Cyber insurance protects businesses against data breaches, cyberattacks, and online liabilities, covering financial losses and recovery costs. Directors and Officers (D&O) insurance safeguards company leaders from lawsuits related to their decisions and management actions. Discover the key differences and benefits of each policy to ensure comprehensive organizational protection.

Why it is important

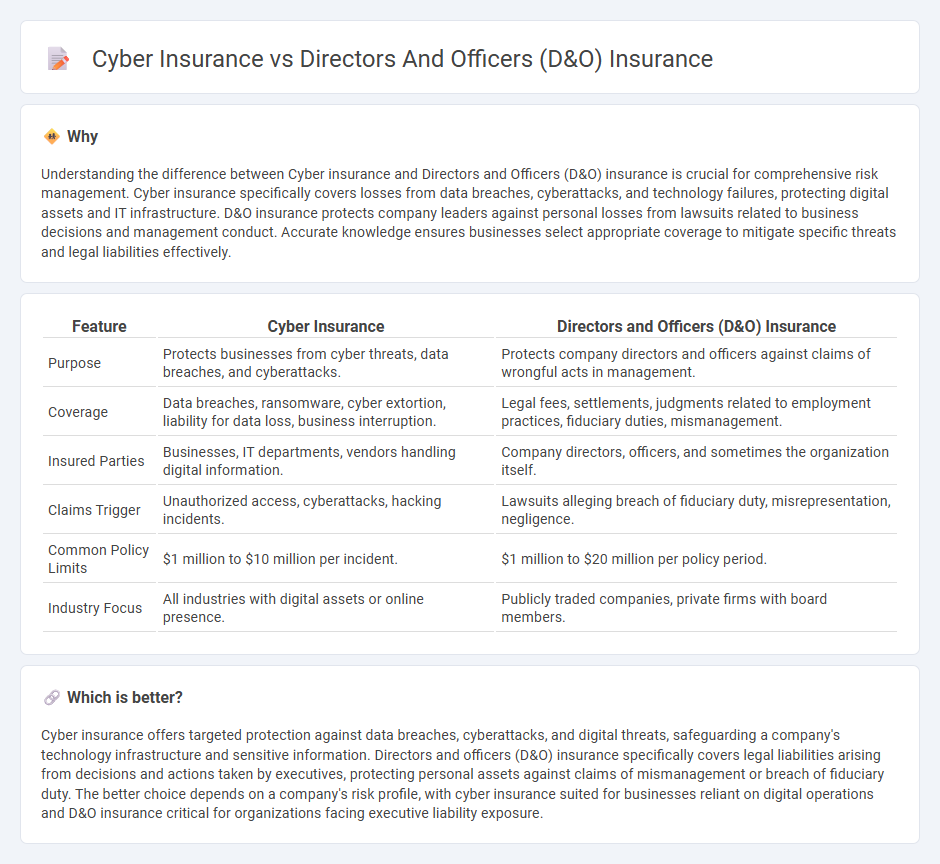

Understanding the difference between Cyber insurance and Directors and Officers (D&O) insurance is crucial for comprehensive risk management. Cyber insurance specifically covers losses from data breaches, cyberattacks, and technology failures, protecting digital assets and IT infrastructure. D&O insurance protects company leaders against personal losses from lawsuits related to business decisions and management conduct. Accurate knowledge ensures businesses select appropriate coverage to mitigate specific threats and legal liabilities effectively.

Comparison Table

| Feature | Cyber Insurance | Directors and Officers (D&O) Insurance |

|---|---|---|

| Purpose | Protects businesses from cyber threats, data breaches, and cyberattacks. | Protects company directors and officers against claims of wrongful acts in management. |

| Coverage | Data breaches, ransomware, cyber extortion, liability for data loss, business interruption. | Legal fees, settlements, judgments related to employment practices, fiduciary duties, mismanagement. |

| Insured Parties | Businesses, IT departments, vendors handling digital information. | Company directors, officers, and sometimes the organization itself. |

| Claims Trigger | Unauthorized access, cyberattacks, hacking incidents. | Lawsuits alleging breach of fiduciary duty, misrepresentation, negligence. |

| Common Policy Limits | $1 million to $10 million per incident. | $1 million to $20 million per policy period. |

| Industry Focus | All industries with digital assets or online presence. | Publicly traded companies, private firms with board members. |

Which is better?

Cyber insurance offers targeted protection against data breaches, cyberattacks, and digital threats, safeguarding a company's technology infrastructure and sensitive information. Directors and officers (D&O) insurance specifically covers legal liabilities arising from decisions and actions taken by executives, protecting personal assets against claims of mismanagement or breach of fiduciary duty. The better choice depends on a company's risk profile, with cyber insurance suited for businesses reliant on digital operations and D&O insurance critical for organizations facing executive liability exposure.

Connection

Cyber insurance and Directors and Officers (D&O) insurance are interconnected as both cover risks arising from digital threats and governance failures that impact corporate liability. Cyber insurance addresses data breaches, ransomware, and cyberattacks, while D&O insurance protects executives from claims related to mismanagement or failure to disclose cyber risks. Together, they provide a comprehensive risk management strategy for organizations facing evolving cyber threats and regulatory scrutiny.

Key Terms

Liability Coverage

Directors and officers (D&O) insurance primarily covers legal liabilities arising from decisions and actions made by company executives, protecting against claims such as breach of fiduciary duty, mismanagement, or securities violations. Cyber insurance focuses on liabilities related to data breaches, cyberattacks, and privacy violations, covering costs like legal fees, notification expenses, and regulatory fines. Explore detailed comparisons to understand which liability coverage best suits your organization's risk profile.

Claims-Made Policy

Directors and officers (D&O) insurance typically operates on a claims-made policy, covering legal defense costs and settlements for alleged wrongful acts during the policy period. Cyber insurance, also often claims-made, protects against data breaches, cyber-attacks, and related liabilities, emphasizing timely claim notification. Explore more to understand how claims-made policies affect coverage limits and retroactive dates in both insurance types.

Exclusions

Directors and officers (D&O) insurance primarily excludes cyber-related incidents such as data breaches, cyber fraud, and privacy violations, which are covered by specialized cyber insurance policies. Cyber insurance, conversely, excludes claims tied to management decisions, fiduciary duties, and non-cyber regulatory investigations that D&O insurance addresses. Explore the distinct exclusions and coverage nuances to ensure comprehensive risk protection by understanding both policies in depth.

Source and External Links

What is D&O insurance? Learn more here - Directors and Officers insurance protects company executives and board members from legal claims arising from their decisions and actions.

Directors and Officers Liability Insurance - This insurance covers directors and officers for claims made against them while serving on a board or as officers, including defense fees and costs.

Directors and Officers (D&O) Liability Insurance - Designed to protect directors and officers from personal losses resulting from lawsuits related to their roles in the company.

dowidth.com

dowidth.com