Climate risk insurance provides comprehensive coverage against a broad range of climate-related hazards including droughts, hurricanes, and rising temperatures, while flood insurance focuses specifically on damages caused by flooding events. The Global Climate Risk Index highlights the increasing frequency and severity of climate disasters, making climate risk insurance essential for businesses and governments seeking resilient protection. Explore detailed differences between these policies to choose the most suitable risk management solution for your needs.

Why it is important

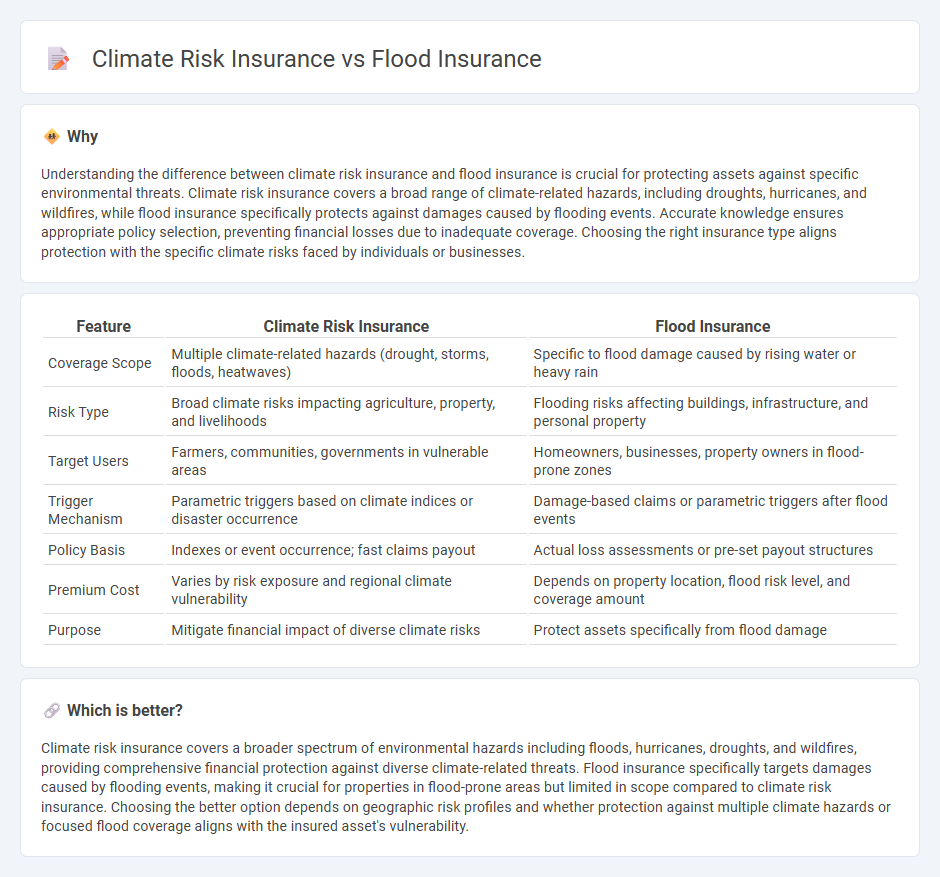

Understanding the difference between climate risk insurance and flood insurance is crucial for protecting assets against specific environmental threats. Climate risk insurance covers a broad range of climate-related hazards, including droughts, hurricanes, and wildfires, while flood insurance specifically protects against damages caused by flooding events. Accurate knowledge ensures appropriate policy selection, preventing financial losses due to inadequate coverage. Choosing the right insurance type aligns protection with the specific climate risks faced by individuals or businesses.

Comparison Table

| Feature | Climate Risk Insurance | Flood Insurance |

|---|---|---|

| Coverage Scope | Multiple climate-related hazards (drought, storms, floods, heatwaves) | Specific to flood damage caused by rising water or heavy rain |

| Risk Type | Broad climate risks impacting agriculture, property, and livelihoods | Flooding risks affecting buildings, infrastructure, and personal property |

| Target Users | Farmers, communities, governments in vulnerable areas | Homeowners, businesses, property owners in flood-prone zones |

| Trigger Mechanism | Parametric triggers based on climate indices or disaster occurrence | Damage-based claims or parametric triggers after flood events |

| Policy Basis | Indexes or event occurrence; fast claims payout | Actual loss assessments or pre-set payout structures |

| Premium Cost | Varies by risk exposure and regional climate vulnerability | Depends on property location, flood risk level, and coverage amount |

| Purpose | Mitigate financial impact of diverse climate risks | Protect assets specifically from flood damage |

Which is better?

Climate risk insurance covers a broader spectrum of environmental hazards including floods, hurricanes, droughts, and wildfires, providing comprehensive financial protection against diverse climate-related threats. Flood insurance specifically targets damages caused by flooding events, making it crucial for properties in flood-prone areas but limited in scope compared to climate risk insurance. Choosing the better option depends on geographic risk profiles and whether protection against multiple climate hazards or focused flood coverage aligns with the insured asset's vulnerability.

Connection

Climate risk insurance and flood insurance are interconnected as both address financial protection against extreme weather events caused by climate change, with flood insurance specifically covering damages from water-related disasters. Rising global temperatures increase the frequency and intensity of floods, making flood insurance a critical component of climate risk insurance portfolios. Incorporating flood risk assessments into climate insurance models enhances resilience and mitigates economic losses for vulnerable communities.

Key Terms

**Flood Insurance:**

Flood insurance specifically covers property damage caused by flooding, often excluded from standard homeowners policies, providing financial protection against rising waters due to heavy rainfall, river overflow, or storm surges. Key entities involved include the National Flood Insurance Program (NFIP) in the United States, which offers federally backed policies, and private insurers expanding coverage options amid increasing flood risk. Discover how flood insurance safeguards assets and supports recovery in flood-prone regions.

Floodplain

Flood insurance specifically covers damages caused by rising water levels within designated floodplains, addressing risks from river overflows and storm surges. Climate risk insurance encompasses a broader spectrum of climate-related events, including severe weather patterns affecting floodplains beyond traditional flood scenarios. Explore detailed differences and coverage options to better protect properties in vulnerable floodplain areas.

National Flood Insurance Program (NFIP)

The National Flood Insurance Program (NFIP) primarily provides flood insurance to property owners in flood-prone areas, aiming to reduce the financial impact of flooding events. Climate risk insurance covers a broader spectrum of climate-related hazards, including droughts and storms, offering more comprehensive protection against the increasing unpredictability due to climate change. Explore more to understand how NFIP compares with climate risk insurance in addressing evolving flood and climate threats.

Source and External Links

Flood Insurance - This webpage provides information on the National Flood Insurance Program (NFIP), which offers flood insurance to property owners and renters, helping them recover from flood damage.

Flood Insurance Quotes - This page discusses the importance of flood insurance, its requirements, and ways to mitigate flood risks, and offers quotes for securing your home against flood damage.

Get a Flood Insurance Quote Now! - This webpage allows users to get a free flood insurance quote through GEICO, offering coverage that is backed by the Federal Government and tailored to specific areas.

dowidth.com

dowidth.com