Artificial intelligence underwriting leverages advanced machine learning algorithms to analyze vast datasets, enabling dynamic risk assessment and real-time decision-making. Predictive analytics underwriting relies on historical data and statistical models to forecast risk by identifying patterns and trends in insured populations. Explore how these cutting-edge technologies are transforming insurance underwriting to enhance accuracy and efficiency.

Why it is important

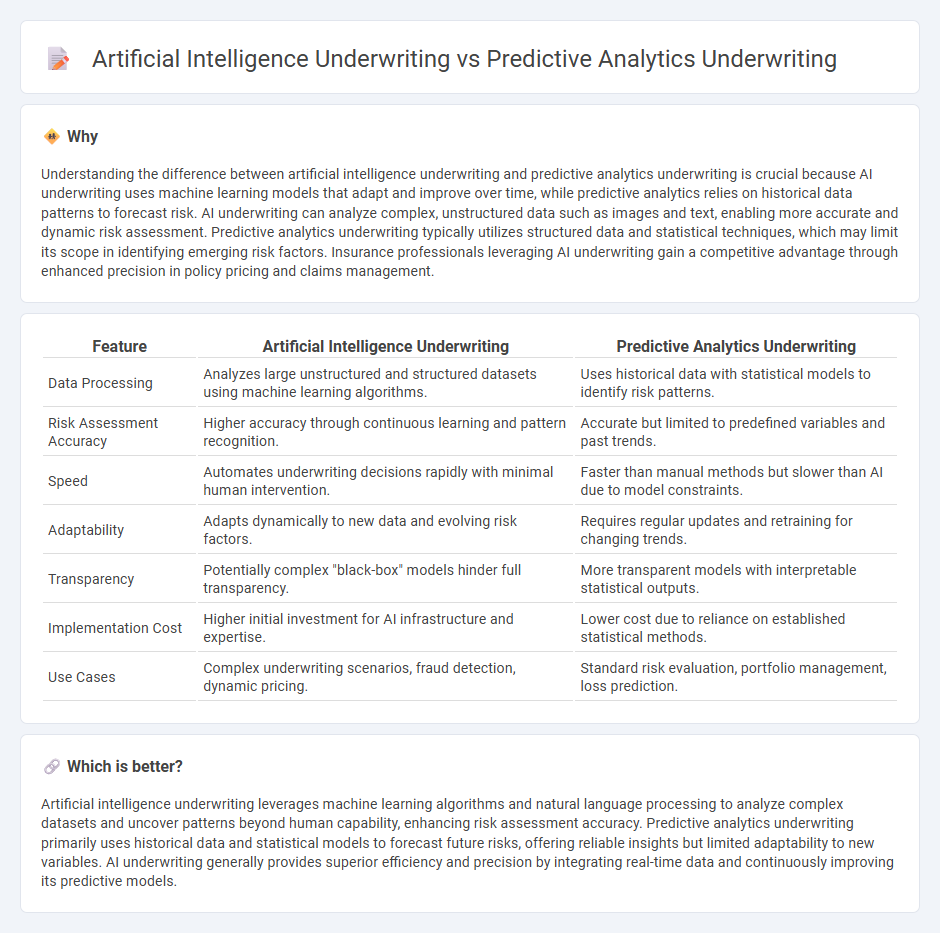

Understanding the difference between artificial intelligence underwriting and predictive analytics underwriting is crucial because AI underwriting uses machine learning models that adapt and improve over time, while predictive analytics relies on historical data patterns to forecast risk. AI underwriting can analyze complex, unstructured data such as images and text, enabling more accurate and dynamic risk assessment. Predictive analytics underwriting typically utilizes structured data and statistical techniques, which may limit its scope in identifying emerging risk factors. Insurance professionals leveraging AI underwriting gain a competitive advantage through enhanced precision in policy pricing and claims management.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Predictive Analytics Underwriting |

|---|---|---|

| Data Processing | Analyzes large unstructured and structured datasets using machine learning algorithms. | Uses historical data with statistical models to identify risk patterns. |

| Risk Assessment Accuracy | Higher accuracy through continuous learning and pattern recognition. | Accurate but limited to predefined variables and past trends. |

| Speed | Automates underwriting decisions rapidly with minimal human intervention. | Faster than manual methods but slower than AI due to model constraints. |

| Adaptability | Adapts dynamically to new data and evolving risk factors. | Requires regular updates and retraining for changing trends. |

| Transparency | Potentially complex "black-box" models hinder full transparency. | More transparent models with interpretable statistical outputs. |

| Implementation Cost | Higher initial investment for AI infrastructure and expertise. | Lower cost due to reliance on established statistical methods. |

| Use Cases | Complex underwriting scenarios, fraud detection, dynamic pricing. | Standard risk evaluation, portfolio management, loss prediction. |

Which is better?

Artificial intelligence underwriting leverages machine learning algorithms and natural language processing to analyze complex datasets and uncover patterns beyond human capability, enhancing risk assessment accuracy. Predictive analytics underwriting primarily uses historical data and statistical models to forecast future risks, offering reliable insights but limited adaptability to new variables. AI underwriting generally provides superior efficiency and precision by integrating real-time data and continuously improving its predictive models.

Connection

Artificial intelligence underwriting integrates machine learning algorithms to analyze vast datasets, enhancing risk assessment accuracy and speeding the decision-making process. Predictive analytics underwriting utilizes historical data and statistical models to forecast potential claims and policyholder behavior, improving underwriting precision. Both approaches leverage advanced data processing techniques to optimize risk evaluation and streamline insurance underwriting workflows.

Key Terms

Risk Assessment

Predictive analytics underwriting leverages historical data and statistical models to estimate risk probabilities, enabling insurers to price policies more accurately and reduce losses. Artificial intelligence underwriting employs machine learning algorithms and real-time data processing, enhancing risk assessment by identifying complex patterns beyond traditional methods. Explore the evolving impact of these technologies on risk evaluation to optimize underwriting strategies.

Data Modeling

Predictive analytics underwriting primarily relies on statistical models and historical data patterns to assess risk and forecast outcomes, emphasizing structured data inputs and regression techniques. Artificial intelligence underwriting utilizes machine learning algorithms and neural networks to analyze vast and diverse data sources, including unstructured data, enabling more adaptive and dynamic risk evaluation. Explore deeper insights into how these data modeling approaches transform underwriting efficiency and accuracy.

Automation

Predictive analytics underwriting leverages historical data and statistical models to assess risk and forecast outcomes, streamlining decision-making processes. Artificial intelligence underwriting incorporates machine learning algorithms and natural language processing, enabling more dynamic automation by continuously learning from new data inputs. Explore the advancements in underwriting automation to understand how these technologies transform risk assessment efficiency.

Source and External Links

Predictive Analytics in Insurance Underwriting - Predictive analytics uses AI and real-time data to make insurance underwriting faster, more accurate, and data-driven, moving beyond traditional manual methods to uncover hidden risk patterns.

Predictive Analytics Solutions -- Pricing and Underwriting - Milliman's solutions provide granular risk views and text mining to support actuaries and underwriters, enabling efficient, informed decisions by analyzing both structured and unstructured data.

Predictive analytics in insurance: Benefits and use cases - Predictive analytics automates risk assessment in underwriting, leveraging dozens to hundreds of metrics to deliver precise risk scores, optimize premiums, and even support new insurance products.

dowidth.com

dowidth.com