Credit life insurance pays off a borrower's outstanding debt if they die, ensuring financial obligations like loans or mortgages are covered without burdening survivors. Accidental death insurance provides a lump sum benefit exclusively when death occurs due to an accident, offering additional financial support beyond traditional life insurance. Explore the key differences and benefits of each policy to determine the right coverage for your needs.

Why it is important

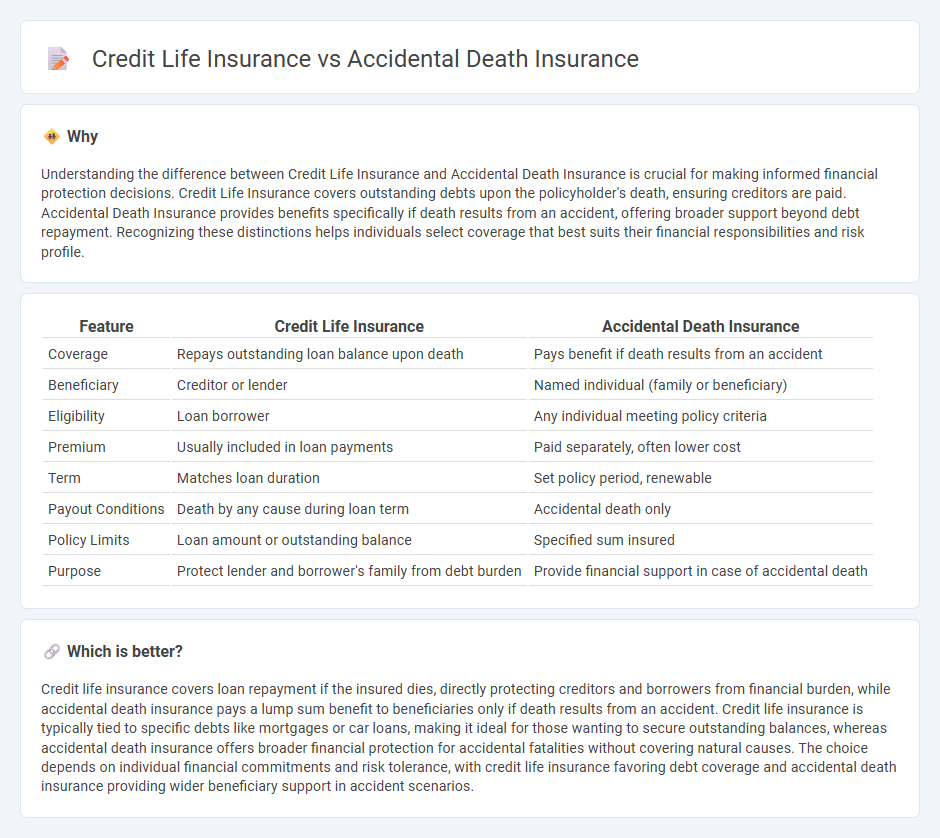

Understanding the difference between Credit Life Insurance and Accidental Death Insurance is crucial for making informed financial protection decisions. Credit Life Insurance covers outstanding debts upon the policyholder's death, ensuring creditors are paid. Accidental Death Insurance provides benefits specifically if death results from an accident, offering broader support beyond debt repayment. Recognizing these distinctions helps individuals select coverage that best suits their financial responsibilities and risk profile.

Comparison Table

| Feature | Credit Life Insurance | Accidental Death Insurance |

|---|---|---|

| Coverage | Repays outstanding loan balance upon death | Pays benefit if death results from an accident |

| Beneficiary | Creditor or lender | Named individual (family or beneficiary) |

| Eligibility | Loan borrower | Any individual meeting policy criteria |

| Premium | Usually included in loan payments | Paid separately, often lower cost |

| Term | Matches loan duration | Set policy period, renewable |

| Payout Conditions | Death by any cause during loan term | Accidental death only |

| Policy Limits | Loan amount or outstanding balance | Specified sum insured |

| Purpose | Protect lender and borrower's family from debt burden | Provide financial support in case of accidental death |

Which is better?

Credit life insurance covers loan repayment if the insured dies, directly protecting creditors and borrowers from financial burden, while accidental death insurance pays a lump sum benefit to beneficiaries only if death results from an accident. Credit life insurance is typically tied to specific debts like mortgages or car loans, making it ideal for those wanting to secure outstanding balances, whereas accidental death insurance offers broader financial protection for accidental fatalities without covering natural causes. The choice depends on individual financial commitments and risk tolerance, with credit life insurance favoring debt coverage and accidental death insurance providing wider beneficiary support in accident scenarios.

Connection

Credit life insurance and accidental death insurance both provide financial protection linked to debt repayment in the event of the insured's death. Credit life insurance covers outstanding loan balances upon the borrower's death, ensuring creditors receive payment, while accidental death insurance pays a lump sum specifically if death results from an accident, which can also be used to cover debts. Together, they reduce financial risk for both borrowers and lenders by securing loan obligations against unforeseen fatal incidents.

Key Terms

Beneficiary

Accidental death insurance provides a beneficiary with a payout specifically for deaths caused by accidents, offering financial support distinct from other life insurance policies. Credit life insurance pays off outstanding loan balances if the insured dies, ensuring creditors rather than personal beneficiaries receive funds. Explore more about how beneficiary rights and claims differ between these insurance types.

Coverage

Accidental death insurance provides financial protection exclusively in the event of death caused by an accident, covering medical expenses, funeral costs, and dependents' support. Credit life insurance specifically covers outstanding loan balances, ensuring creditors are repaid if the borrower dies during the term of the loan, but does not offer broader family support. Explore detailed comparisons to determine which policy aligns with your financial security needs.

Premium

Accidental death insurance premiums are generally lower because they cover only deaths caused by accidents, offering limited risk exposure to insurers. Credit life insurance premiums tend to be higher as they cover the outstanding loan balance in case of the borrower's death, factoring in age, loan amount, and payment term. Explore our detailed comparison to understand which insurance aligns best with your financial priorities.

Source and External Links

A Guide to Accidental Death Insurance Claims - Accidental death insurance provides financial compensation if the insured dies in an accident, paying out for unexpected, unintentional deaths but typically excluding natural death and suicide.

TruStage AD&D Insurance - Accidental Death & Dismemberment (AD&D) insurance pays a cash benefit if the insured dies in a covered accident or suffers a qualifying permanent injury, with coverage available at a monthly rate and no requirement for health questions or medical exams.

Accidental Death and Dismemberment | Atlanta GA - AD&D insurance covers non-job-related accidental death or dismemberment, allows for family coverage options, and does not require evidence of insurability to enroll.

dowidth.com

dowidth.com