Insurance as a service delivers tailored policies through personalized consultations and traditional agent support, emphasizing human interaction and customized risk management. Digital insurance leverages AI, big data, and mobile platforms to streamline policy acquisition, claims processing, and customer engagement, enhancing speed and accessibility. Explore the advantages of both to determine the best insurance solution for your needs.

Why it is important

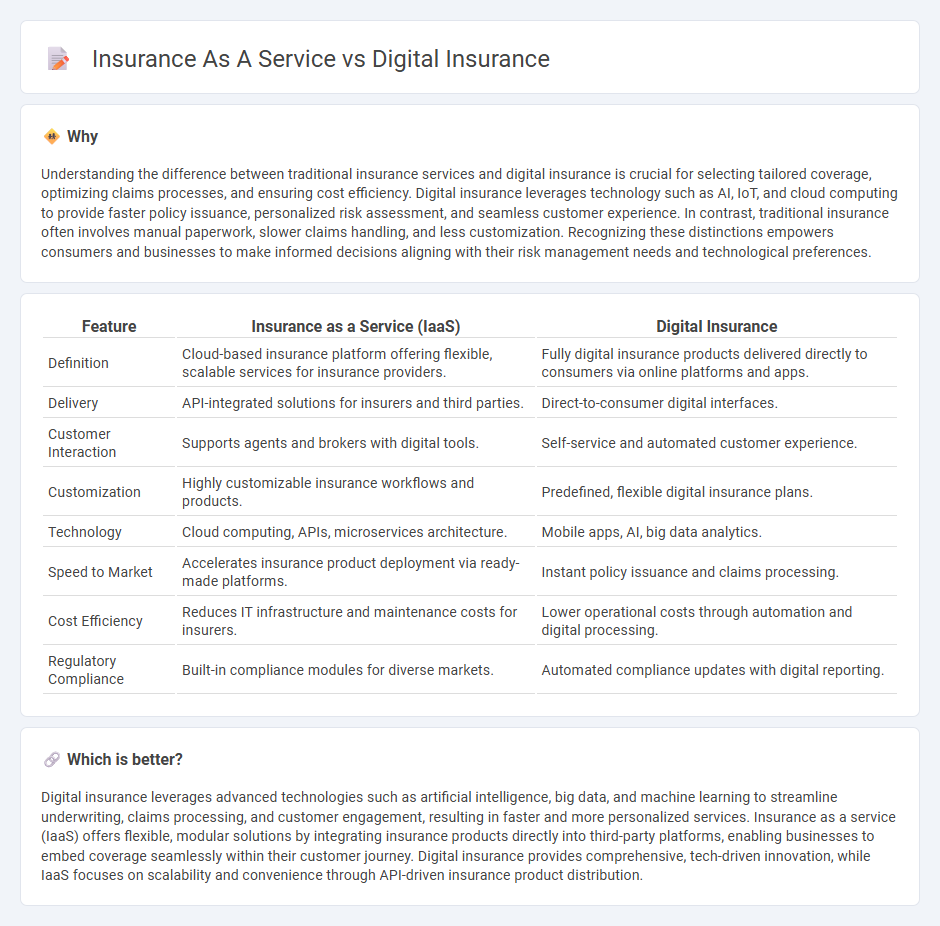

Understanding the difference between traditional insurance services and digital insurance is crucial for selecting tailored coverage, optimizing claims processes, and ensuring cost efficiency. Digital insurance leverages technology such as AI, IoT, and cloud computing to provide faster policy issuance, personalized risk assessment, and seamless customer experience. In contrast, traditional insurance often involves manual paperwork, slower claims handling, and less customization. Recognizing these distinctions empowers consumers and businesses to make informed decisions aligning with their risk management needs and technological preferences.

Comparison Table

| Feature | Insurance as a Service (IaaS) | Digital Insurance |

|---|---|---|

| Definition | Cloud-based insurance platform offering flexible, scalable services for insurance providers. | Fully digital insurance products delivered directly to consumers via online platforms and apps. |

| Delivery | API-integrated solutions for insurers and third parties. | Direct-to-consumer digital interfaces. |

| Customer Interaction | Supports agents and brokers with digital tools. | Self-service and automated customer experience. |

| Customization | Highly customizable insurance workflows and products. | Predefined, flexible digital insurance plans. |

| Technology | Cloud computing, APIs, microservices architecture. | Mobile apps, AI, big data analytics. |

| Speed to Market | Accelerates insurance product deployment via ready-made platforms. | Instant policy issuance and claims processing. |

| Cost Efficiency | Reduces IT infrastructure and maintenance costs for insurers. | Lower operational costs through automation and digital processing. |

| Regulatory Compliance | Built-in compliance modules for diverse markets. | Automated compliance updates with digital reporting. |

Which is better?

Digital insurance leverages advanced technologies such as artificial intelligence, big data, and machine learning to streamline underwriting, claims processing, and customer engagement, resulting in faster and more personalized services. Insurance as a service (IaaS) offers flexible, modular solutions by integrating insurance products directly into third-party platforms, enabling businesses to embed coverage seamlessly within their customer journey. Digital insurance provides comprehensive, tech-driven innovation, while IaaS focuses on scalability and convenience through API-driven insurance product distribution.

Connection

Insurance as a service leverages cloud-based platforms to offer scalable, on-demand insurance solutions, enhancing customer accessibility and operational efficiency. Digital insurance integrates advanced technologies like AI, big data analytics, and IoT to automate underwriting, claims processing, and risk assessment in real time. Together, these innovations revolutionize traditional insurance models by enabling personalized policies, faster service delivery, and improved risk management.

Key Terms

Platform Integration

Digital insurance leverages advanced technology to streamline policy management, claims processing, and customer engagement through integrated platforms that enhance operational efficiency. Insurance as a Service (IaaS) extends this model by offering scalable, cloud-based solutions that enable seamless integration with third-party applications, fostering agility and personalized insurance products. Explore how platform integration transforms insurance delivery and drives innovation in risk management.

API Ecosystem

Digital insurance leverages advanced APIs to streamline policy management, claims processing, and customer engagement within an integrated ecosystem, enhancing operational efficiency and customer experience. Insurance as a Service (IaaS) focuses on offering scalable, modular insurance products through API ecosystems that enable seamless third-party integrations and real-time data exchange. Explore how these API-driven frameworks transform insurance delivery and create new business opportunities.

On-Demand Coverage

Digital insurance leverages technology to provide instant policy management and claims processing, enhancing customer experience with real-time access. Insurance as a Service integrates modular, scalable coverage options that offer on-demand flexibility tailored to specific user needs and situations. Explore how these innovations redefine protection models and empower consumers with personalized coverage options.

Source and External Links

What is Digital Insurance? - Digital insurance is an insurance model driven by technology-first operations that improve speed, accessibility, and customer experience through features like omni-channel presence, automated claims handling, and digital platforms for pricing and risk evaluation.

Digital insurance in 2018 - Digital insurance integrates AI, automation, and analytics into claims and customer service, enabling end-to-end digitization of processes like first notification of loss and automated settlement for faster, more efficient claims resolution.

A Guide to Digital Insurance - Digital insurance encompasses all insurers using technology-first business models with customer-facing digital platforms that deliver instant, personalized service on any device, accelerate product and service delivery, and leverage AI for fraud detection.

dowidth.com

dowidth.com