Earthquake microinsurance offers affordable, localized protection against seismic damages, focusing on rapid claims and community resilience, while disability microinsurance provides financial support to low-income individuals facing temporary or permanent loss of income due to disability. Targeting marginalized populations, both insurance types employ simplified underwriting and mobile platforms to enhance accessibility and disaster recovery. Explore the distinct benefits and coverage details of earthquake and disability microinsurance to find the best fit for your needs.

Why it is important

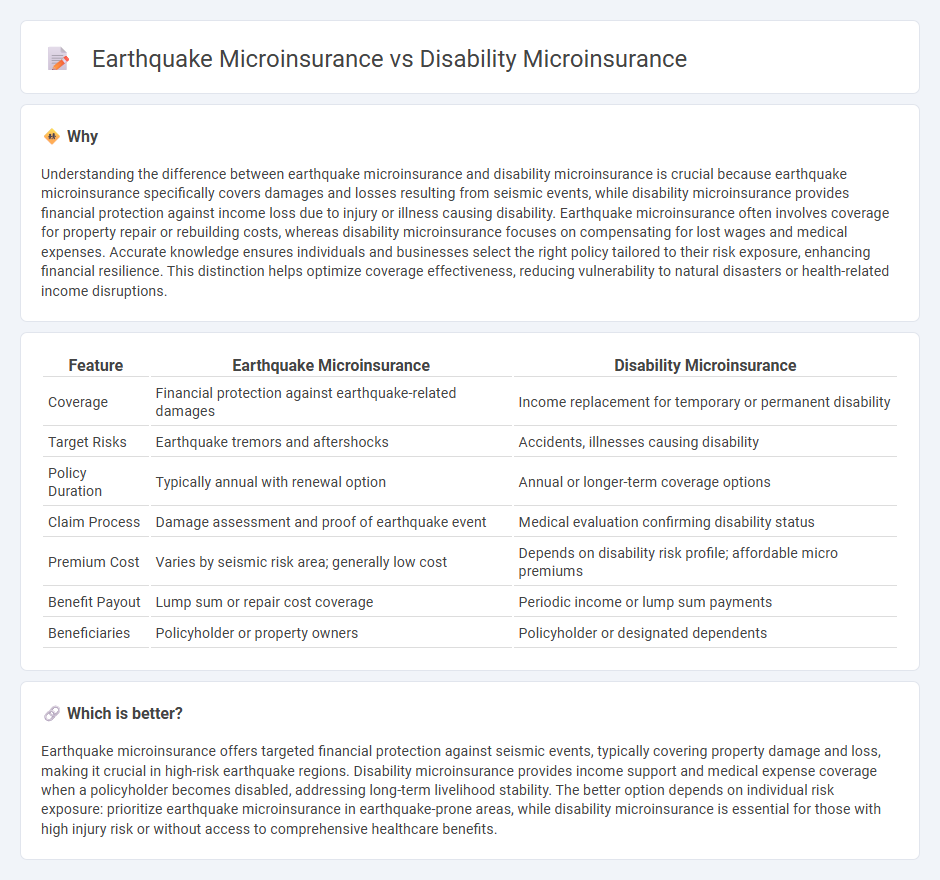

Understanding the difference between earthquake microinsurance and disability microinsurance is crucial because earthquake microinsurance specifically covers damages and losses resulting from seismic events, while disability microinsurance provides financial protection against income loss due to injury or illness causing disability. Earthquake microinsurance often involves coverage for property repair or rebuilding costs, whereas disability microinsurance focuses on compensating for lost wages and medical expenses. Accurate knowledge ensures individuals and businesses select the right policy tailored to their risk exposure, enhancing financial resilience. This distinction helps optimize coverage effectiveness, reducing vulnerability to natural disasters or health-related income disruptions.

Comparison Table

| Feature | Earthquake Microinsurance | Disability Microinsurance |

|---|---|---|

| Coverage | Financial protection against earthquake-related damages | Income replacement for temporary or permanent disability |

| Target Risks | Earthquake tremors and aftershocks | Accidents, illnesses causing disability |

| Policy Duration | Typically annual with renewal option | Annual or longer-term coverage options |

| Claim Process | Damage assessment and proof of earthquake event | Medical evaluation confirming disability status |

| Premium Cost | Varies by seismic risk area; generally low cost | Depends on disability risk profile; affordable micro premiums |

| Benefit Payout | Lump sum or repair cost coverage | Periodic income or lump sum payments |

| Beneficiaries | Policyholder or property owners | Policyholder or designated dependents |

Which is better?

Earthquake microinsurance offers targeted financial protection against seismic events, typically covering property damage and loss, making it crucial in high-risk earthquake regions. Disability microinsurance provides income support and medical expense coverage when a policyholder becomes disabled, addressing long-term livelihood stability. The better option depends on individual risk exposure: prioritize earthquake microinsurance in earthquake-prone areas, while disability microinsurance is essential for those with high injury risk or without access to comprehensive healthcare benefits.

Connection

Earthquake microinsurance and disability microinsurance are interconnected as both provide targeted financial protection to vulnerable populations against specific risks that can cause severe economic hardship. Earthquake microinsurance covers losses from seismic events, while disability microinsurance offers income support in case of injury-related disabilities, often caused by such disasters. These microinsurance products collectively enhance resilience by mitigating the financial impact of natural catastrophes and health impairments in low-income communities.

Key Terms

**Disability Microinsurance:**

Disability microinsurance provides financial protection by offering income replacement and medical expense coverage specifically tailored for low-income individuals who experience disabilities due to illness or injury. It addresses the risk of long-term income loss, ensuring policyholders maintain financial stability and access to necessary rehabilitation services. Explore the benefits and key features of disability microinsurance to secure your financial future effectively.

Income Replacement

Disability microinsurance primarily provides income replacement when a policyholder experiences a disabling injury or illness, enabling continued financial stability during recovery. Earthquake microinsurance focuses on property loss or damage from seismic events, often covering repair and rebuilding costs rather than income replacement. Explore detailed comparisons to understand which microinsurance solution best fits your risk management needs.

Waiting Period

Disability microinsurance typically features a waiting period ranging from 7 to 30 days before benefits begin, allowing verification of the insured's condition, whereas earthquake microinsurance often has a much shorter waiting period or none at all, since payouts are triggered immediately by an earthquake event. The waiting period in disability microinsurance serves to prevent fraudulent claims and aligns with the nature of prolonged disability, while earthquake microinsurance focuses on quick financial relief after sudden disasters. Explore more about how waiting periods impact your coverage choice in microinsurance products.

Source and External Links

Microinsurance: A new insurance model for the developing world - Microinsurance offers low-income people, particularly in developing countries, limited insurance coverage at very low premiums, including protection against disability, to prevent financial ruin from risks like illness or accidents.

Can Parametric Microinsurance Improve the Financial Resilience of ... - Microinsurance policies are designed to provide affordable, low-premium coverage with rapid payouts to protect low-income households from financial shocks such as disability, often with regulatory premium limits tied to income or minimum wage.

Issues in Regulation and Supervision of Microinsurance - Disability microinsurance frequently accompanies personal accident products, offering coverage for permanent and temporary disability, tailored to low-income workers often outside formal insurance or social protection schemes.

dowidth.com

dowidth.com