Telematics insurance leverages real-time driving data collected via GPS and sensors to tailor premiums based on individual driving behavior, promoting safer driving habits and cost savings. On-demand insurance offers flexible coverage activated only when needed, allowing users to insure specific vehicles or activities for short periods, enhancing convenience and affordability. Explore the differences and benefits of telematics insurance versus on-demand insurance to find the best fit for your coverage needs.

Why it is important

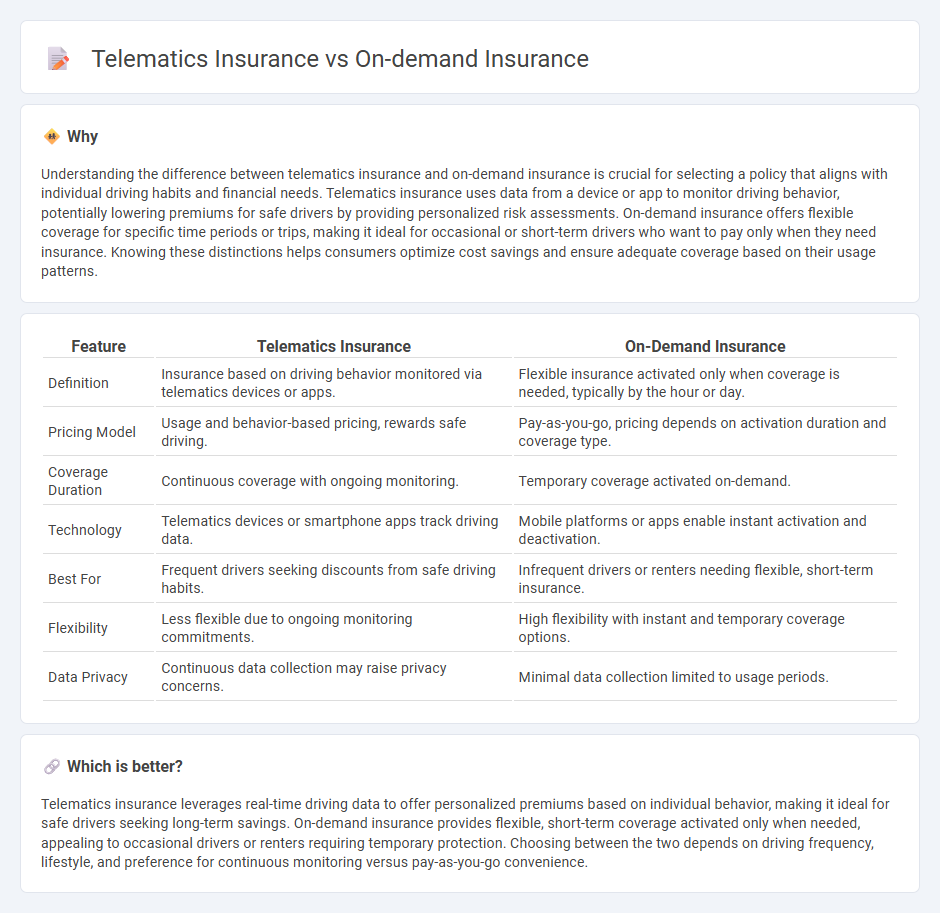

Understanding the difference between telematics insurance and on-demand insurance is crucial for selecting a policy that aligns with individual driving habits and financial needs. Telematics insurance uses data from a device or app to monitor driving behavior, potentially lowering premiums for safe drivers by providing personalized risk assessments. On-demand insurance offers flexible coverage for specific time periods or trips, making it ideal for occasional or short-term drivers who want to pay only when they need insurance. Knowing these distinctions helps consumers optimize cost savings and ensure adequate coverage based on their usage patterns.

Comparison Table

| Feature | Telematics Insurance | On-Demand Insurance |

|---|---|---|

| Definition | Insurance based on driving behavior monitored via telematics devices or apps. | Flexible insurance activated only when coverage is needed, typically by the hour or day. |

| Pricing Model | Usage and behavior-based pricing, rewards safe driving. | Pay-as-you-go, pricing depends on activation duration and coverage type. |

| Coverage Duration | Continuous coverage with ongoing monitoring. | Temporary coverage activated on-demand. |

| Technology | Telematics devices or smartphone apps track driving data. | Mobile platforms or apps enable instant activation and deactivation. |

| Best For | Frequent drivers seeking discounts from safe driving habits. | Infrequent drivers or renters needing flexible, short-term insurance. |

| Flexibility | Less flexible due to ongoing monitoring commitments. | High flexibility with instant and temporary coverage options. |

| Data Privacy | Continuous data collection may raise privacy concerns. | Minimal data collection limited to usage periods. |

Which is better?

Telematics insurance leverages real-time driving data to offer personalized premiums based on individual behavior, making it ideal for safe drivers seeking long-term savings. On-demand insurance provides flexible, short-term coverage activated only when needed, appealing to occasional drivers or renters requiring temporary protection. Choosing between the two depends on driving frequency, lifestyle, and preference for continuous monitoring versus pay-as-you-go convenience.

Connection

Telematics insurance leverages data from devices tracking driving behavior to customize premiums, while on-demand insurance offers flexible coverage activated only when needed. Both innovations use real-time data technology to create personalized, usage-based insurance solutions, enhancing cost efficiency and customer control. This integration transforms traditional insurance models by aligning costs closely with individual risk profiles and actual usage patterns.

Key Terms

Flexibility

On-demand insurance offers unparalleled flexibility by allowing policyholders to activate coverage only when needed, ideal for occasional drivers or short-term insurance needs. Telematics insurance adjusts premiums based on real-time driving behavior, providing personalized rates but requiring continuous monitoring through a connected device. Discover how these flexible insurance options can tailor coverage to your lifestyle and driving habits.

Usage-based

Usage-based insurance (UBI) leverages telematics technology to track driving behavior and mileage, offering personalized premiums based on actual usage rather than fixed rates. On-demand insurance provides flexible coverage activated only when needed, ideal for occasional drivers or specific trips, though it often lacks detailed behavioral data unlike telematics-based UBI. Explore the nuances, benefits, and cost-saving potential of these innovative insurance models to determine which suits your driving habits best.

Real-time data

On-demand insurance offers flexible coverage activated as needed, leveraging basic real-time data for short periods, while telematics insurance continuously monitors driving behavior through advanced sensors and GPS, providing detailed, real-time insights that enable personalized premiums. Telematics platforms collect data on speed, braking, and mileage, enhancing risk assessment accuracy compared to the more static approach of on-demand insurance. Explore the detailed impact of real-time data in transforming insurance models and customer experiences.

Source and External Links

The ins and outs of on-demand insurance: a growing trend in coverage flexibility - On-demand insurance allows consumers to purchase flexible, personalized coverage as needed through digital platforms like mobile apps, often for specific short-term uses such as travel or rental car insurance, reshaping the traditional insurance model by enabling coverage to be switched on and off with real-time adjustments.

What Is On-Demand Insurance? - On-demand insurance refers to policies that can be instantly purchased online without broker interaction, streamlining the application process and making coverage accessible via smartphones, although currently limited to specific items like electronics and photography equipment.

On-demand Insurance Market Size & Share Report, 2030 - The global on-demand insurance market was valued at $955.3 million in 2022 and is projected to grow rapidly at a CAGR of 21.2%, driven by digital convenience, transparent policies, and adoption of AI and machine learning to offer personalized coverage primarily in regions like North America.

dowidth.com

dowidth.com