Embedded insurance integrates coverage directly into the purchase of products or services, providing seamless protection without separate transactions, enhancing convenience and customer experience. Telematics insurance uses data from devices installed in vehicles to monitor driving behavior, allowing personalized premiums based on real-time risk assessment. Explore how these innovative insurance models are transforming risk management and consumer engagement.

Why it is important

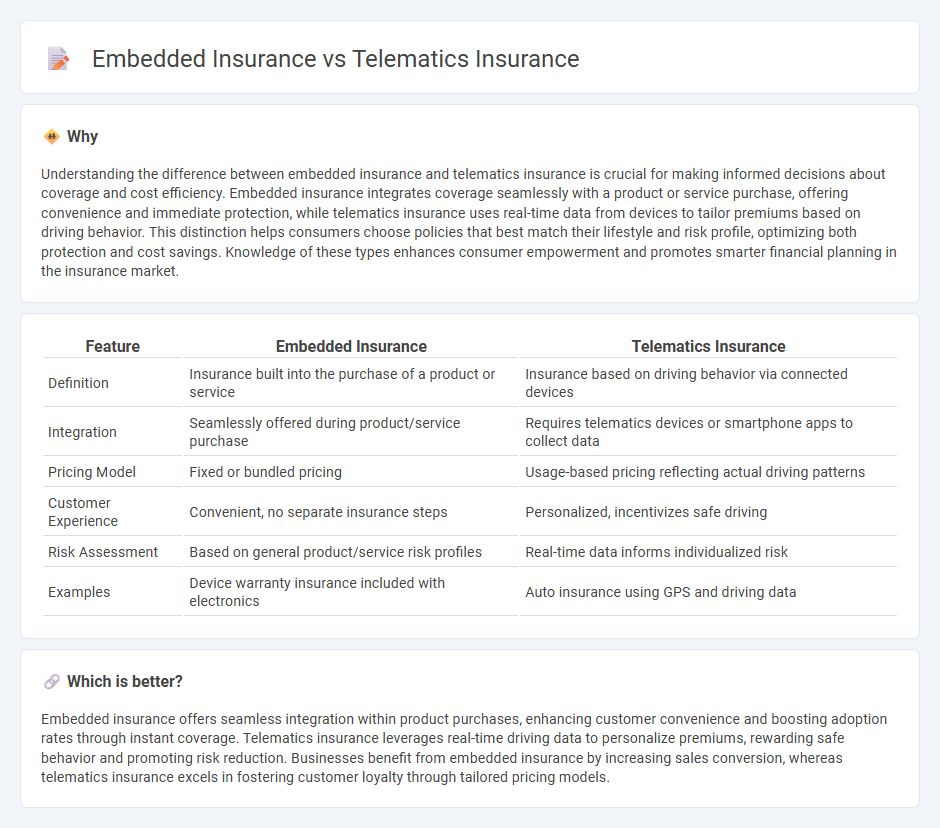

Understanding the difference between embedded insurance and telematics insurance is crucial for making informed decisions about coverage and cost efficiency. Embedded insurance integrates coverage seamlessly with a product or service purchase, offering convenience and immediate protection, while telematics insurance uses real-time data from devices to tailor premiums based on driving behavior. This distinction helps consumers choose policies that best match their lifestyle and risk profile, optimizing both protection and cost savings. Knowledge of these types enhances consumer empowerment and promotes smarter financial planning in the insurance market.

Comparison Table

| Feature | Embedded Insurance | Telematics Insurance |

|---|---|---|

| Definition | Insurance built into the purchase of a product or service | Insurance based on driving behavior via connected devices |

| Integration | Seamlessly offered during product/service purchase | Requires telematics devices or smartphone apps to collect data |

| Pricing Model | Fixed or bundled pricing | Usage-based pricing reflecting actual driving patterns |

| Customer Experience | Convenient, no separate insurance steps | Personalized, incentivizes safe driving |

| Risk Assessment | Based on general product/service risk profiles | Real-time data informs individualized risk |

| Examples | Device warranty insurance included with electronics | Auto insurance using GPS and driving data |

Which is better?

Embedded insurance offers seamless integration within product purchases, enhancing customer convenience and boosting adoption rates through instant coverage. Telematics insurance leverages real-time driving data to personalize premiums, rewarding safe behavior and promoting risk reduction. Businesses benefit from embedded insurance by increasing sales conversion, whereas telematics insurance excels in fostering customer loyalty through tailored pricing models.

Connection

Embedded insurance integrates insurance products directly into the purchase process of goods or services, enhancing customer convenience and seamless coverage. Telematics insurance collects real-time driving data through devices or apps to personalize premiums based on behavior, improving risk assessment accuracy. Combining embedded insurance with telematics allows insurers to offer tailored, usage-based policies instantly at the point of sale, leveraging data-driven insights for dynamic pricing and risk management.

Key Terms

**Telematics Insurance:**

Telematics insurance uses real-time data collected from vehicle sensors or smartphones to assess driving behavior, enabling personalized premiums based on actual risk patterns. Embedded insurance integrates coverage directly within the purchase of a product or service, streamlining the buying process but often lacking the dynamic risk assessment features of telematics. Discover how telematics insurance transforms risk evaluation and premium accuracy by exploring its benefits and technology.

Usage-Based Pricing

Telematics insurance leverages real-time driving data collected via GPS and onboard diagnostics to offer usage-based pricing, tailoring premiums based on individual driving behavior and mileage. Embedded insurance integrates coverage options directly into the purchase of a product or service, often using usage data as a factor but emphasizing seamless customer experience rather than pure telematics data analysis. Explore how these innovative models reshape insurance pricing to better align cost with actual risk exposure.

Vehicle Data Monitoring

Telematics insurance leverages real-time vehicle data monitoring through GPS, accelerometers, and onboard diagnostics to personalize premiums based on driving behavior, while embedded insurance integrates coverage directly into vehicle purchase or financing processes, often using basic vehicle data for streamlined activation. Telematics offers granular insights on speed, braking patterns, and mileage, enabling dynamic risk assessment and incentivizing safe driving habits. Explore how vehicle data monitoring enhances risk management and customer experience in both insurance models.

Source and External Links

Telematics Insurance: How it Works, Benefits + Providers - Telematics insurance uses GPS trackers or mobile apps to collect driving data, allowing insurers to assess risk more accurately and offer usage-based premiums that reward safe driving habits while lowering claims costs.

Car Insurance Telematics Pros and Cons - Telematics programs track your driving behavior to provide discounts that can reach up to 40% with some insurers, but actual savings vary and depend on factors like mileage, time of driving, and driving habits.

Telematics Devices for Car Insurance - Telematics devices, either apps or plug-in hardware, monitor driving details such as speed, mileage, and braking to help insurance companies offer personalized rates and help drivers improve their safety on the road.

dowidth.com

dowidth.com