Workers compensation carveout specifically covers work-related injuries and illnesses, providing tailored benefits and protections for employees under state-mandated programs. Blanket accident insurance offers broader coverage for accidental injuries regardless of location or cause but typically lacks the comprehensive wage replacement and medical benefits found in workers compensation. Explore the key differences to determine the best fit for your organization's risk management strategy.

Why it is important

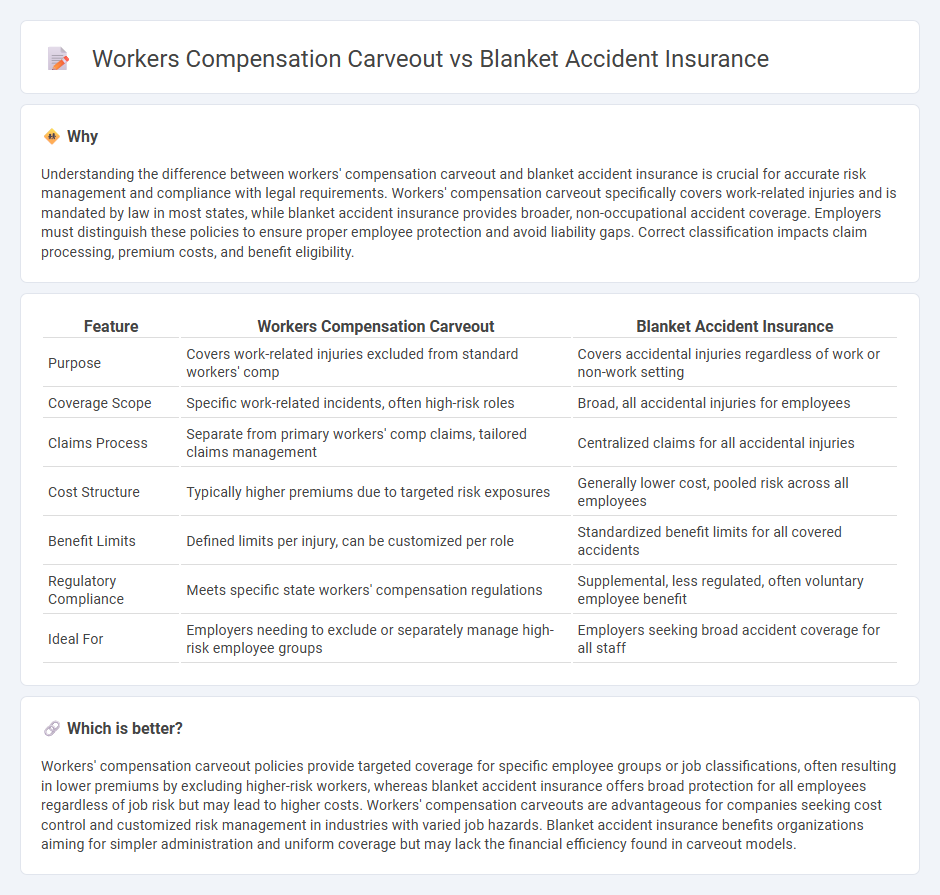

Understanding the difference between workers' compensation carveout and blanket accident insurance is crucial for accurate risk management and compliance with legal requirements. Workers' compensation carveout specifically covers work-related injuries and is mandated by law in most states, while blanket accident insurance provides broader, non-occupational accident coverage. Employers must distinguish these policies to ensure proper employee protection and avoid liability gaps. Correct classification impacts claim processing, premium costs, and benefit eligibility.

Comparison Table

| Feature | Workers Compensation Carveout | Blanket Accident Insurance |

|---|---|---|

| Purpose | Covers work-related injuries excluded from standard workers' comp | Covers accidental injuries regardless of work or non-work setting |

| Coverage Scope | Specific work-related incidents, often high-risk roles | Broad, all accidental injuries for employees |

| Claims Process | Separate from primary workers' comp claims, tailored claims management | Centralized claims for all accidental injuries |

| Cost Structure | Typically higher premiums due to targeted risk exposures | Generally lower cost, pooled risk across all employees |

| Benefit Limits | Defined limits per injury, can be customized per role | Standardized benefit limits for all covered accidents |

| Regulatory Compliance | Meets specific state workers' compensation regulations | Supplemental, less regulated, often voluntary employee benefit |

| Ideal For | Employers needing to exclude or separately manage high-risk employee groups | Employers seeking broad accident coverage for all staff |

Which is better?

Workers' compensation carveout policies provide targeted coverage for specific employee groups or job classifications, often resulting in lower premiums by excluding higher-risk workers, whereas blanket accident insurance offers broad protection for all employees regardless of job risk but may lead to higher costs. Workers' compensation carveouts are advantageous for companies seeking cost control and customized risk management in industries with varied job hazards. Blanket accident insurance benefits organizations aiming for simpler administration and uniform coverage but may lack the financial efficiency found in carveout models.

Connection

Workers' compensation carve-outs and blanket accident insurance both address employee injury risks but cover different aspects; carve-outs exclude certain injuries or employees from standard workers' compensation policies, transferring liability to separate agreements. Blanket accident insurance provides broad coverage for accidental injuries not typically included in workers' compensation, offering an additional safety net. This complementary structure ensures comprehensive protection by filling gaps left by traditional workers' compensation policies.

Key Terms

Coverage Scope

Blanket accident insurance provides broad protection against a range of accidental injuries, covering employees both on and off the job, while workers' compensation carveouts specifically exclude certain injury types or employee groups from standard workers' compensation policies. The coverage scope of blanket accident insurance often extends to incidents beyond the workplace, offering supplementary benefits such as medical expense reimbursement and disability compensation that workers' compensation carveouts may limit or omit. Explore the differences in coverage scope to determine the best fit for your business risk management strategy.

Beneficiary Eligibility

Blanket accident insurance provides broad coverage for employees injured on the job, often extending benefits regardless of employment status or full-time equivalency, while workers' compensation carveouts target specific groups or job roles with tailored eligibility criteria. Beneficiary eligibility under workers' compensation carveouts is usually tightly defined to comply with state regulations and employer agreements, potentially limiting coverage scope compared to blanket policies. Explore how these differences impact claim processing and employee protection in detail to make an informed insurance choice.

Legal Liability

Blanket accident insurance provides broad coverage for employees injured on the job, often supplementing workers' compensation by covering gaps in benefits and out-of-pocket expenses not typically reimbursed. Workers' compensation carveouts limit the employer's liability by specifically excluding certain risks or employee groups from standard coverage, thereby shifting legal liability and potential claims resolution to alternative policies like blanket accident insurance. Explore the distinctions and legal implications of these coverage options to better manage workforce risk and compliance.

Source and External Links

Blanket Accident - Starr Insurance Companies - Starr offers Blanket Accident policies providing school coverage for Accidental Death, Dismemberment, and Accident Medical Coverage for enrolled students with tailored plans for various school types and activities.

Blanket accident and health insurance defined (North Carolina Statutes) - Defines blanket accident insurance as a policy covering a group of persons, often linked to transportation or organized groups, insuring against accidental death or injury under specified conditions.

Group Blanket Accident Insurance - Philadelphia Insurance Companies - Group blanket accident insurance protects participants against medical expenses from injuries occurring during sponsored activities, providing financial support in case of accidents.

dowidth.com

dowidth.com