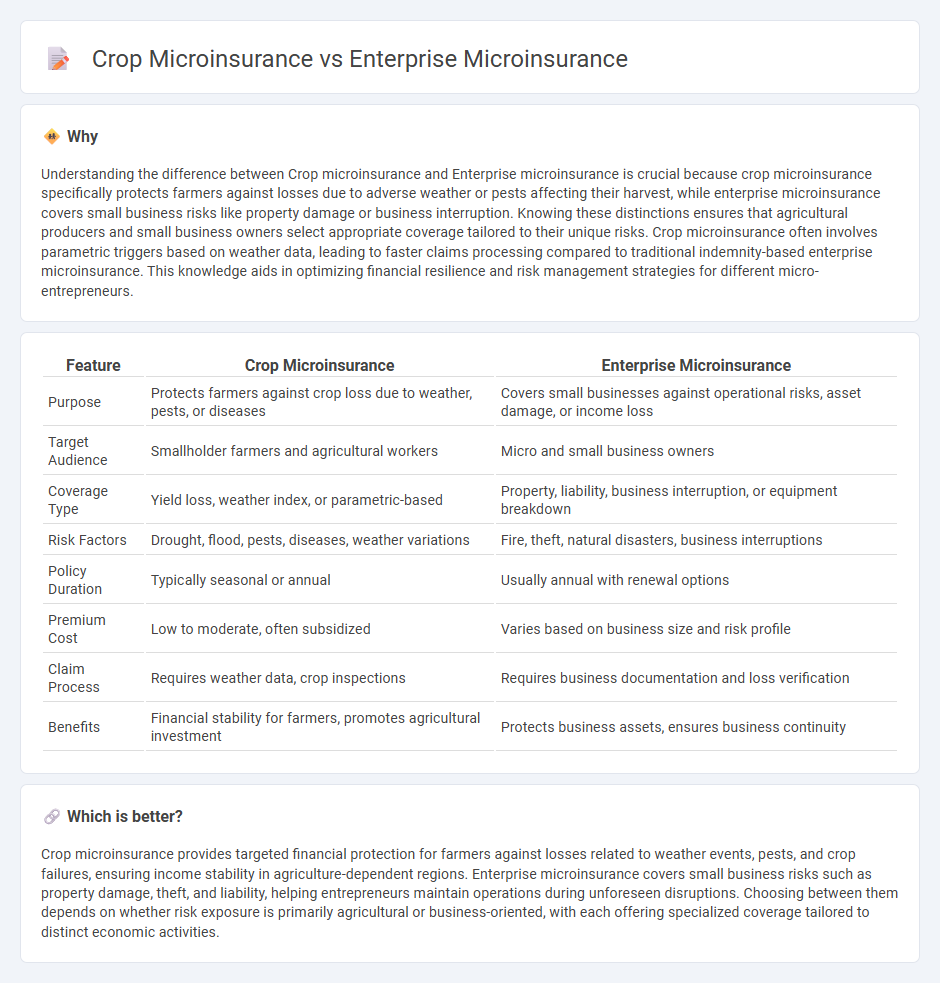

Understanding the difference between Crop microinsurance and Enterprise microinsurance is crucial because crop microinsurance specifically protects farmers against losses due to adverse weather or pests affecting their harvest, while enterprise microinsurance covers small business risks like property damage or business interruption. Knowing these distinctions ensures that agricultural producers and small business owners select appropriate coverage tailored to their unique risks. Crop microinsurance often involves parametric triggers based on weather data, leading to faster claims processing compared to traditional indemnity-based enterprise microinsurance. This knowledge aids in optimizing financial resilience and risk management strategies for different micro-entrepreneurs.

Comparison Table

| Feature | Crop Microinsurance | Enterprise Microinsurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to weather, pests, or diseases | Covers small businesses against operational risks, asset damage, or income loss |

| Target Audience | Smallholder farmers and agricultural workers | Micro and small business owners |

| Coverage Type | Yield loss, weather index, or parametric-based | Property, liability, business interruption, or equipment breakdown |

| Risk Factors | Drought, flood, pests, diseases, weather variations | Fire, theft, natural disasters, business interruptions |

| Policy Duration | Typically seasonal or annual | Usually annual with renewal options |

| Premium Cost | Low to moderate, often subsidized | Varies based on business size and risk profile |

| Claim Process | Requires weather data, crop inspections | Requires business documentation and loss verification |

| Benefits | Financial stability for farmers, promotes agricultural investment | Protects business assets, ensures business continuity |

Which is better?

Crop microinsurance provides targeted financial protection for farmers against losses related to weather events, pests, and crop failures, ensuring income stability in agriculture-dependent regions. Enterprise microinsurance covers small business risks such as property damage, theft, and liability, helping entrepreneurs maintain operations during unforeseen disruptions. Choosing between them depends on whether risk exposure is primarily agricultural or business-oriented, with each offering specialized coverage tailored to distinct economic activities.

Connection

Crop microinsurance and enterprise microinsurance are connected through their shared goal of mitigating financial risks for small-scale farmers and entrepreneurs in developing regions. Crop microinsurance specifically safeguards agricultural producers against losses caused by adverse weather events, pests, or diseases, while enterprise microinsurance extends coverage to small business risks like equipment damage, theft, and operational disruptions. Both types of microinsurance enhance economic resilience by providing critical risk protection, enabling access to credit, and promoting sustainable livelihoods within vulnerable communities.

Key Terms

Enterprise microinsurance:

Enterprise microinsurance offers tailored risk protection solutions for small and medium-sized enterprises (SMEs), addressing challenges such as property damage, equipment breakdown, and business interruption risks critical to their sustainability. It leverages data analytics and digital platforms to provide affordable, scalable coverage that supports business continuity and financial resilience in emerging markets. Explore the evolving landscape of enterprise microinsurance and its impact on SME growth and economic development.

Business Interruption

Enterprise microinsurance specifically covers risks related to business interruption, including loss of income and extra expenses arising from unforeseen events, thereby ensuring financial stability for small enterprises. Crop microinsurance primarily protects farmers against losses due to adverse weather conditions, pests, or disease impacting crop yield, but may not cover broader business interruptions like equipment failure or market disruptions. Explore comprehensive strategies to optimize microinsurance coverage for diverse agricultural and enterprise risks.

Property Coverage

Enterprise microinsurance primarily offers property coverage tailored to small businesses, safeguarding assets such as inventory, equipment, and infrastructure against risks like fire, theft, and natural disasters. Crop microinsurance specializes in protecting farmers from losses due to weather-related events, pests, and disease, ensuring financial stability for agricultural production. Explore detailed comparisons and benefits of each microinsurance type to better understand their critical roles in risk management.

Source and External Links

Microinsurance - Wikipedia - Enterprise microinsurance is a form of insurance offering low premiums and low coverage caps, aimed at protecting low-income people from specific risks, often distributed through various channels including microfinance institutions and community-based schemes.

Microinsurance Software: Features, Technologies, Integrations, Costs - Custom microinsurance software supports enterprise microinsurance by managing products, automating application processing, and enabling digital distribution and bundling with related services to cater to the specific needs of low-income customers and agents.

How to Thrive in Microinsurance - Successful enterprise microinsurance focuses on being customer-centric, ensuring quick claims processing to provide timely payouts especially in emergency situations, and designing products with frequent claims to demonstrate value to low-income customers.

dowidth.com

dowidth.com