Insurance sandbox allows insurers and startups to test innovative products and services in a controlled environment with reduced regulatory constraints, fostering rapid development and customer-centric solutions. Regulatory sandbox focuses on broader financial regulation, enabling fintech firms to experiment with new technologies while ensuring compliance and risk management under regulatory oversight. Explore how these sandboxes transform innovation and compliance in the insurance industry.

Why it is important

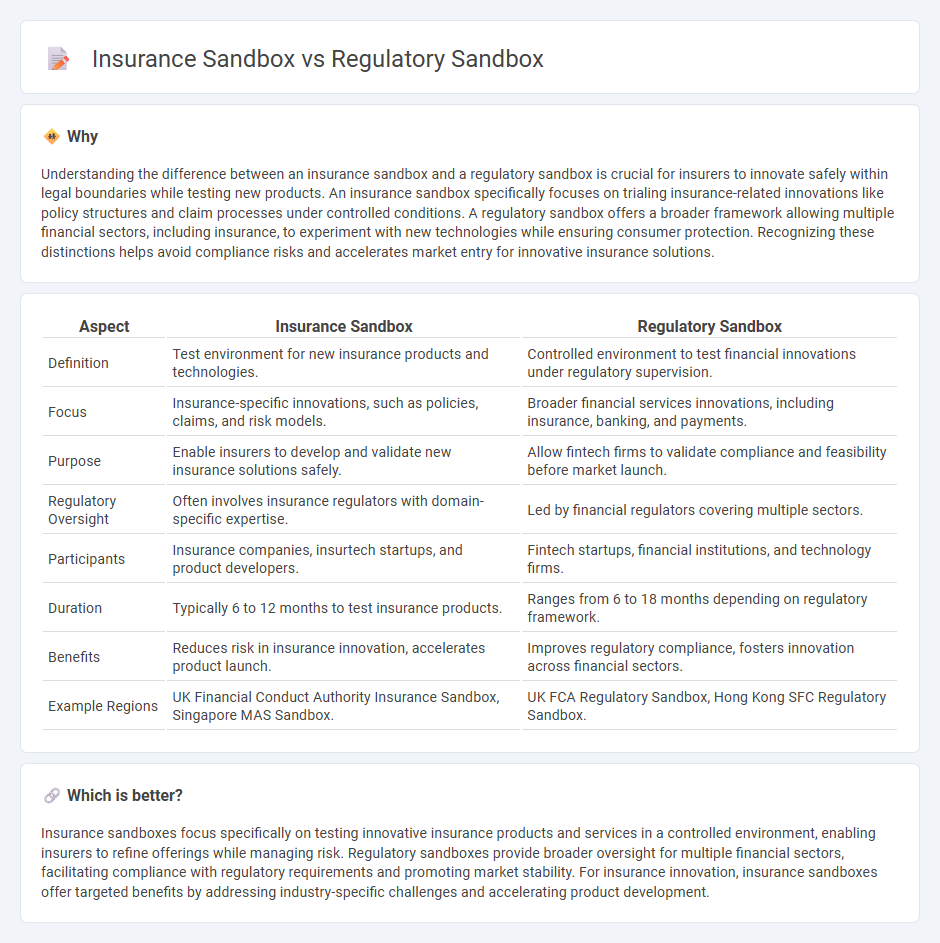

Understanding the difference between an insurance sandbox and a regulatory sandbox is crucial for insurers to innovate safely within legal boundaries while testing new products. An insurance sandbox specifically focuses on trialing insurance-related innovations like policy structures and claim processes under controlled conditions. A regulatory sandbox offers a broader framework allowing multiple financial sectors, including insurance, to experiment with new technologies while ensuring consumer protection. Recognizing these distinctions helps avoid compliance risks and accelerates market entry for innovative insurance solutions.

Comparison Table

| Aspect | Insurance Sandbox | Regulatory Sandbox |

|---|---|---|

| Definition | Test environment for new insurance products and technologies. | Controlled environment to test financial innovations under regulatory supervision. |

| Focus | Insurance-specific innovations, such as policies, claims, and risk models. | Broader financial services innovations, including insurance, banking, and payments. |

| Purpose | Enable insurers to develop and validate new insurance solutions safely. | Allow fintech firms to validate compliance and feasibility before market launch. |

| Regulatory Oversight | Often involves insurance regulators with domain-specific expertise. | Led by financial regulators covering multiple sectors. |

| Participants | Insurance companies, insurtech startups, and product developers. | Fintech startups, financial institutions, and technology firms. |

| Duration | Typically 6 to 12 months to test insurance products. | Ranges from 6 to 18 months depending on regulatory framework. |

| Benefits | Reduces risk in insurance innovation, accelerates product launch. | Improves regulatory compliance, fosters innovation across financial sectors. |

| Example Regions | UK Financial Conduct Authority Insurance Sandbox, Singapore MAS Sandbox. | UK FCA Regulatory Sandbox, Hong Kong SFC Regulatory Sandbox. |

Which is better?

Insurance sandboxes focus specifically on testing innovative insurance products and services in a controlled environment, enabling insurers to refine offerings while managing risk. Regulatory sandboxes provide broader oversight for multiple financial sectors, facilitating compliance with regulatory requirements and promoting market stability. For insurance innovation, insurance sandboxes offer targeted benefits by addressing industry-specific challenges and accelerating product development.

Connection

Insurance sandboxes and regulatory sandboxes are interconnected platforms designed to foster innovation within the insurance industry by allowing companies to test new products, technologies, and business models in a controlled regulatory environment. Both sandboxes facilitate collaboration between insurers, regulators, and technology providers to ensure compliance with legal standards while accelerating digital transformation and customer-centric solutions. This regulatory flexibility helps mitigate risks and promotes the development of cutting-edge insurance offerings that respond to evolving market demands.

Key Terms

Regulatory Sandbox:

Regulatory sandboxes provide a controlled environment where fintech startups can test innovative financial products under regulatory supervision, minimizing risks while ensuring compliance with legal frameworks. These sandboxes facilitate collaboration between regulators and businesses, promoting agile regulatory adjustments and enabling faster market entry for novel financial technologies. Explore further to understand how regulatory sandboxes accelerate innovation and shape future financial ecosystems.

Innovation Testing

Regulatory sandboxes provide a controlled environment for fintech and financial services companies to test new products and services under regulatory supervision, enabling innovation while managing risk. Insurance sandboxes specifically target the insurance sector, allowing startups and established insurers to experiment with innovative policies, claims processing, and risk assessment technologies. Explore the differences and benefits of each sandbox model to understand how they drive innovation testing in financial and insurance markets.

Regulatory Oversight

Regulatory sandboxes create controlled environments for fintech startups to test innovative financial products under close supervision from financial authorities, ensuring compliance with existing regulations while identifying potential risks early. Insurance sandboxes specifically tailor this approach to the insurance sector, allowing insurers and insurtech companies to experiment with new insurance models, products, and distribution channels under regulatory oversight focused on consumer protection and solvency standards. Explore more about how these sandboxes enhance regulatory oversight and foster innovation in finance and insurance.

Source and External Links

Artificial intelligence act and regulatory sandboxes - A regulatory sandbox is a supervised environment allowing businesses to develop and test innovative products or services temporarily, helping both business innovation and regulatory learning under controlled risk conditions, especially for emerging technologies like AI and blockchain.

Regulatory sandbox: 5 key things to know - Regulatory sandboxes provide firms a safe space to trial innovations under regulatory supervision, often with relaxed rules to foster innovation while keeping consumer protection intact, prominently used in finance and fintech sectors worldwide.

Article 57: AI Regulatory Sandboxes - AI regulatory sandboxes offer a controlled setting for developing, testing, and validating AI systems before market release, including oversight to identify risks and compliance guidance, with the potential to accelerate conformity assessments based on sandbox outcomes.

dowidth.com

dowidth.com