Pandemic business interruption insurance provides financial protection against losses caused by government-mandated closures during global health crises, covering tangible revenue decreases directly linked to the pandemic. Parametric insurance offers a predefined payout triggered by specific measurable events like infection rates or government restrictions, bypassing traditional claims processes to ensure rapid compensation. Explore these innovative insurance solutions to safeguard your business resilience in uncertain times.

Why it is important

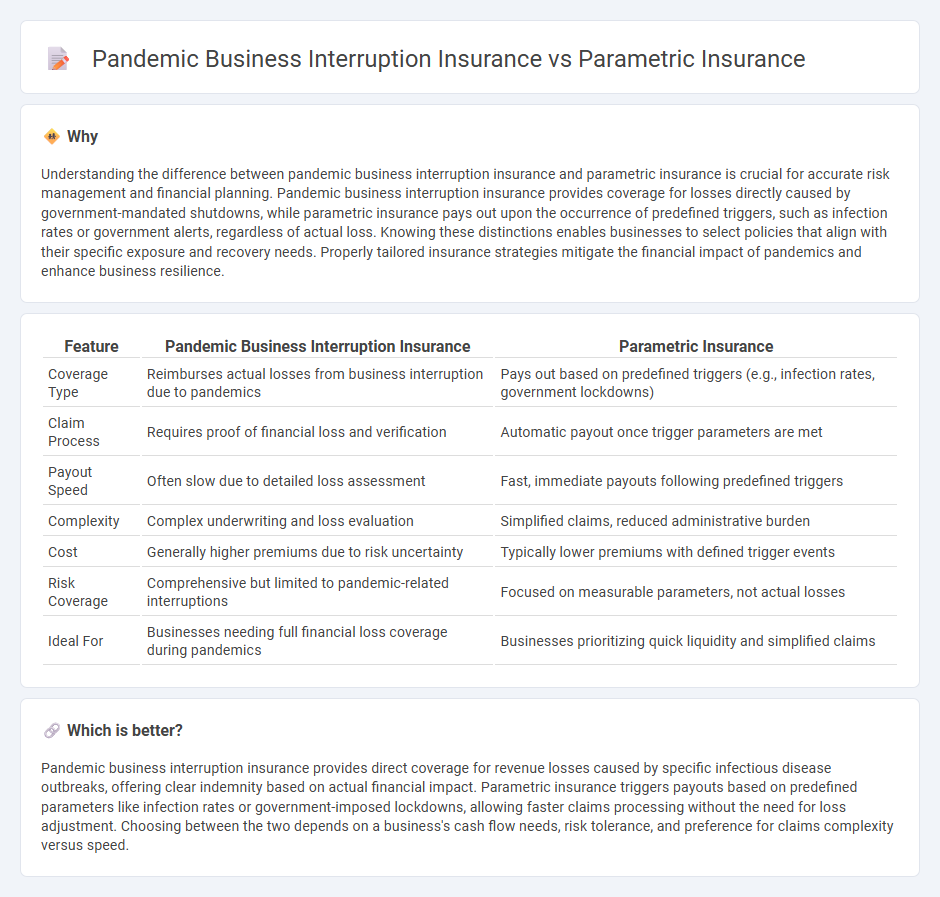

Understanding the difference between pandemic business interruption insurance and parametric insurance is crucial for accurate risk management and financial planning. Pandemic business interruption insurance provides coverage for losses directly caused by government-mandated shutdowns, while parametric insurance pays out upon the occurrence of predefined triggers, such as infection rates or government alerts, regardless of actual loss. Knowing these distinctions enables businesses to select policies that align with their specific exposure and recovery needs. Properly tailored insurance strategies mitigate the financial impact of pandemics and enhance business resilience.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Parametric Insurance |

|---|---|---|

| Coverage Type | Reimburses actual losses from business interruption due to pandemics | Pays out based on predefined triggers (e.g., infection rates, government lockdowns) |

| Claim Process | Requires proof of financial loss and verification | Automatic payout once trigger parameters are met |

| Payout Speed | Often slow due to detailed loss assessment | Fast, immediate payouts following predefined triggers |

| Complexity | Complex underwriting and loss evaluation | Simplified claims, reduced administrative burden |

| Cost | Generally higher premiums due to risk uncertainty | Typically lower premiums with defined trigger events |

| Risk Coverage | Comprehensive but limited to pandemic-related interruptions | Focused on measurable parameters, not actual losses |

| Ideal For | Businesses needing full financial loss coverage during pandemics | Businesses prioritizing quick liquidity and simplified claims |

Which is better?

Pandemic business interruption insurance provides direct coverage for revenue losses caused by specific infectious disease outbreaks, offering clear indemnity based on actual financial impact. Parametric insurance triggers payouts based on predefined parameters like infection rates or government-imposed lockdowns, allowing faster claims processing without the need for loss adjustment. Choosing between the two depends on a business's cash flow needs, risk tolerance, and preference for claims complexity versus speed.

Connection

Pandemic business interruption insurance and parametric insurance are connected through their innovative approaches to managing risk during unforeseen events like pandemics. Pandemic business interruption insurance provides coverage for losses stemming from government-mandated shutdowns, while parametric insurance pays out predetermined amounts based on specific triggers such as infection rates or government announcements. This connection enhances risk management by offering quicker claims processing and greater financial certainty to businesses affected by pandemic disruptions.

Key Terms

Trigger Event

Parametric insurance triggers payout based on predefined parameters such as earthquake magnitude or rainfall levels, allowing rapid and objective claim settlements without the need for loss assessment. Pandemic business interruption insurance typically requires proof of actual loss and confirmation of a government-declared pandemic event causing business disruption. Explore how these distinct trigger events affect coverage speed and reliability in different risk scenarios.

Indemnity

Parametric insurance provides predetermined payouts based on predefined event triggers, such as the occurrence of specific pandemic-related indicators, without the need for loss assessment, offering faster indemnity. Pandemic business interruption insurance relies on traditional indemnity principles, compensating actual financial losses incurred due to interrupted operations during a pandemic, which involves detailed claims verification. Explore the distinct indemnity mechanisms in parametric versus pandemic business interruption insurance for a deeper understanding of risk management strategies.

Basis Risk

Parametric insurance minimizes basis risk by triggering payouts based on predefined parameters like infection rates or government lockdown measures rather than actual losses, providing faster and more transparent compensation compared to traditional pandemic business interruption insurance. Pandemic business interruption insurance often involves higher basis risk due to subjective loss assessments and complex claims processes, which can delay payments and cause disputes. Explore the detailed differences and benefits of both insurance types to better manage pandemic-related business risks.

Source and External Links

What is parametric insurance? - Parametric insurance is a type of insurance that pays out based on the occurrence of a predefined event meeting a certain measurable threshold (like earthquake magnitude or wind speed), rather than indemnifying actual losses, enabling faster and clearer payout processes aligned with client risk tolerance.

Parametric insurance - Wikipedia - Parametric insurance offers predetermined payouts triggered by specific measured events, providing quick liquidity after disasters, with benefits including lower transaction costs and coverage for hard-to-model risks, though it may not fully cover all loss bases due to basis risk.

Parametric Insurance Solutions - Parametric insurance pays based on event characteristics such as windspeed or earthquake magnitude using predefined triggers and payout functions, enabling fast claims with simplified proof of loss, and allowing insureds to use proceeds freely to address financial impacts.

dowidth.com

dowidth.com