Catastrophe bonds are risk-linked securities that transfer insurance risks from insurers to capital market investors, typically triggered by defined catastrophic events such as hurricanes or earthquakes. Weather derivatives are financial instruments that companies use to hedge against the financial impact of adverse weather conditions like temperature fluctuations or rainfall levels. Explore the key differences and applications of catastrophe bonds and weather derivatives to better understand their roles in managing weather-related risks.

Why it is important

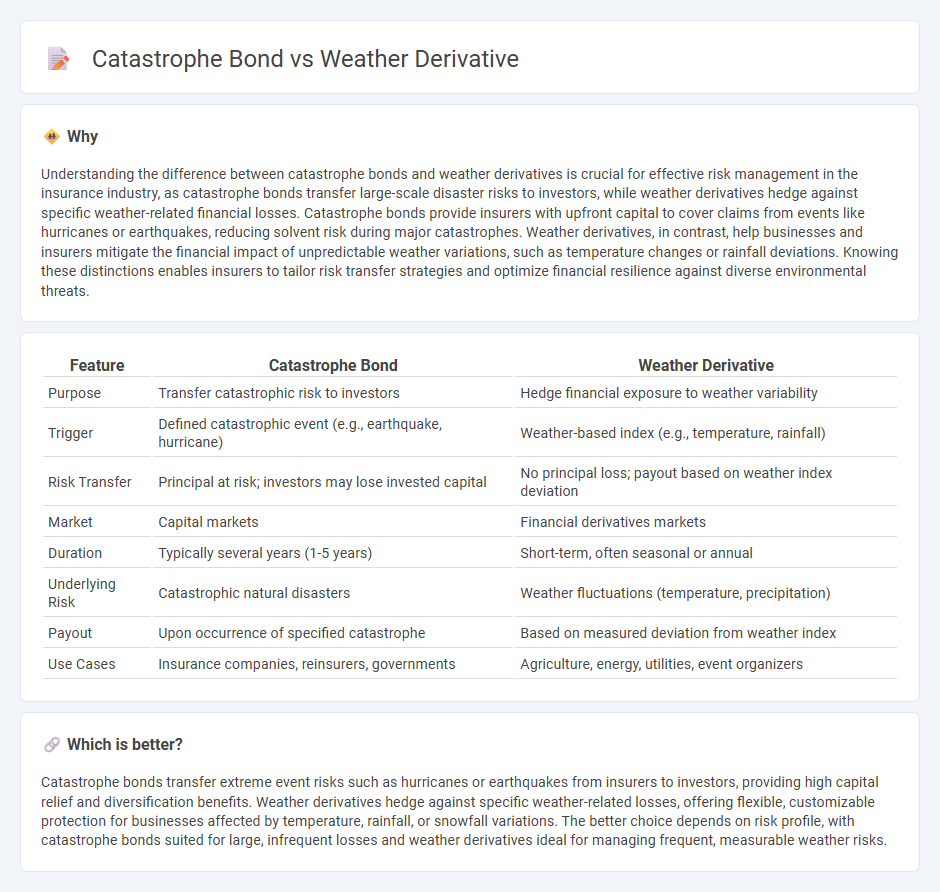

Understanding the difference between catastrophe bonds and weather derivatives is crucial for effective risk management in the insurance industry, as catastrophe bonds transfer large-scale disaster risks to investors, while weather derivatives hedge against specific weather-related financial losses. Catastrophe bonds provide insurers with upfront capital to cover claims from events like hurricanes or earthquakes, reducing solvent risk during major catastrophes. Weather derivatives, in contrast, help businesses and insurers mitigate the financial impact of unpredictable weather variations, such as temperature changes or rainfall deviations. Knowing these distinctions enables insurers to tailor risk transfer strategies and optimize financial resilience against diverse environmental threats.

Comparison Table

| Feature | Catastrophe Bond | Weather Derivative |

|---|---|---|

| Purpose | Transfer catastrophic risk to investors | Hedge financial exposure to weather variability |

| Trigger | Defined catastrophic event (e.g., earthquake, hurricane) | Weather-based index (e.g., temperature, rainfall) |

| Risk Transfer | Principal at risk; investors may lose invested capital | No principal loss; payout based on weather index deviation |

| Market | Capital markets | Financial derivatives markets |

| Duration | Typically several years (1-5 years) | Short-term, often seasonal or annual |

| Underlying Risk | Catastrophic natural disasters | Weather fluctuations (temperature, precipitation) |

| Payout | Upon occurrence of specified catastrophe | Based on measured deviation from weather index |

| Use Cases | Insurance companies, reinsurers, governments | Agriculture, energy, utilities, event organizers |

Which is better?

Catastrophe bonds transfer extreme event risks such as hurricanes or earthquakes from insurers to investors, providing high capital relief and diversification benefits. Weather derivatives hedge against specific weather-related losses, offering flexible, customizable protection for businesses affected by temperature, rainfall, or snowfall variations. The better choice depends on risk profile, with catastrophe bonds suited for large, infrequent losses and weather derivatives ideal for managing frequent, measurable weather risks.

Connection

Catastrophe bonds and weather derivatives both serve as financial instruments designed to manage risks associated with extreme weather events and natural disasters. Catastrophe bonds transfer the risk of significant insurance losses to investors, providing insurers with capital relief after events like hurricanes or earthquakes. Weather derivatives enable companies to hedge against financial losses caused by weather variability, such as temperature or rainfall fluctuations, complementing the risk management offered by catastrophe bonds.

Key Terms

**Weather Derivative:**

Weather derivatives are financial instruments designed to hedge risks associated with unpredictable weather conditions, such as temperature, rainfall, or snowfall, impacting industries like agriculture, energy, and tourism. Unlike catastrophe bonds, which cover extreme events like hurricanes or earthquakes, weather derivatives address more frequent, weather-related fluctuations by providing payouts based on measurable weather indexes. Explore how weather derivatives can optimize risk management strategies for weather-sensitive businesses.

Hedging

Weather derivatives provide targeted financial protection against specific weather-related risks such as temperature fluctuations, rainfall, or wind speed, enabling businesses to hedge operational exposure with customizable contracts. Catastrophe bonds transfer extreme event risks like hurricanes or earthquakes to investors, offering high-yield investments that trigger payouts upon specified disaster occurrences, primarily benefiting insurers and reinsurers. Explore how these innovative financial instruments differ in risk management strategies and suitability for your hedging needs.

Index-based

Weather derivatives based on index-based measures provide financial protection against unfavorable weather conditions by paying out when specific weather indices, such as temperature or rainfall levels, deviate from predefined thresholds. Catastrophe bonds are insurance-linked securities that transfer risk from catastrophic events, like hurricanes or earthquakes, to investors, triggering payouts when modeled losses exceed set levels in an index-based system. Explore the complexities and applications of index-based weather derivatives and catastrophe bonds to optimize risk management strategies.

Source and External Links

Weather Derivatives: How Do They Work? - This article explains how weather derivatives function as financial tools to manage risks associated with weather changes.

How Weather Derivatives Hedge Against Nature's Uncertainty - This resource provides insights into how weather derivatives are structured and used to hedge weather-related risks.

Monte Carlo Pricing of Temperature Weather Derivatives - This document discusses the application of Monte Carlo simulations for pricing temperature weather derivatives, accounting for the unique characteristics of weather variables.

dowidth.com

dowidth.com