Insurtech sandboxes enable insurance companies to test innovative products and technologies in a controlled environment, accelerating regulatory approval and market entry. AI-driven risk assessment leverages machine learning algorithms to analyze vast datasets for more accurate underwriting and claims management, reducing costs and enhancing customer experience. Explore how these advancements are transforming the insurance landscape.

Why it is important

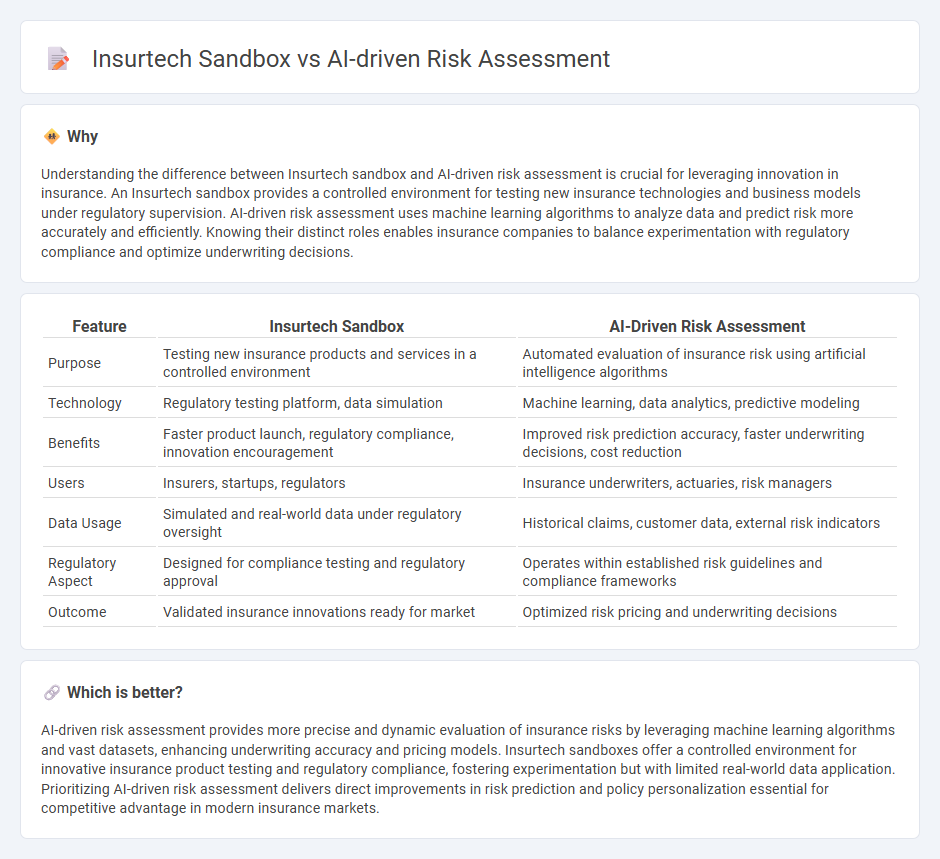

Understanding the difference between Insurtech sandbox and AI-driven risk assessment is crucial for leveraging innovation in insurance. An Insurtech sandbox provides a controlled environment for testing new insurance technologies and business models under regulatory supervision. AI-driven risk assessment uses machine learning algorithms to analyze data and predict risk more accurately and efficiently. Knowing their distinct roles enables insurance companies to balance experimentation with regulatory compliance and optimize underwriting decisions.

Comparison Table

| Feature | Insurtech Sandbox | AI-Driven Risk Assessment |

|---|---|---|

| Purpose | Testing new insurance products and services in a controlled environment | Automated evaluation of insurance risk using artificial intelligence algorithms |

| Technology | Regulatory testing platform, data simulation | Machine learning, data analytics, predictive modeling |

| Benefits | Faster product launch, regulatory compliance, innovation encouragement | Improved risk prediction accuracy, faster underwriting decisions, cost reduction |

| Users | Insurers, startups, regulators | Insurance underwriters, actuaries, risk managers |

| Data Usage | Simulated and real-world data under regulatory oversight | Historical claims, customer data, external risk indicators |

| Regulatory Aspect | Designed for compliance testing and regulatory approval | Operates within established risk guidelines and compliance frameworks |

| Outcome | Validated insurance innovations ready for market | Optimized risk pricing and underwriting decisions |

Which is better?

AI-driven risk assessment provides more precise and dynamic evaluation of insurance risks by leveraging machine learning algorithms and vast datasets, enhancing underwriting accuracy and pricing models. Insurtech sandboxes offer a controlled environment for innovative insurance product testing and regulatory compliance, fostering experimentation but with limited real-world data application. Prioritizing AI-driven risk assessment delivers direct improvements in risk prediction and policy personalization essential for competitive advantage in modern insurance markets.

Connection

Insurtech sandboxes provide a controlled environment for testing AI-driven risk assessment models, enabling insurers to evaluate innovative algorithms without regulatory constraints. These sandboxes facilitate the integration of machine learning techniques to analyze vast datasets, improving accuracy in predicting risk and pricing policies. By leveraging this synergy, insurance companies enhance underwriting efficiency and develop personalized coverage options.

Key Terms

**AI-driven risk assessment:**

AI-driven risk assessment leverages machine learning algorithms and big data analytics to enhance the accuracy of insurance risk predictions, reducing underwriting errors and improving policy pricing. Insurers employing AI models analyze vast datasets including customer behavior, claims history, and external risk factors to automate decision-making processes. Explore how AI-driven risk assessment is transforming risk management practices and shaping the future of insurance.

Predictive analytics

AI-driven risk assessment leverages advanced predictive analytics to analyze vast datasets, enabling insurers to accurately forecast potential claims and optimize underwriting processes. Insurtech sandboxes provide a controlled environment for testing these predictive models, facilitating innovation and regulatory compliance without disrupting existing operations. Explore how integrating AI-powered predictive analytics within insurtech sandboxes transforms risk management strategies in insurance.

Machine learning

AI-driven risk assessment leverages machine learning algorithms to analyze vast datasets, improving accuracy in predicting insurance claims and optimizing pricing models. Insurtech sandboxes provide a controlled environment for testing these innovative AI solutions, ensuring regulatory compliance and operational robustness before market deployment. Explore how integrating machine learning within insurtech sandboxes transforms risk evaluation and accelerates insurance innovation.

Source and External Links

AI-Driven Risk Assessment in GRC - AI-driven risk assessment enhances governance, risk, and compliance by automating data analysis, identifying potential risks, and recommending strategies using machine learning algorithms.

Can AI Be Used for Risk Assessments - AI technologies are used in risk assessments to detect threats, analyze data quickly, and verify control effectiveness with automated measurements.

AI-Powered Risk Management - AI streamlines risk assessment by automating data collection and analysis, promoting coordination across risk functions and standardizing risk terminology.

dowidth.com

dowidth.com