Crop microinsurance offers tailored financial protection to farmers against losses caused by adverse weather, pests, or crop failure, ensuring stability in agricultural income. Property microinsurance provides low-cost coverage for individuals or small businesses to safeguard homes, shops, and assets from risks like fire, theft, or natural disasters. Explore more to understand how these microinsurance types support economic resilience in vulnerable communities.

Why it is important

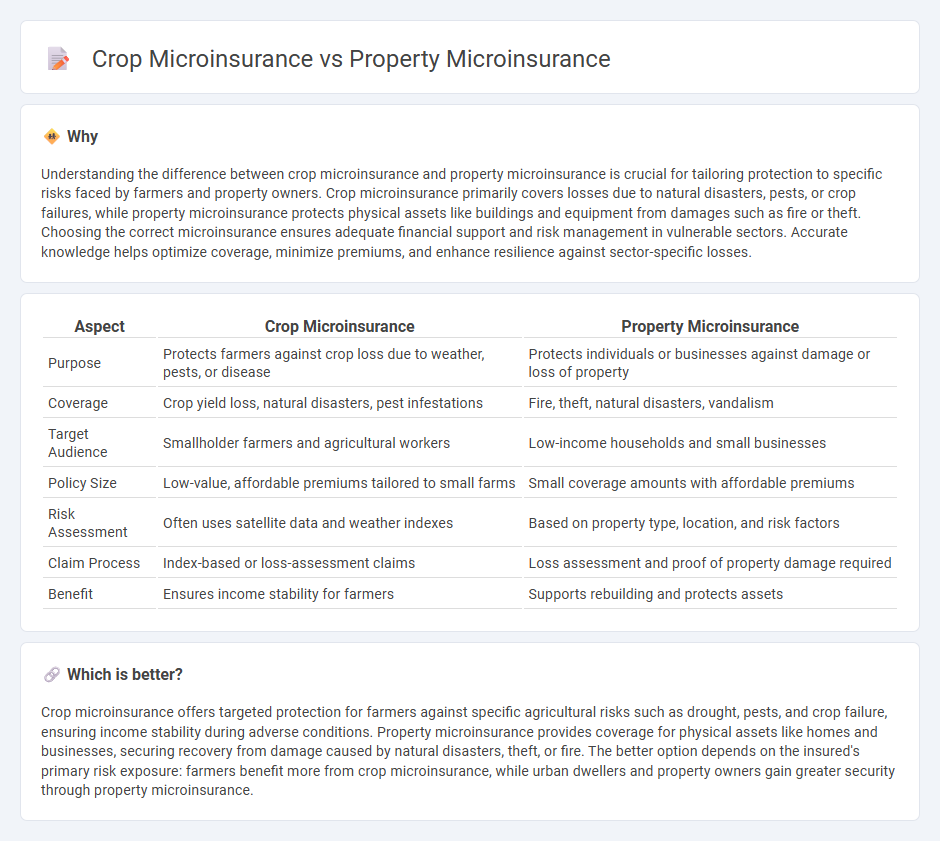

Understanding the difference between crop microinsurance and property microinsurance is crucial for tailoring protection to specific risks faced by farmers and property owners. Crop microinsurance primarily covers losses due to natural disasters, pests, or crop failures, while property microinsurance protects physical assets like buildings and equipment from damages such as fire or theft. Choosing the correct microinsurance ensures adequate financial support and risk management in vulnerable sectors. Accurate knowledge helps optimize coverage, minimize premiums, and enhance resilience against sector-specific losses.

Comparison Table

| Aspect | Crop Microinsurance | Property Microinsurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to weather, pests, or disease | Protects individuals or businesses against damage or loss of property |

| Coverage | Crop yield loss, natural disasters, pest infestations | Fire, theft, natural disasters, vandalism |

| Target Audience | Smallholder farmers and agricultural workers | Low-income households and small businesses |

| Policy Size | Low-value, affordable premiums tailored to small farms | Small coverage amounts with affordable premiums |

| Risk Assessment | Often uses satellite data and weather indexes | Based on property type, location, and risk factors |

| Claim Process | Index-based or loss-assessment claims | Loss assessment and proof of property damage required |

| Benefit | Ensures income stability for farmers | Supports rebuilding and protects assets |

Which is better?

Crop microinsurance offers targeted protection for farmers against specific agricultural risks such as drought, pests, and crop failure, ensuring income stability during adverse conditions. Property microinsurance provides coverage for physical assets like homes and businesses, securing recovery from damage caused by natural disasters, theft, or fire. The better option depends on the insured's primary risk exposure: farmers benefit more from crop microinsurance, while urban dwellers and property owners gain greater security through property microinsurance.

Connection

Crop microinsurance and property microinsurance are interconnected as both provide financial protection to vulnerable populations against specific risks--crop microinsurance covers agricultural losses due to natural disasters, while property microinsurance safeguards homes and belongings from damages or theft. These insurance types collectively enhance economic resilience by reducing the financial impact of unforeseen events on rural households and low-income families. By mitigating risks in both agriculture and housing, they enable beneficiaries to stabilize livelihoods and access credit more easily.

Key Terms

Coverage scope

Property microinsurance typically covers damages and losses related to physical assets such as homes, small businesses, and personal belongings caused by natural disasters, theft, or fire. Crop microinsurance, on the other hand, focuses on protecting farmers' agricultural investments by mitigating losses due to weather events, pests, and diseases that impact crop yield and quality. Explore detailed comparisons and benefits to understand which microinsurance suits your protection needs better.

Risk assessment

Property microinsurance involves evaluating risks such as fire, theft, and natural disasters to determine premium rates and coverage limits, relying heavily on historical data and property condition assessments. Crop microinsurance focuses on agricultural risks like weather variability, pest infestations, and crop yield fluctuations, often using satellite imagery and meteorological data for precise risk modeling. Explore more to understand how these risk assessment methods impact insurance affordability and farmer protection.

Payout trigger

Property microinsurance uses payout triggers based on physical damage assessments, such as loss from fire or flood, while crop microinsurance relies on weather indices like rainfall levels or temperature deviations to determine compensation. Both types aim to mitigate financial risks for low-income households, but crop microinsurance often employs parametric triggers for faster and objective payouts, reducing claim processing time. Explore more about how payout triggers vary across microinsurance products to optimize agricultural and property risk management.

Source and External Links

MILK Brief #18: Doing the Math - Property Microinsurance in Coastal Colombia - A study explores the value proposition of modular, voluntary property microinsurance policies for low-income borrowers in Colombia, highlighting their limitations in fully covering flood damages and lost income despite product flexibility.

What is Microinsurance? - Property Insurance Coverage Law Blog - Property microinsurance provides low-premium, fixed-indemnity coverage against natural disasters for individuals, with standardized triggers and regulatory oversight to ensure accessibility and affordability.

Feasibility Study for Property Microinsurance - Habitat for Humanity - Property microinsurance remains an underdeveloped segment globally, with significant demand demonstrated in Kenya, yet market growth is hindered by insurers' reluctance to cover informal housing and the lack of lender support for uninsured properties.

dowidth.com

dowidth.com